The Bank of Jamaica’s Financial Policy Committee (FPC) is seeking to assure the island that no local financial institution currently has any major exposures related to the recently reports of banks failing international.

In a statement, based on its assessment of the implications of the recent international bank failures for the domestic financial sector, the FPC said: “There has recently been a spate of banking problems in the US and Europe. Several factors appear to have underlaid these events, including concentrated exposures to specific industries and inadequate safeguards against interest rate and concentration risks.”

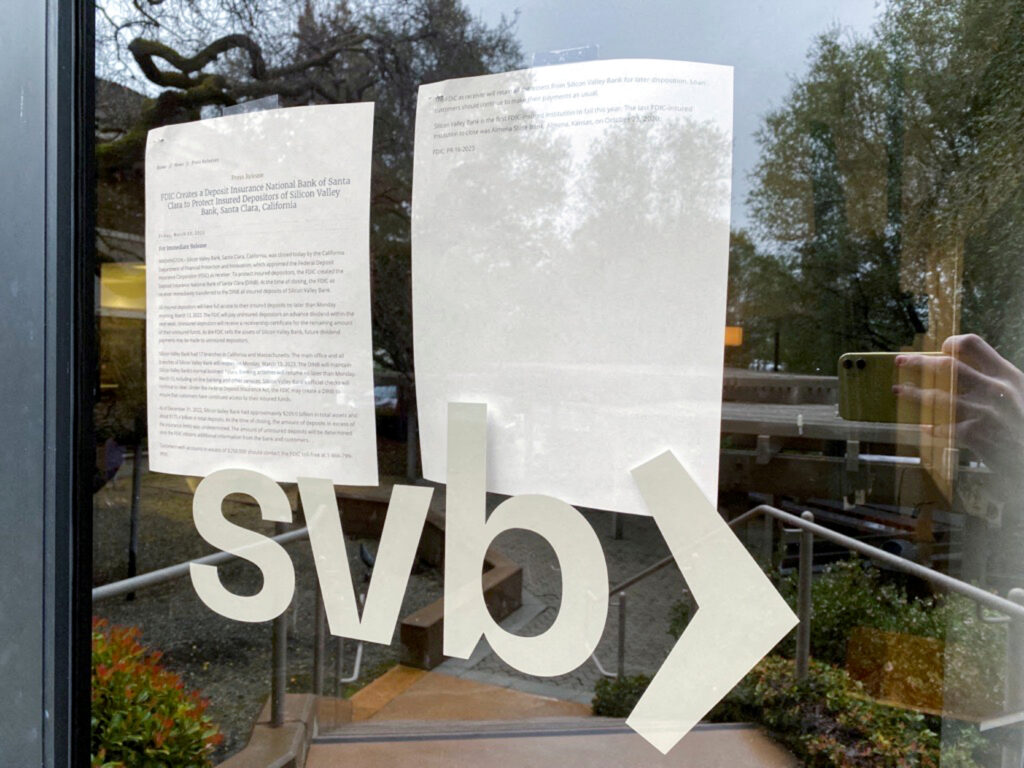

Earlier this month, between March 10 and March 12, Silicon Valley Bank in the Santa Clara, California and Signature Bank in New York were forced to close in the United States, while European institution Credit Suisse collapsed days later.

The collapse of Silicon Valley Bank and Signature Bank in close succession in the US frightened regulators and investors worldwide and led to US government measures to stabilise the global financial system.

At the same, according to a buyout agreement with Credit Suisse rival ,UBS, Credit Suisse shareholders will receive one UBS share for every 22.48 Credit Suisse shares held. Credit Suisse stock will be delisted by the time the deal is completed, likely by the end of 2023.

Meanwhile, in its statement, the FPC added: “No Jamaican financial institution currently has any major exposures to the failed banks. The domestic financial system, while having been subjected in 2022 to similar fair value shocks as the institutions in the US, has not reflected any unmanageable deterioration in its balance sheet position. The financial system, through several initiatives, has remained well capitalised and is able to meet liquidity needs. Furthermore, contagion risks to the Jamaican financial system from the events in the US and Europe is low.”

Said the FPS: “The supervisors of the domestic financial system will maintain their enhanced monitoring of the system to ensure that it remains sound.”

Comments