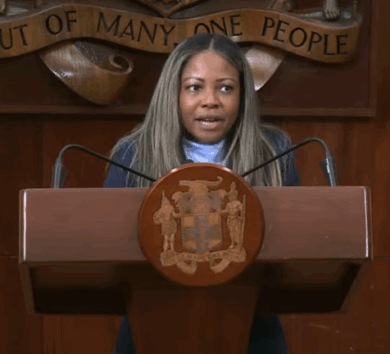

Finance Minister declares no been a better time to be an ambitious entrepreneur in Jamaica

Durrant Pate/Contributor

Jamaican micro, small and medium-sized enterprises (MSMEs) are getting $13.45 billion in new equity financing during the upcoming 2023-2024 financial year to grow the sector, which is responsible for the majority of employment in Jamaica and drives economic growth and development.

Finance Minister Dr Nigel Clarke announced the windfall equity financing programmes for MSMEs, as he opened the 2023-2024 Budget Debate in Parliament last evening (March 7).

“I am pleased to report that, through the policies of this Government, new funds, with a total capitalisation of $13.45 billion have been established to provide equity funding to Jamaican businesses, primarily small and medium-sized businesses, SMEs and start-ups,“ he advised.

This, is in addition to the many other credit programmes for MSMEs that can be accessed through the BIGEE Programme, which is being executed with funding from the Inter-American Development Bank, European Union and the Government of Jamaica (GOJ) through the Development Bank of Jamaica (DBJ).

Benefits of BIGEE programme

The BIGEE programme has established an Innovation Grant Fund that provides grants for innovation, a Patent Grant Fund to help inventors to protect their intellectual property, three Incubators (and Pre-Incubator) programmes, which are expected to provide training, mentorship, and incubation support services to approximately 100 high potential Jamaican startup companies.

There are also two Accelerator programmes that are expected to provide acceleration services to 100 scalable Jamaican start-up companies in the coming year. With these initiatives being rolled out, Clarke smilingly commented: “There has never been a better time to be an ambitious entrepreneur, especially a young entrepreneur, in Jamaica.”

He advised MSME looking for equity financing that there are at least three alternatives that are available to assist once they have met the criteria. The three options listed were Vertex SME Holdings, managed by JMMB Securities Limited; Stratus Private Equity & SME Fund, managed by NCB Capital Markets and JASMEF 1, managed by Victoria Mutual Investments and Actus Partners.

Benefiting from loan guarantees

Clarke told the Parliament that 1,059 MSMEs have benefited from loan guarantees under the GOJ’s Credit Enhancement Facility. This facility provides credit guarantee support to MSME’s with little or no access to collateral needed to secure loans.

In addition, a total of 248 MSMEs were supported through the DBJ’s Voucher for Technical Assistance Programme as at December 31, 2022.

“This is another way in which we are committed to sharing the gains of our economic recovery with our local entrepreneurs and businesses,” Clarke emphasised.

Turning to the matter of the Large Scale Projects and Pioneer Industries Act, Clarke reported that the Government is pursuing amendments to the legislation to operationalise the regime to attract US$ billion investments. A bill enacting the proposed amendments is to be tabled in the Jamaican legislature next month for debate and eventual passage.

Comments