LONDON (Reuters)

BP today (February 7) reported a record profit of US$28 billion for 2022 while boosting its dividend in a sign of confidence as it sharply raised overall spending plans and scaled back ambitions to reduce oil and gas output by 2030.

The blockbuster profit follows similar reports from rivals Shell, Exxon Mobil and Chevron last week after energy prices surged in the wake of Russia’s invasion of Ukraine, prompting new calls to further tax the sector as households struggle to pay energy bills.

Three years after Chief Executive Bernard Looney took the helm with an ambitious plan to pivot BP away from oil and gas towards renewables and low-carbon energy, the company said it will increase annual spending in both sectors by Us$1 billion with a sharper focus on developing low-carbon biofuels and hydrogen.

SHARES SIGNIFICANTLY UNDERPERFORMED

But it scaled back plans to cut oil output, now aiming to produce two million barrels of oil equivalent per day by 2030, down just 25 per cent from 2019 levels compared with previous plans for a 40 per cent cut. Looney said that would not impact a target of reducing emissions from fuels BP sells by up to 40 per cent by the end of the decade.

While many investors backed Looney’s strategy, which he told Reuters “is working”, BP’s shares have significantly underperformed top Western energy companies since the CEO took office, remaining largely flat compared with a 17 per cent gain for Shell and a nearly 80 per cent rise in Exxon shares.

“In a departure from its peers, it would appear that criticisms of its spending on renewables has started to sting,” said Michael Hewson, chief market analyst at CMC Markets UK.

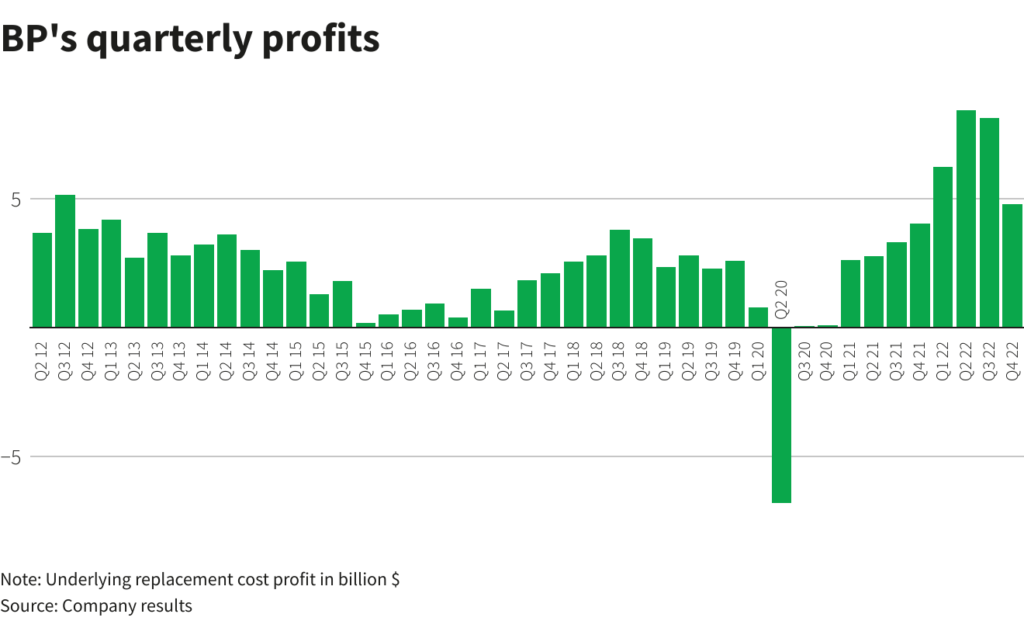

BP’s US$4.8-billion fourth-quarter underlying replacement cost profit, its definition of net income, narrowly missed a US$5 billion company-provided analyst forecast and compared with US$4 billion a year earlier and US$8.2 billion in the third quarter.

The results were impacted by weaker gas trading activity after an “exceptional” third quarter, higher refinery maintenance and lower oil and gas prices.

But for the year, BP’s US$27.6 billion profit exceeded its 2008 record of US$26 billion despite a US$25 billion writedown of its Russian assets.

That allowed it to boost its dividend by 10 per cent to 6.61 cents per share, after halving it in the wake of the pandemic, and announce plans to repurchase US$2.75 billion worth of shares over the next three months after buying US$11.7 billion in 2022.

BP shares rose 5.6 per cent by 1220 GMT to their highest since early 2020.

ENERGY TRANSITION

BP reiterated plans to divide its spending to 2030 equally between the oil and gas business and its energy transition businesses, upping the total budget to up to US$18 billion from a previously guided upper range of US$16 billion.

Transition businesses, such as renewables and electric vehicle charging, account for around 30 per cent of the current budget compared with three per cent in 2019.

BP kept its returns outlook for renewables largely unchanged at six per cent to eight per cent, without taking into account debt, even though global offshore wind production costs have soared in recent months.

Looney said BP’s wind and solar production will focus more on providing renewable power to generate biofuels and low-carbon hydrogen, doubling down, particularly in the United States where the landmark Inflation Reduction Act offers investment credits and tax cuts.

BP, whose trading operations further boost renewables returns, maintained plans to have 50 gigawatts of renewable projects under development and 10 GW operating by 2030.

INCREASED FOCUS ON RENEWABLE NATURAL GAS

It said it expects returns of upwards of 15 per cent from its bioenergy business and its combined electric vehicle charging and convenience store businesses, while looking for double-digit returns on hydrogen.

It aims to translate this into a core profit from the transition businesses of US$10 billion to US$12 billion by 2030, out of targeted total group earnings before interest, tax, depreciation and amortisation (EBITDA) of US$51 billion- US$56 billion.

BP also wants to increase its focus on renewable natural gas having last year acquired US producer Archaea Energy for US$4.1 billion, and it has also set a target to produce 0.5 million-0.7 million tonnes a year of low-carbon hydrogen to initially supply its own refineries.

BP, which increased its 2030 oil price forecast by US$10 to US$70 a barrel, will focus its global oil and gas operations in nine regions, with plans to sharply increase output from its US shale business and in the Gulf of Mexico.

Comments