Despite turbulence and a contracting Jamaican economy, Barita fared well for the quarter ended 31st December 2024.

It’s performance for Q1 2025 was favourable when compared with many of its competitors.

Net operating revenue for the period under review came in at J$1.4 billion, a 9 per cent increase on the J$1.32 billion posted for the same period last year. This was driven in the main by Fees and Commission Income of $904.8 million, an 11 per cent increase on the $812. 1 million registered for the corresponding quarter last year. Gains on Investment Activities escalated to $503.9 million, a 56 per cent climb on the $313 million posted last year.

Net interest income rose by 15 per cent to $169 million, $22 million more than the same period last year. Barita saw its Foreign Exchange Trading operation take a beating, showing a loss of $185.3 million as opposed to the $7.4 million booked last year.

Barita posted a net profit of $551.2 million for Q1 2025, a 15 per cent increase on the $479.3 million displayed in its unaudited accounts for Q1, 2024.

Total assets stood at $139.6 billion, marginally down while total liabilities increased to $104.1 billion. It was $92 billion for the same period last year. Repos were flat for the three month period ended December 31st, 2024. Total shareholders’ Equity was up to $35.5 billion.

Barita has made an effort to cut costs and embarked on an exercise last year which is beginning to pay off. Operating expenses increased to $761.6 million for the period under review, a 9 per cent jump on the $695.6 million posted last year. However, staff costs came down by 17 per cent to $367.4 million. Administration expenses did increase to $516.2 million, a 25 per cent increase on the $414.2 million of last year.

Earnings Per Share (EPS) moved from 0.40 for Q1 2024 to $0.46 for Q1 2025. For this three month period, Barita had an Efficiency Ratio of 53 per cent. Barita continues to lead the industry with Capital Adequacy of 24.6 per cent with the average being 21.2 per cent and the FSC’s minimum being 10 per cent.

The management team have drilled down to four revenue lines namely: Investment Banking, Alternative Investments, Asset Management, Treasury, Trading and Brokerage. They all performed commendably and there is not a notable imbalance of these revenue streams. Barita is firing on all engines.

Under the stewardship of CEO Ramon Small-Ferguson, Barita has been both strategic and prudent. How Jamaica National and Curtis Martin wish they had his prudence and wherewithal at this time.

Small-Ferguson is proving to be one of the stand-out younger business leaders on Jamaica’s corporate landscape with a grasp of both local and international dynamics impacting the business and Jamaica’s financial sector.

Speaking at an investor briefing on Thursday morning, Ramon Small-Ferguson said: “ Q1 2025 was characterised by growth in certain key areas of the business. This comes in the context of a challenging environment. There were positives despite global growth showing a slowdown. Local inflation came within the target band at 5.7 per cent. The United States is dominating the growth picture and is leading its peers. We are seeing the overarching trend of disinflation start to diverge where it is moving faster in some countries than others. We are also seeing the pace of monetary easing start to diverge across countries. Geo-politics is a central source of uncertainty as we look across the upcoming quarters with a change in administration in the United States.

“Credit spreads remain very tight amid the overarching economic performance.

“On the local front, near-term growth is subdued by the continued effects of Beryl. We are however seeing that our improved fiscal framework policy and sustained fiscal discipline have taken hold. The financial system remains adequately capitalised and is liquid. We are seeing the effects of less restrictive monetary policy.”

Small-Ferguson went on to say the Barira business is placed on four pillars namely Client Centricity, Revenue Diversification, Capital & Liquidity Discipline and Alternative Investments. Central to client centricity is deepening the understanding of clients’ needs and ideating around solutions to better meet those needs from both a product perspective and a service perspective. This sees Barita infusing technology into improving the client experience.

Revenue Diversification is a critical underlying theme. The aim is to reduce volatility in elements of Barita’s performance, in other words growing the share of recurring revenue in the overall revenue base. Barita has a large endowment of capital and is focused on using that efficiently while maintaining sufficient liquidity buffers to ensure it can capitalise on opportunities as they present. In others, Barita will be able to readily pounce on mergers and acquisitions and pick up deals when competitors falter.

What is prescient at this time is that Barita is resilient in the face of uncertainty. The geo-political landscape is fraught with uncertainty and already we see the Bank of Jamaica follow the Fed’s lead and refrain from reducing the policy rate at this time. Then there is the impact of nature occurrences like hurricanes, earthquakes and other such disasters.

As far as alternative investments are concerned, Barita is looking to unlock the value of those investments including real estate, private credit and private equity.

Small-Ferguson continued: “ We anticipate more vibrant capital markets which augurs well for our investment banking business. Complimenting that is potential growth in our asset management business coming from improved investor confidence. The overall growth outlook is stable and we expect to benefit from that. We are aware that regulatory changes brought about by Twin Peaks and Basel III are anticipated to impact the financial system including us.”

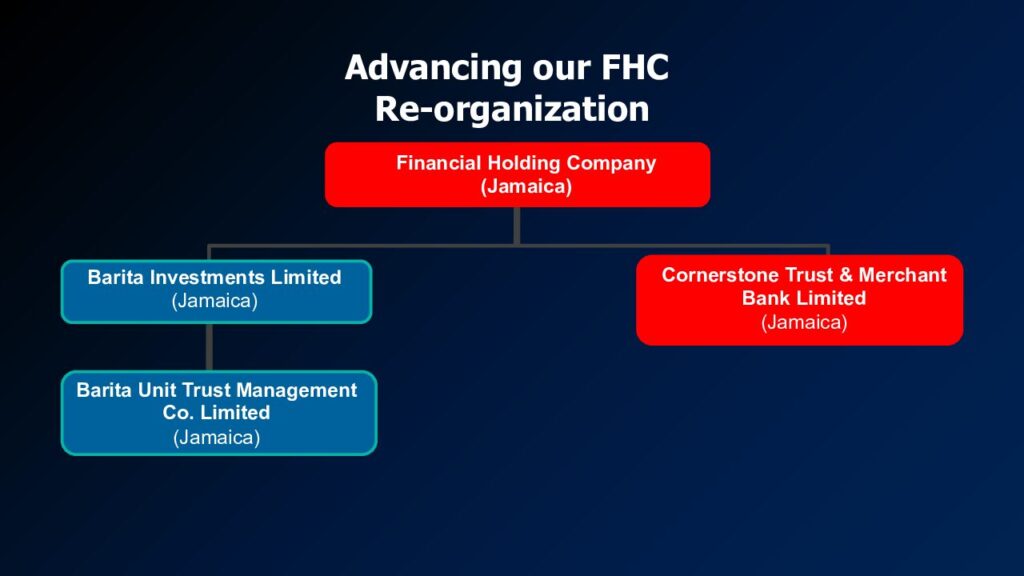

He went on to address the Group’s reorganisation plans and to assure shareholders that they would not be unduly impacted by this major move. Last month Barita shareholders voted overwhelmingly to support the reorganisation of the broader Group of which Barita is a member of into a financial holding structure.

“Under that structure, the majority shareholding of Barita, currently held by Cornerstone Financial Holdings Limited ( about 75 per cent) will move

To be held by the Barita Financial Group, an entity 100 per cent owned by Cornerstone Holdings Limited. Therefore the effective shareholding will not change. What this means is that the shareholding will move from directly held by Cornerstone Financial Holdings to being held by the Barita Financial Group Limited.

“ Importantly, this reorganisation will not impact minority shareholders, they will continue to hold the same number of Barita shares at the same percentage of the overall Barita shareholding. The shares will remain listed after the Scheme is implemented. The Scheme is being implemented to conform with the Banking Services Act. This piece of legislation stipulates entities that own more than one financial institution within their Group which includes a bank, need to reorganise under a financial holding structure.

This move will allow us to become more customer centric, seamlessly offering complete financial solutions between Barita, the investment bank and our sister company Cornerstone Trust& Merchant Bank.

“We also anticipate the benefits from efficiency as we will now more clearly be able to share services across the Group.”

Comments