The Supreme Court in Trinidad has ordered former Clico Investment Bank (CIB) chairman, Andre Monteil, his company Stone Street Capital (SSC), and the bank’s former CEO, Richard Trotman, to repay a whopping $78 million.

This is in addition to almost $20 million in interest to the bank. In a recent decision, Mrs. Justice Avason Quinlan-Williams also gave CIB permission to trace assets owned by the two men and SSC from a $78-million loan agreement dating back to 2007.

The CIB, which is currently in compulsory liquidation and therefore under the management of the Central Bank (CB), had sued Monteil. The suit stems from allegations that a $78-million loan was paid out in 2007 to facilitate Stone Street Capital’s acquisition of Clico’s 43.8 per cent interest in the Home Mortgage Bank (HMB). This was done in breach of the bank’s internal controls and was an act of “self-dealing”.

Details of the banking transaction

The bank sought the return of some $110 million as a result of the loan transaction. The money sought represented the outstanding $78 million loan balance, plus interest payments on the February 14, 2007 issued to Stone Street.

The deal consisted of a series of complex financial transactions that took place between 2007 and 2008. According to the judge, “this case involves a web of transactions and a cast of players, individual and corporate.”

The evidence was that Monteil sought and obtained the loan through Stone Street in February 2007. Shortly after, the debt was transferred to Monteil’s other company, First Capital Ltd (FCL), which held his 300,000-plus shares in CIB’s parent company, CL Financial (CLF).

At the time, the shares were valued at almost $444 million. Monteil reportedly struck a deal with Duprey for him to take control of First Capital’s debt and assets in exchange for an option to purchase CLF’s 43 per cent shareholding in the HMB.

Monteil bought the HMB shares for $110 million and sold them to the National Insurance Board (NIB) for almost exactly the purchase price. The lawsuit accused Monteil and Trotman of a series of wrongful actions, and also took the entire CIB board of directors to task for mishandling the situation and breach of fiduciary duties on several counts.

Both men were cited for breach of fuduciary responsibility

Key among them was the failure to ensure the loan was fully secured. Both men were found to have breached their fiduciary duties and the court voided the 2007 loan agreement.

In her ruling, Quinlan-Williams said of Monteil: “He knew that the payment of $78 million by CIB on February 14, 2007 for the benefit of Stone Street was unauthorised and was purely on oral terms. This was the case given that there was no adequate security, as the process was completely undocumented and was procured by Mr Trotman without having done any due diligence.”

The high court judge said Monteil knew it was “highly irregular and not in CIB’s best interests and, as chairman and a director of CIB, he allowed it to happen, leaving CIB exposed and unsecured.”

The judge remarked that Monteil failed to declare the full nature and extent of his interest and for it to be recorded in CIB’s board minutes and “acted dishonestly” by not disclosing the true purpose of the transfer and substitution of the 2007 agreements.

He waa cited for “deliberately” misleading Trotman and the CIB board that the transfer of loan obligations was to another of his companies –First Capital Ltd, St Kitts (a subsidiary of SSC). While still chairman and a director of CIB, Monteil was also found to have participated in and approved, the transfer of loan obligation to FCL, which was not in existence at the time.

CIB’s claim against FCL was dismissed.

At the trial, Monteil defended his borrowing from CIB to finance a share purchase for his private investment firm and denied there was anything underhanded in his transferring a $78-million loan debt and $315 million worth of CLF shares in HMB to his former boss, billionaire businessman Lawrence Duprey.

Monteil confirmed that Stone Street Capital did not repay the $78 million but transferred it to Duprey, who wanted the 337,269 shares the former CIB chairman had in CLF. Monteil said the agreement was for Duprey to take over the loan debt and buy the CLF shares, which would have been transferred to First Capital Ltd and later to Dalco – another company owned by Duprey.

Monteil admitted that he did not inform Trotman of the deal he struck with Duprey, since the chairman of the CLF conglomerate said he would do so himself. However, in her findings against Trotman, the judge ordered that he pay the restitution sum.

The judge said it was for his breaches of his duty to act “honestly and in good faith and in the best interests of CIB” and to “exercise the care, diligence and skill that a reasonably prudent director would exercise,” that she is ordering that he pay restitution. She also found Trotman breached his fiduciary duties of loyalty, honesty, good faith and acting in the best interests of CIB and to avoid conflicts of interest; his contractual duty to act with the highest standard of professional and ethical competence and integrity; and his no-self-dealing duty to ensure Monteil fully disclosed the nature and extent of his interest in the transactions.

Evidence against Stone Street

Against Stone Street, the judge observed that having received the $78 million from CIB, knowing it was unauthorised and procured in breach of Monteil and Trotman’s fiduciary duties, the company held the millions, or its traceable proceeds, on constructive trust for CIB.

Having voided the 2007 agreements, Quinlan-Williams also ordered them rescinded forthwith and that the defendants were liable to account to CIB for all assets now or previously in their possession acquired from the $78-million loan disbursement.

In addition to being allowed to trace these assets, and all necessary accounts, she also ordered them returned to CIB. In her 129-page decision, the judge said the 2008 agreements – the transfer of the loan by CIB to SSC and the HMB shares as security – were “ingeniously crafted for the purpose of deceit”.

“Trotman and Monteil exhibited extreme dishonesty and breaches of duty in relation to both the loan and its transfer to conceal the true state of affairs.”

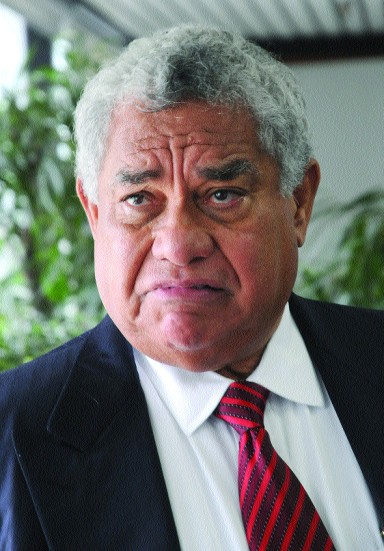

Justice Avason Quinlan-Williams

“Trotman and Monteil exhibited extreme dishonesty and breaches of duty in relation to both the loan and its transfer to conceal the true state of affairs,” she said, adding the dishonesty was “well-hidden and was only revealed upon careful scrutiny of all the details relating to the loan and transfer.”

DEFENDANTS LACK CREDIBILITY

She also pointed out that CIB, up to now, has not been paid the principal of the $78-million loan or any interest, and did not hold the HMB shares as security. According to the Trinidad and Tobago High Court judge: “I have found the first and second defendants to lack credibility and in many respects to be untruthful witnesses.”

In addition to millions in restitution and interest, the judge also ordered the two men and SSC to pay CIB’s costs. She ordered a stay of execution on her decision from April 27.

CIB was represented by Michael Green, QC, Nadine Ratiram and Keliah Granger. Jason Mootoo, Christopher Sieuchand and Shivangelie Ramoutar represented both Monteil and his company. Mathew Gayle represented Trotman.

Comments