Trust and Corporate Services providers now fall under the legal framework

The Jamaican Parliament has approved legislation strengthening the island’s anti-money laundering framework.

The lower House of Parliament on Tuesday approved the Proceeds of Crime (Designated Non-Financial Institution) (Trust and Corporate Services Providers) Order, 2022. The Order provides for the designation of Trust and Corporate Services providers, as designated non-financial institutions and therefore comes under the legal framework.

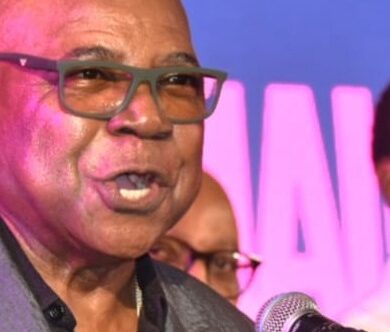

National Security Minister Dr Horace Chang, who piloted the Order, advised the Jamaican legislature that, “this designation reiterates Jamaica’s stance in the fight against money laundering and also signals Jamaica’s compliance with set international obligations and practices.”

The designation will apply to any person or entity providing a Trust service, or a corporate service, and allows these entities to fall within the regulated sector as provided by the 2007 Proceeds of Crime Act.

According to Chang, who is also Jamaica’s deputy prime minister, “additionally the designation of Trust and Corporate Services providers as designated non-financial institutions will strengthen Jamaica’s Anti Money Laundering and combatting the Financing of Terrorism regime and the recommendations set by the Financial Action Task Force (FATF).”

Meeting FATF’s recommendation 24

He explained that Trust and Corporate Services providers are categorised under recommendation 24 of the FATF Methodology as Designated Non-Financial Businesses and Professions.

Recommendation 24 makes it a requirement for countries to ensure that this class of business is subject to effective systems of monitoring and is compliant with anti-money laundering and countering the financing of terrorism measures.

Chang informed the House of Representatives that, based on Jamaica’s 3rd Follow-Up Report and Technical Compliance Re-Rating, the country is only partially compliant with recommendation 24, due to deficiencies in the monitoring of Trust and Corporate Services providers.

“It is believed that the designation of Trust and Corporate Services Providers will ensure Jamaica’s compliance with recommendation 24 as set by the FATF. This designation will also enable the Financial Services Commission (FSC) to be given the requisite authority to ensure that the Trust and Corporate Services Providers operate in compliance with the Proceeds of Crime Act and its Regulations,” Chang said.

In concluding, he pointed out that the Proceeds of Crime Act outlines and imposes obligations on businesses in regulated sectors to take active steps to prevent and detect money laundering and creates offences for breaches under that law.

Comments