Provision also made to regional governments to strengthen social resilience

The Caribbean Development Bank (CDB) provided more than US$140.2 million in financing in 2020 and secured an additional US$50 million for 2021 to support its Borrowing Member Countries (BMCs) in mitigating the macroeconomic fallout and adverse social effects of the COVID-19 pandemic.

The onset of COVID in the first quarter of the year triggered a steep fall in BMC government revenues, along with an increased demand for healthcare and social support. In addition, the pandemic has put social services and health systems under pressure, exacerbated inequalities in education and increased the vulnerability of at-risk groups.

In response, the CDB provided multi-dimensional support to address the immediate needs of BMCs through mitigative intervention. The seven beneficiary countries were:

- Antigua and Barbuda – US$13 million

- Belize – US$15 million

- Dominica – US$2.5 million

- Grenada – US$5.9 million

- St Lucia – US$10.8 million

- St Vincent and the Grenadines – US$11.3 million

- Suriname – US$8.2 million

The CDB also provided US$50 million in policy-based loans (PBL) for St Lucia (US$30 million) and Dominica (US$20 million) to support economic recovery and resilience building in the sectors hardest hit by the COVID-19 pandemic.

Additionally, US$15 million from a PBL for The Bahamas was assigned for supplementary support for the country’s COVID-19 response.

OESC countries benefiting from US$50-million IDB loan secured by CDB

In December 2020, CDB signed a US$50-million loan agreement with the Inter-American Development Bank to support COVID-19 response projects in member countries of the Organisation of Eastern Caribbean States (OECS). This line of credit will finance programmes to help reduce COVID-19 transmission and fatality rates; ensure access to minimum levels of quality of life and health for vulnerable citizens and provide support for micro, small and medium-sized enterprises (MSMEs) in 2021 and beyond.

In addition, the CDB provided support to strengthen social resilience within its BMCs. This included US$4.2 million from a previous loan, which was repurposed by the Government of Grenada to procure 15,000 laptops to improve remote learning access for primary and secondary school students.

Similarly, almost US$310,000 from an earlier CDB loan was used to purchase laptops, projectors and cloud storage for online technical and vocational teaching in Guyana. A US$200,000 grant was given to the University of the West Indies to purchase computing devices for disadvantaged students and a US$59,000 grant was used to procure 130 tablets for special needs students in St Lucia.

Through collaboration with the Caribbean Public Health Agency, the Caribbean Disaster Emergency Management Agency and the Pan-American Health Organisation, the CDB provided US$3 million to procure personal protective equipment for healthcare workers across 14 countries.

The CDB also collaborated with the Caribbean Export Development Agency to provide a US$600,000 emergency response mechanism to assist export-oriented MSMEs to retool.

Cultural and creative industries also benefitting

Through its Cultural and Creative Industries Innovation Fund, the CDB awarded US$100,000 in grant funding to implementors of seven cultural and entertainment events that lost income from the cancelations due to the onset of COVID-19.

“We were able to use resources from our concessional Special Development Fund to provide US$66.7 million in emergency loans to seven eligible countries.”

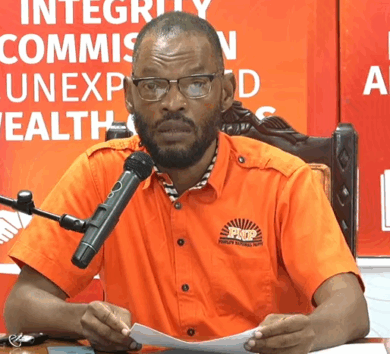

Dr Warren Smith, president of the Caribbean Development Bank

“When the pandemic struck, CDB recognised quickly that the resulting increase in COVID-related expenditure was occurring at a time when taxes and other government revenues were also being adversely affected,” said the bank’s president Dr Warren Smith in commenting on the CDB’s COVID-19 funding assistance to the region.

In a statement released yesterday (February 26) on the bank’s Regional Report: 2020 Review and 2021 Outlook, Smith added: “We were able to use resources from our concessional Special Development Fund to provide US$66.7 million in emergency loans to seven eligible countries.”

He added: “In this way these countries gained access to additional resources to meet unforeseen expenditures whilst continuing to protect the most vulnerable in their populations.”

Comments