Once the undoubted leader among commercial banks in Jamaica, taking away the top spot from BNS, NCB has recently been beset by bad news.

This week its stock dipped below the J$100 mark for the first time in many years, before staging a recovery.

This may well be due to a confluence of events that more recently has spelt bad news for the Group.

For the financial year ended September 30, 2021, NCB reported consolidated net profit of J$20.1 billion, a decline of 25 per cent or $6.8 billion from the prior year. Operating expenses came to $94.9 billion, an increase of $13.3 billion or 16 per cent over the prior year.

In May 2019, NCB finalised the acquisition of a 62 per cent shareholding in Guardian Holdings after share purchase transactions totaling US$207 million.

Guardian would then become the primary insurance arm of the NCB Group with Patrick Hylton (who together with Dennis Cohen did a fantastic job of positioning NCB as the leading financial group in the country) taking on the chairmanship of Guardian Holdings.

Before the pandemic, Guardian reported good results but then the pandemic had a devastating impact on the Trinidad-headquartered regional insurance giant, impairing premiums.

Last month Guardian Holdings recorded just a one per cent increase in net profits to end 2021 at TT$798.35 million up from TT$778.69 million in 2020.

Earlier this month, after eight years as Group CEO of Guardian Holdings, Ravi Tewari inexplicably resigned after only last year mapping out the way forward.

That NCB has taken a very cautious approach to dividends is of concern to shareholders. After announcing that there would be no dividend payout in 2020 into 2021, it has since reversed itself, albeit paying out just 50 cents per share.

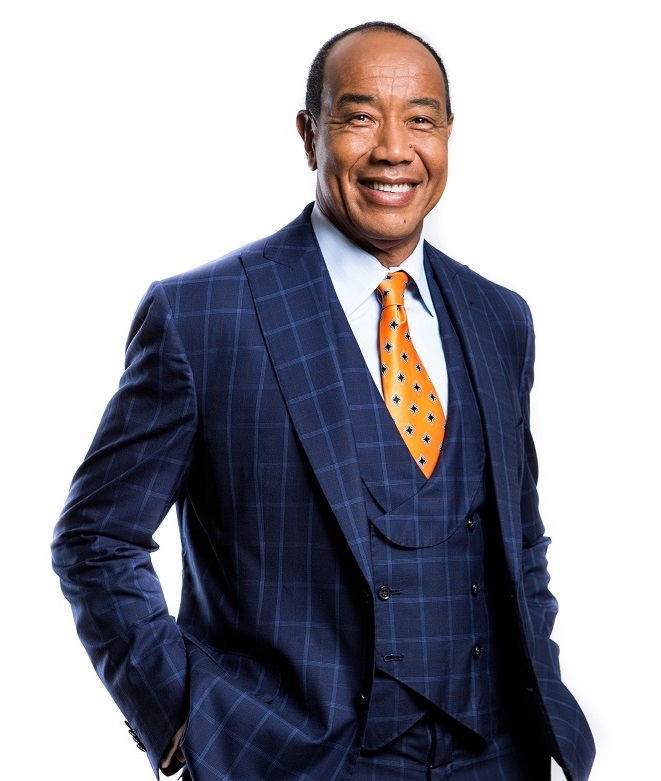

In February, at NCB’s AGM, Chairman Michael Lee Chin declared: “We will alight from this dividend hiatus which is tough, I know and we all know. But once we start it, you can count on us. It has been a difficult year.”

Shareholders may feel a bit disgruntled, having to see the share price go from $230 in 2019 to somewhere near $115 today.

Back in 2019, before the pandemic, NCB paid out $8.3 billion in dividends and has consistently had a good reputation of being a good earner.

The COVID pandemic has taken its toll. Adding to the litany of woes is the announcement that NCB’s profits fell eight per cent for December’s first quarter with revenues remaining flat.

Last week saw more bad news from NCB, with the Group announcing it will be closing four branches in the heart of the city – namely Cross Roads, Hagley Park Road, Oxford Road and Washington Boulevard. It will also be closing the Black River branch in St Elizabeth.

This may be a nudge for customers to rely more upon digital offerings which will allow NCB to reduce its operating expenses.

In these times, NCB is looking to preserve capital by holding on to retained earnings. The last thing it wants to contend with is a liquidity crisis.

Lee Chin will no doubt advice shareholders to buy, hold and prosper.

NCB, acquired by Lee Chin, is celebrating its 20th anniversary under his ownership and stewardship this month. It has been the standout success story of Corporate Jamaica over the last two decades. It now has to find a way to reassert its preeminence and come out of the struggle to grow its bottom line.

In the second week of November of 2021, NCB’s stock price began the week at $125 and closed at $119.

At the time, Group President and CEO Patrick Hylton said: “We do not like seeing the stock price fall off, but it is a reality of the pandemic. But we are starting to see a change in the environment and change in our fortunes as a lot of challenges are behind us.”

Comments