The JMMB Group on Friday (January 21) kicked off the first in a series of virtual events, dubbed JMMB Elevate 4.0, an event thematically designed to place a focus on financial education.

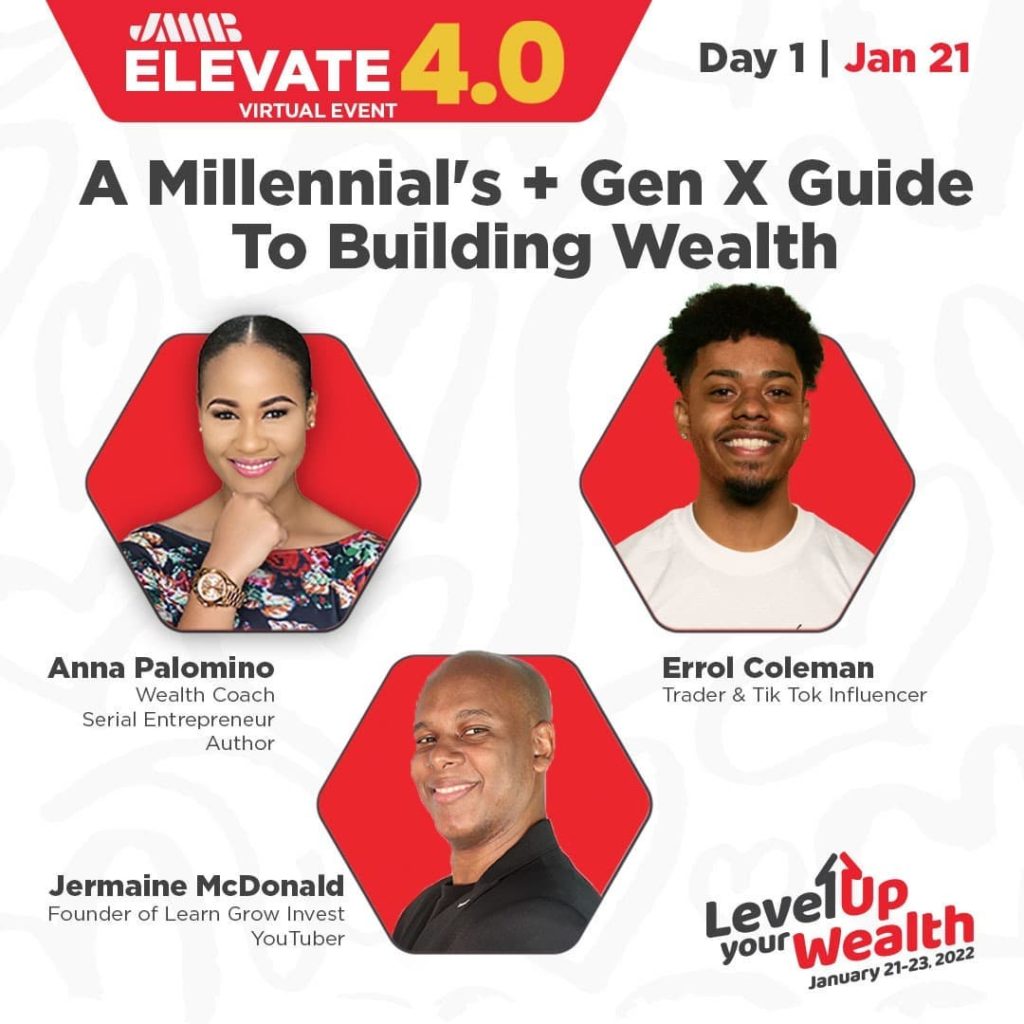

After getting underway at approximately 7 pm last Friday, Day one of the events titled, ‘A Millenial’s + Gen X Guide To Building Wealth’ saw a panel discussion with Jamaican wealth coach and author Anna Palomino and American trader and Tik Tok influencer Errol Coleman.

The night’s discussion, which was moderated by Jamaican YouTuber Jermaine McDonald, founder of the Learn Grow Invest group, took listeners on a journey through the evolution of the idea of wealth building across different generations, mistakes millennials make when building wealth and opportunities young people can take advantage of for wealth building.

On the matter of differing opinions on wealth building across different generations, Palomino noted that previous generations placed an emphasis on finding good-paying jobs at which they would labour until retirement while millennials are more interested in building wealth to facilitate earlier retirement.

For his part, Coleman summed up the change in wealth building ideology across generations by highlighting that previous generations emphasised “saving” while millennials place greater focus on “investing”.

According to the panellists, in their experience, the most common mistakes millennials make on their wealth-building journey often include a focus on following trends, spending more than they earn or being guided by a get-rich quick mindset.

“I have a programme called the money society,” said Palomino, “and almost every time somebody new joins the programme they tell me oh I see this thing on Tik Tok and I want to do it or when you look at their portfolio they may have some stocks in their portfolio and when I ask them okay this is nice tell me why did you purchase this stock, well I saw it on Instagram…”.

In light of this, the wealth coach argued: “We need to invest more in financial literacy and financial education. The biggest mistake you’re making (on your wealth-building journey) is not doing that, because if you don’t have that then you have no choice but to listen to other people… and this may not always be good.”

On the issue of spending more than they earn, Coleman relayed that many millennials tend to find themselves accumulating debt, a direct result of living above their means.

For McDonald, the biggest mistakes of millennials as it relates to building wealth “are persons wanting to take shortcuts. They don’t really want to put in the work, they want to get rich in a month, in two months, three months and they don’t realise that real wealth takes time.”

Having acknowledged the mistakes millennials make on their wealth-building journey, the panellists sought to highlight the opportunities young people can find to build wealth.

These opportunities include making investing a habit this could be in stocks or real estate, monetising their talents and experiences by creating an online course or writing an ebook and working towards increasing passive income streams, that is income that does not require trading your time in return for money.

READ: Financial advisors give advice to their younger selves

Comments