The Ministry of Culture, Gender, Entertainment and Sport has signed an agreement with Guardian Life Limited to provide free group life and personal accident insurance coverage for members of the creative, media and entertainment sectors, effective immediately.

Under the newly launched Jamaica Entertainers and Creatives Insurance Plan (JECIP), some 400 small businesses and nearly 4,500 individuals whose data are currently on the National Registry of Entertainment and Creatives Industries Practitioners will be provided with group health, group life and personal accident insurance coverage.

At the contract signing ceremony on Tuesday, November 12, in Kingston, Minister Olivia “Babsy” Grange encouraged the scores of attendees to sign up on location, as there was no limit to the number of people who could benefit.

The plan is open to individuals aged up to 75 years, who must be a member of one of the fraternities within the entertainment sector. Coverage of the group life and group personal accident coverage terminates at age 75, with the option to extend the group life coverage to 99 years on condition that a medical report is submitted annually after age 74, but the benefit will be halved at age 65.

In response to a question from the floor, Minister Grange said the Ministry of Finance had provided seed funding of $55 million and the health plan would be sustained through the Consolidated Fund as part of the annual budget.

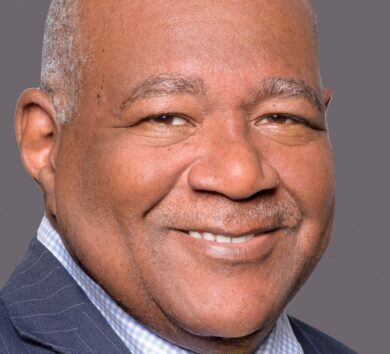

In addressing the gathering, Eric Hosin, group president of Life, Health and Pension at Guardian Group, said it was important for each person to include the name of a beneficiary upon registering.

“Otherwise, the distribution of the benefits of the deceased registrant can get caught up in administrative issues for years and the immediate needs, such as funeral cost benefits, will not be available,” he explained.

Hosin said he was pleased to be a part of the current record-making group plan, especially as entertainment has remained critical to the success of the nation and Brand Jamaica.

Comments