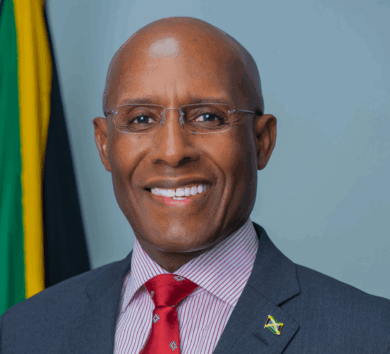

Durrant Pate/Contributor

Despite recent data indicating a further easing of inflation pressures and the possibility of improvement in the local interest rate environment to support higher stock valuations, most of the Jamaica Stock Exchange (JSE) indices (seven out of nine) continued to lose ground in trading last week.

The index with the highest depreciation was the JSE Financial Index (-0.99 per cent). Price declines in large market capitalisation stocks – namely Scotia Group Jamaica (SGJ: -6.06 per cent) and NCB Financial Group Limited (NCBFG: -1.06 per cent) resulted in the index declining.

The USD Equities Index +0.20 per cent was one of the two indices advancing with gains underpinned by Productive Business Solutions Ltd. (+3.98 per cent) and Transjamaican Highway. (+1.00 per cent).

NCB Capital Markets reports that there was no news to support the price movements. Overall market activity reflected trading in 126 stocks, of which 57 advanced, 47 declined, and 22 traded firm.

Market volume amounted to 149.62 million units valued at over $1.44 billion. This marked a 165.24 per cent increase in volume and a 201.69 per cent increase in value relative to the previous week ending April 19, 2024.

TransJamaican Highway, Sagicor Group Jamaica and Jamaica Broilers Group were the week-over-week volume leaders with 40.10 million units (26.57 per cent), 12.57 million units (8.33 per cent) and 12.22 million units (8.10 per cent) changing hands, respectively.

Comments