Traders gets an additional 1 ½ hours to trade securities

Durrant Pate/Contributor

Come Money May 27, there will be longer trading hours on the Jamaica Stock Exchange (JSE), as part of changes announced by Jamaica’s equities regulator.

Starting Monday, the stocks and securities market trading hours will be extended from 3 ½ hours to 5 hours. As a result, trading will commence at 9:00 a.m. and close at 2:00 p.m., giving traders an additional 1 ½ hours to trade securities.

Additionally, the settlement cycle for transactions will be shortened from Trading plus two additional business days (T+2) to one business day after trading (T+1).

The JSE has been working closely with its stakeholders over the past six months to implement the T+1 settlement cycle, culminating in a final meeting with brokers and listed companies.

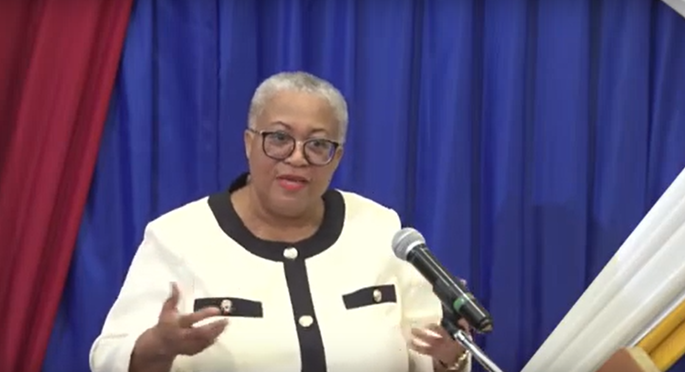

JSE managing director, Marlene Street Forrest, explains that the move to T+1 and the extended market hours, required changes to the JSE’s rules, thereby impacting how listed companies and member/dealers provide information to the JSE. She is assuring the financial community that these changes are in the best interest of all stakeholders.

According to the JSE boss, “we want to inform our members about the measures the JSE and the Jamaica Central Securities Depository (JCSD) are taking to improve the market for the benefit of investors, reduce market risks, and enhance market activities and liquidity. We are attentive to the needs of our investors, listed companies, brokers, and other stakeholders, and we respond to enhance our market’s advantages. We strive to align with global best practices and provide opportunities for growth.”

T+1 Implementation

For her part, Althea Daley of the JCSD explains that the settlement cycle is the period required to finalize a trade and deliver funds and securities. In a T+1 settlement cycle, a trade becomes final on the next business day following the trade date, “T”.

Mrs. Daley highlighted several anticipated changes such as

- Trades will be final one day after the trade date.

- Member/Dealers will pay and receive payment for securities one day after trading, on behalf of themselves or clients.

- The JCSD will stand in the middle of all transactions to ensure payment and delivery.

- Investors should not be impacted, as the requirement to fund their accounts with Member/Dealers remains unchanged.

- Shares traded can be pledged on T+1.

Benefits

Mrs. Daley emphasized the benefits of shortening the settlement cycle to T+1:

- Harmonization with major markets internationally and counterparties, for example, the USA and Canada.

- Quicker receipt of cash/securities for investors.

- Reduction of JCSD’s credit and settlement risk.

- Operational process improvements.

- Increased market liquidity.

- Reduced Foreign Exchange risk in USD transactions.

Listed Companies

- Listing ceremonies on the JSE will now occur at 8:30 a.m. instead of 9:00 a.m.

- News releases to the market will be issued after 2:00 p.m. and before 8:30 a.m.

- The ex-date and the record date will be the same.

Comments