Carbyne Capital Investments Limited has embarked on applying for a microlending licence from the Bank of Jamaica (BOJ) with plans to expand its product offerings to include reverse factoring.

The company said the strategic endeavour is the first step in further strengthening its position in the local financial services ecosystem, having established itself as a leading factor financing provider.

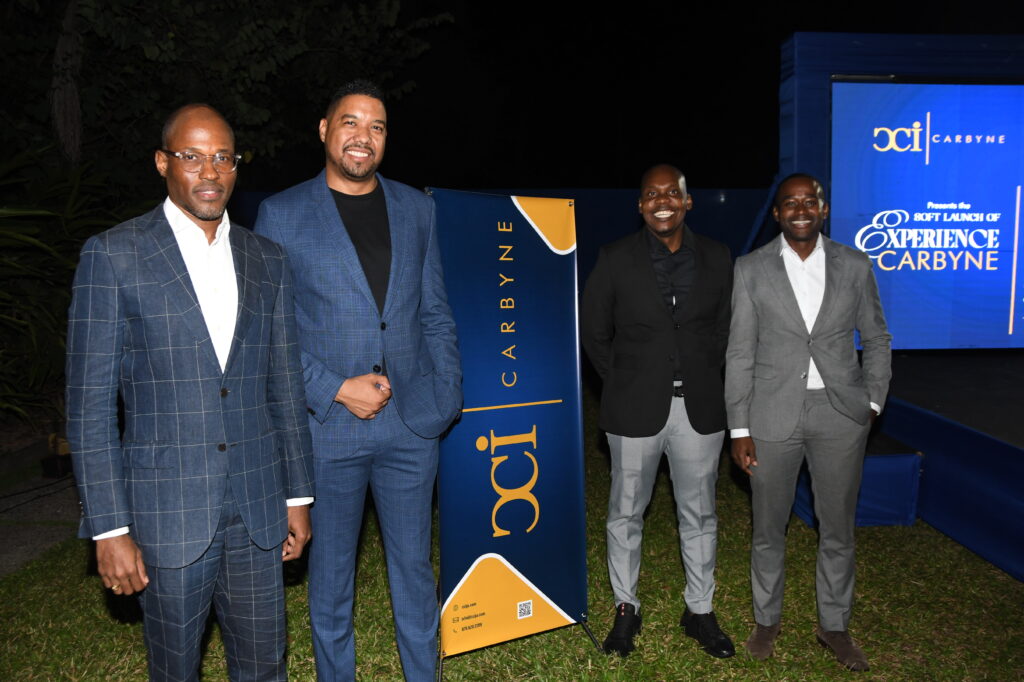

“We are excited about the expansion of our suite of services and the opportunity to support the financial growth of Jamaican companies. Our clients can rest assured that we are constantly exploring innovative solutions to meet their evolving financial needs,” Carbyne CEO Rajiv Ebanks remarked on the new development.

Ebanks further anticipates that the introduction of reverse factoring will surely contribute to the broader economic development of Jamaica.

“Our expanded suite of services will not only benefit individual businesses, but it will also facilitate smoother cash flow for SMEs, stimulate business growth and job creation, and boost financial inclusion and overall economic stability,” he explained.

Reverse factoring, also known as supply chain financing, is a financial service that enables the client to arrange early payment to its suppliers on approved invoices while holding off on repaying the finance provider until the invoice maturity date. This service augurs well for SMEs looking to improve their cash flow and working capital while reducing the risk of late payments. It also fosters stronger supplier-buyer relationships.

By incorporating reverse factoring into its suite of services, Carbyne will increase its range of financial products aimed at addressing the funding needs of businesses across Jamaica.

The company is bullish on building a strong reputation in the market for providing innovative and flexible financial solutions to small and medium-sized enterprises (SMEs) across various industries and large companies undertaking expansive projects. So, a micro-lending licence will allow the company to broaden its service portfolio as it caters to the growing demand for diverse financing options.

Securing approval for a micro-lending licence from the BOJ requires meeting several regulatory and procedural requirements that indicates its services are secure. The requirements for the licence include proof of capital adequacy and audited financial statements, a detailed business plan and market analysis, regulatory training and compliance policies, details on all substantial shareholders, officers, and directors including Fit and Proper assessments, and a comprehensive regulatory and governance framework.

“We’re updating all policies and procedures to align with the requirements of the regulator and having our shareholders and directors complete necessary KYC [know your customer] and fit and proper requirements. We are far advanced with these tasks internally and once finished, we’ll be submitting a complete package to BOJ for review and approval,” Ebanks told Our Today.

“We’re always looking for new opportunities to support businesses with innovative financing solutions. The reverse factoring product is one of those non-traditional financing products that we want to bring to market in the short run. It will mean further diversifying income/revenue streams for Carbyne,” he added.

Comments