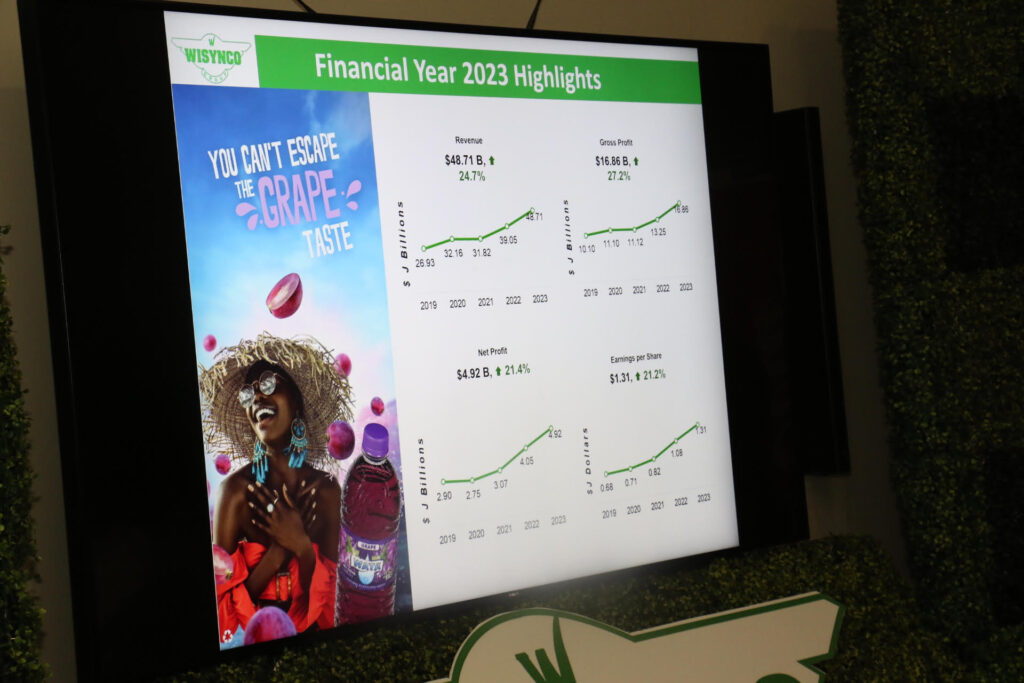

Jamaican manufacturing and distribution company Wisynco, headed by the dynamic duo of Willian and Andrew Mahfood, put in a fantastic performance for the fiscal year ending June 30, 2023, posting revenues of J$49 billion, an increase of 25 per cent on the prior year. This is remarkable given Wisynco posted revenues of $27 billion in 2019.

Gross profit came in at J$17 billion, a 27 per cent increase on financial year 22’s figure. Right now gross profit is growing faster than revenues, which is good news for shareholders .Net Profit for financial year 23 stood at J$5 billion, nearly a billion more than last year. Return on equity stood at 23.3 per cent, which is an improvement of 50 basis points over the 22.8 per cent achieved in fiscal year 2022. Earnings Per Share (EPS) grew by 21.3 per cent. EBIDTA for the year was J$7.5 billion, 23 per cent greater than the prior year with a margin of 15.4 per cent. William Mahfood would like to see that climb to 18 to 20 per cent.

At yesterday’s AGM held at the AC Marriott in Kingston, Wisynco Group CEO Andrew Mahfood paid tribute to Chairman William Mahfood, who he has worked with for the last 32 years.

Andrew Mahfood said: “ Looking at the financial health of the company, our current debt to equity ratio is 2.8 per cent We took on some debt to contribute to our expansion. Our cash ratio shows that the cash held can cover all our liabilities (except the long-term debt). Our total equity and assets are growing nicely which means the engine is running well.

“For Q1, our Director of Manufacturing Devon Reynolds told me Wisynco is like Michael Holding and Andy Roberts of the West Indies, smashing records. We did $13.7 billion in revenues for this period, $1.1 billion more than the record set in Q4 this year. For this period the Group recorded a gross profit of $4.8 billion with a margin of 35 per cent. Net profit for Q1 was $1.5 billion, up 20 per cent with a net margin of 11.3 per cent which is better than last year. EPS was 41 cents also better than last year.”

What you are looking at here is Wisynco, a manufacturer and producer performed far better this year than many financial sector players who typically rule the roost.

WATCH THIS OUR TODAY VIDEO

Comments