We live in turbulent times with a rearrangement of the world order and an increasingly bellicose United States under the Trump administration. What does that mean for us here in the Caribbean?

One of NCB’s top executives, Angus Young, gave a fulsome and insightful presentation at the 21st Regional JSE Investments & Capital Markets Conference held at the Pegasus Hotel in Kingston last week, on geopolitical developments and how they are likely to impact the Caribbean

Below is Angus Young’s presentation:

My purpose this evening is to provide a practical overview of two significant issues that influence the “investability” of our region, specifically the English-speaking Caribbean.

These two issues are:

- Current geopolitical developments; and

- Evolving regulatory environments.

Current Day Geopolitics

In the latter half of 2025, the United States initiated a significant military buildup in the Caribbean Sea under the stated purpose of combating drug trafficking. The situation escalated as the U.S. began a series of deadly strikes in September 2025 against vessels alleged to be smuggling narcotics. President Trump characterised these actions as an “armed conflict” with drug cartels.

By November 2025, the force was bolstered by the arrival of the USS Gerald R. Ford aircraft carrier strike group, creating the largest U.S. military concentration in the region in decades.

The scenario intensified in December when the U.S. imposed a naval quarantine on oil tankers servicing Venezuela and conducted the first land-based strike on a Venezuelan port facility allegedly used by narcotics traffickers.

The climax of the operation occurred on January 3, 2026, 17 days ago, when U.S. forces bombed and invaded Venezuela and captured Venezuelan President Nicolás Maduro.

In the days that followed, President Trump issued stark warnings to Cuba and Colombia.

When you look at it, the invasion of Venezuela has several striking similarities with:

- Bay of Pigs assault in Cuba in 1961; and

- The US invasion of Grenada in 1983

With regard to the Bay of Pigs, the CIA-led operation aimed to overthrow Fidel Castro’s government. The justification was rooted in Cold War politics, with the US viewing Castro’s socialist regime and its ties to the Soviet Union as a significant threat to American interests in the Western Hemisphere.

With regard to the invasion of Grenada, the primary public justification was the need to protect American medical students on the island following a coup. However, a deeper motivation was to prevent the spread of communism and to remove the new Marxist government that had overthrown the previous one.

We can also reflect on the 1989 invasion of Panama, where one of the main stated objectives was to bring Panamanian leader Manuel Noriega to justice on drug trafficking charges.

We can also reflect on Nicaragua. Cuba, Grenada, Panama and Nicaragua all share one common outcome: regime change was the ultimate goal.

Fast forward to today, and while regime change may still form part of the geopolitical agenda, the dominant underlying driver appears to be energy security.

Following Venezuela, attention has now shifted to Greenland. The strategic value of Greenland lies in its geographic position, which is critical for Arctic control, and its vast, largely untapped reservoir of natural resources.

The Arctic is increasingly emerging as a new frontier for geopolitical competition and strategic dominance.

Greenland is believed to hold one of the world’s largest deposits of rare earth elements (REEs). These minerals are essential for producing modern technology, including smartphones, electric vehicles, and advanced military hardware like guided missiles and stealth fighters. Acquiring these deposits would break China’s near-monopoly on the global supply, a major strategic and economic vulnerability for the U.S.

Greenland is also thought to possess significant reserves of oil, natural gas, uranium, zinc, and gold – assets that would bolster U.S. energy independence and economic leverage.

Ok. So, before I transition the conversation to our region, please keep in mind that the rapid growth of Artificial Intelligence and cryptocurrency mining has introduced an unprecedented level of new demand on the U.S. power grid.

Let us now narrow the focus to our region.

I tie my synopsis of the current day geo-political scenario to our agenda because, in my mind, for many years, whether it was true or not, there has been a prevailing perception that the Caribbean Region was relatively stable and safe when compared to the rest of the world. This stability and peace contributed to its attractiveness where capital investment was concerned. The biggest risk was climate change and weather-related.

Tonight, I want to share some perspectives that may change this view. Guyana provides a clear example. ExxonMobil is unequivocally the largest oil producer in Guyana. The Guyana opportunity is well documented and has been discussed at previous JSE conferences over the last couple of years. As of September 2025, Guyana’s Natural Resource Fund held a balance of USD 3.6 billion.

Currently, there are four FPSO (Floating Production, Storage, and Offloading) vessels operating in Guyana’s waters. An additional three are expected to be operational by 2029, bringing the total to seven.

With 4 FPSOs servicing Guyana, 3 on their way and Guyana has already amassed USD 3.6B in less than 3 years. Do the math! As a frame of reference, consider that with mature energy industries, T&T has between USD 5-6B in its Heritage and Stabilisation Fund.

Trinidad & Tobago. Do you know that in August 2025, ExxonMobil secured a major deal with Trinidad and Tobago to explore for oil and gas in a vast ultra-deepwater block off the country’s east coast. This marks the energy giant’s significant return to Trinidad after a two-decade absence.

It is worth asking, who is 6 miles away from Trinidad?

Enter Venezuela. Venezuela has the largest proven oil reserves in the world. As of 2025, estimates place Venezuela’s proven oil reserves at approximately 303 billion barrels, which accounts for roughly 17% to 18% of the global total.

This positions Venezuela ahead of other major oil-rich nations like Saudi Arabia, Iran, and Canada. Venezuela, Guyana and T&T, three countries blessed with significant amounts of oil and gas, are all in very close proximity to each other.

Where the invasion of Venezuela is concerned, the divergence from the broader CARICOM’s perspective stems from Trinidad’s geopolitical reality. For most CARICOM nations, the invasion is a concerning regional event.

For Trinidad & Tobago, it is an immediate and critical national security crisis unfolding just a few miles from its coast. Trinidad and Tobago’s natural gas production reached its peak in 2010.

Today, at the Point Lisas Industrial Estate, a number of gas-fed plants have been forced to lie idle or shut down over the years due to a decline in natural gas production and supply. In July 2023, it was reported that four plants at Point Lisas had been shut down. That’s 4 of about 7 plants.

Trinidad has to access Venezuela’s vast Dragon gas field in order to resuscitate the nation’s gas-dependent industries, including its liquefied natural gas (LNG) and the petrochemical sectors. This influx of gas is crucial for the country’s energy security and economic stability.

I share these insights to provide greater context on global geopolitics and its implications for our region, because if we are to retain capital and attract foreign direct investment, we must pay close attention to the global political agenda unfolding in our own backyard. In doing so, those of us in this room have a responsibility to identify opportunities while actively mitigating risks for our investors, our businesses, and the region as a whole.

So let us now zero in on our domestic spaces.

Most English-speaking Caribbean nations have no “motherland” to rely on. Most of the islands don’t have the abundance of natural resources like Venezuela, so significant, deliberate and fiscal heavy alignment with some superpower is unlikely.

As indigenous people of this region, we must therefore be intentional in “Safeguarding the Region’s Investability” This encompasses many factors- food security, energy security, but tonight we focus on our capital markets. Over the next 2 days, we offer and invite deep discussions on:

- Free flow of capital in the Caribbean

- Free movement of talent in the Caribbean

- Regulatory harmonisation in the Caribbean

- The Broker Dealer’s responsibility to regional stakeholders is because there is no bailout, it’s on us.

For example, Jamaica was on a very positive trajectory and then COVID hit, Jamaica recovered from COVID and regained momentum. Net International Reserves exceed USD6B, Debt to GDP was projected to go sub 70% in 2026 and Jamaica’s international credit ratings continuously improve………….. and then Beryl and Melissa hit.

You know, when Sint Maarten was hit by Hurricane Irma, it devastated the entire island. The Dutch Military flew in, maintained law and order, and reopened the airport under a big, air-conditioned tent. This is what I mean when I say that there is no motherland for us and post Melissa, Jamaica will once again get up and get going and regain our positive trajectory.

Our domestic capital markets will continue to play a major role in post-Melissa economic recovery and we look forward to hearing more on this over the next two days.

PM Holness, Minister Williams, the Broker-Dealers and our capital markets are and will continue to play a significant role in the rebuild and we stand ready to work with the GOJ to accelerate the rebuild.

The capital markets have the ability to be very creative and to think outside the box. We can bridge the gap in capital recovery inflows that take some time to be received. Again, we look forward to hearing more on this during the conference.

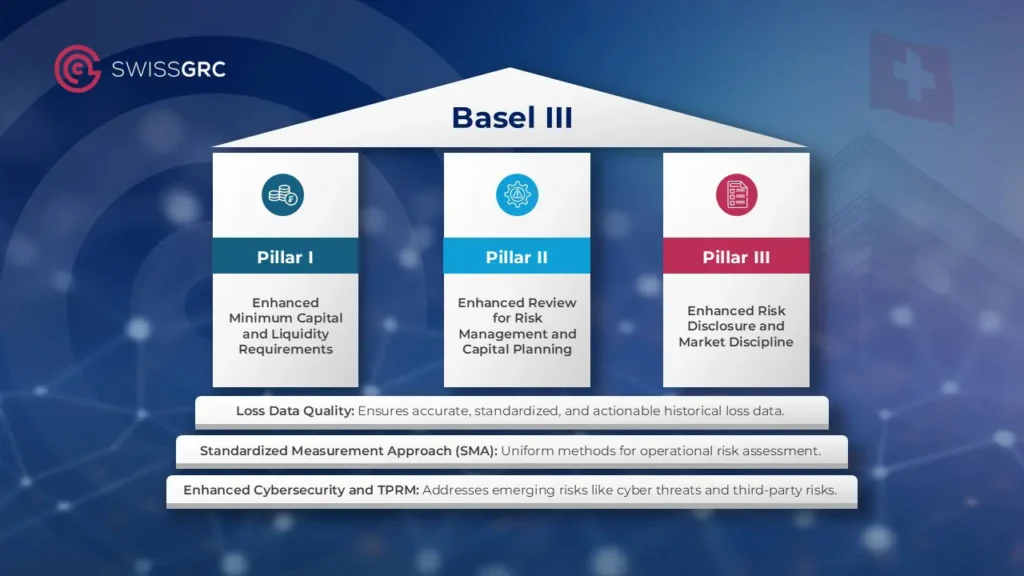

Regulatory change

The adoption of Basel 3 and the twin peaks regulatory regime brings significant change to our industry. Risk weightings force a disciplined and scientific approach to Capital requirements and asset pricing, which aligns well with the mandate of Safeguarding the Region’s

“Investability”

The introduction of liquidity ratio requirements significantly influences the construct of the new age broker-dealer and again points towards a more disciplined approach to capital allocation. But again, in keeping with the theme of Safeguarding the Region’s “Investability”, let us also consider that:

- Capital adequacy.

- Liquidity requirements.

- Qualifiable asset supply &

- The increasing intensity of regulatory reach and the associated cost all make for a safer environment BUT at the same time, it does significantly increase the cost of operations which in turn creates challenges in generating adequate returns for capital deployed in our region.

Compliance teams and internal governance structures are larger than ever, and growing. This costs both money and bandwidth, so in essence, the hurdle rate for adequate profitability to justify capital deployment has a higher bar.

The Special Resolution Regime would also be a big consideration for anyone considering deploying capital into our environment. Foreign Direct Investors know all of the above, and they have to justify to their capital owners why our region ought to be considered.

If one can deploy capital anywhere in the world, what would make our region attractive when capital allocators demand a compensating ROE for the risk and nuances of investing in our territory?

The question before us is simple: how do we make our region investable?

To my industry colleagues, let us all be responsible in pursuing our returns with a broader domestic and regional agenda, knowing that there is no bailout, as there is no motherland.

Our challenge is to strike the right balance, safeguarding stability while creating sustainable returns and to build a region that is self-sufficient, resilient, and globally investable.

Angus Young is the CEO of NCB Capital Markets and the EVP, Corporate & Investment Banking, National Commercial Bank Jamaica Ltd

Comments