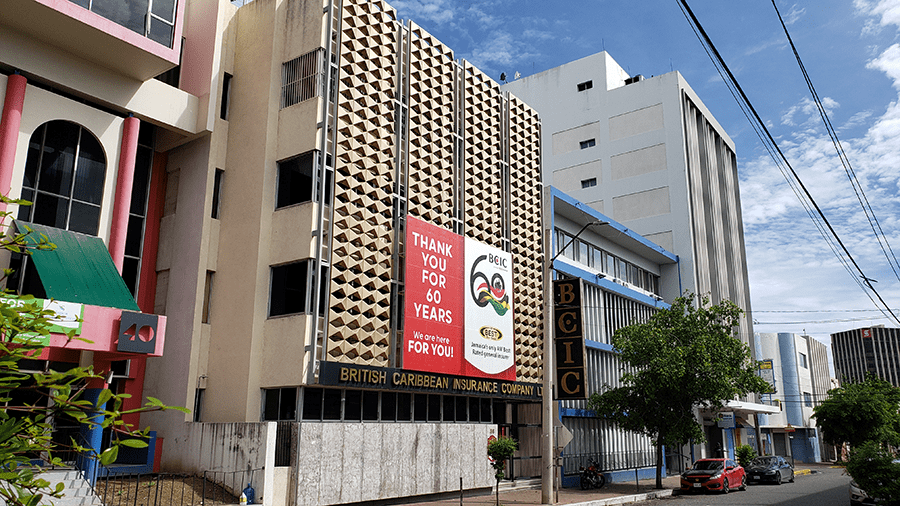

British Caribbean Insurance Company Limited (BCIC) was on October 31 affirmed of its financial strength rating by AM Best, a global credit rating agency specialising in the insurance industry.

AM Best reaffirmed the B++ (Good) rating it gave BCIC, noting that the rating reflects the company’s very strong balance sheet strength, strong operating performance, limited business profile, and appropriate enterprise risk management (ERM).

Based on the Best’s Capital Adequacy Ratio (BCAR), BCIC has the strongest level of risk-adjusted capitalisation, having improved in recent years. However, AM Best noted that the company’s capital structure is “susceptible to tail risk, which is evident by a decline in the BCAR on a catastrophe-stressed basis”.

Welcoming the rating, Peter Levy, BCIC managing director, said, “This reaffirmation of our B++ rating validates our prudent financial management and strong market position.”

He added: “AM Best’s assessment particularly notes our consistent underwriting gains and conservative investment approach, demonstrating our commitment to financial stability for our policyholders.”

AM Best highlighted BCIC’s position as “a top player in Jamaica, with strong market share in both its property and motor segments.” The rating agency also recognised BCIC’s strong operating results and very strong balance sheet strength. The rating agency’s stable outlook reflects BCIC’s established market presence and continued focus on sustainable growth through prudent risk management and strategic investments in operational efficiency.

AM Best’s rating affirms BCIC’s position as a financially secure and reliable insurance provider. BCIC ended 2023 as the number one general insurer in Jamaica and the company continues to demonstrate its commitment to providing high-quality insurance products and services to its customers.

The insurance rating agency also anticipates that, despite a decline in BCIC’s profitability in recent years, operating results will rebound “once the company completes its system implementation and benefits from the efficiencies it is anticipated to provide”.

Comments