(Reuters)

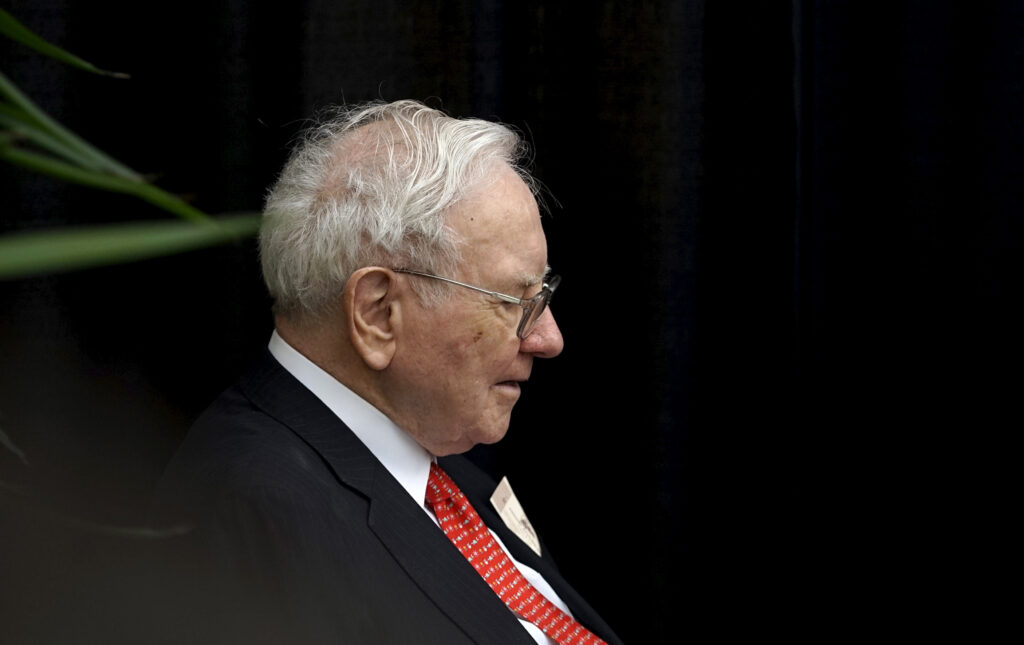

Berkshire Hathaway shares fell 2% in premarket trading after famed investor Warren Buffett said he would step down as CEO of the $1.16 trillion conglomerate after leading it for 60 years.

The company’s board voted unanimously to name Vice Chairman Greg Abel as president and CEO starting next year and Buffett as chairman, it said on Monday.

The decision to hand over the reins to Abel was first announced by Buffett at Berkshire’s annual meeting in Omaha, Nebraska, on Saturday.

Berkshire, which owns railroads, insurance companies and an ice-cream maker, has been planning for decades for the eventuality when Buffett, 94, who has run the company since 1965, is no longer there.

Still, the timing of his announcement came as a surprise as the Oracle of Omaha had not before signalled a clear intention on when to step aside.

Class B shares of the conglomerate dipped to $528.80, putting them on course to wipe out billions of dollars in market value if losses hold through the session. They have jumped about 33% in the past year, outperforming the 12% gain in the S&P 500.

The surprise timing of the announcement, “notwithstanding likely successor Greg Abel’s increasingly demonstrated competence, should pressure the shares on Monday”, KBW analyst Meyer Shields wrote in a note.

However, Buffett’s continuing presence as chair could reassure investors as Abel takes over from an iconic figure whose reputation and legacy loom large.

Berkshire shareholders said it remains unclear how the holding company’s 189 operating businesses, $264 billion of stocks and $348 billion of cash will fare after the man so intertwined with it leaves the stage.

Buffett’s exit from the company “will probably impact investors’ view of Berkshire more than it will actual operations”, Shields said.

Before Buffett disclosed his plan, Abel, who was unaware of the move, told attendees at the annual meeting he would be “more active, but hopefully in a very positive way”, in overseeing Berkshire subsidiaries, though they would continue running “very autonomously”.

Leaders of most Berkshire businesses have reported to Abel since 2018, while its insurance units such as Geico, General Re and National Indemnity have reported to Vice Chairman Ajit Jain, which they will continue doing.

Comments