Following a review of its financing mechanisms, processes and channels, the Development Bank of Jamaica (DBJ) has affirmed its commitment to improving how businesses can access funding.

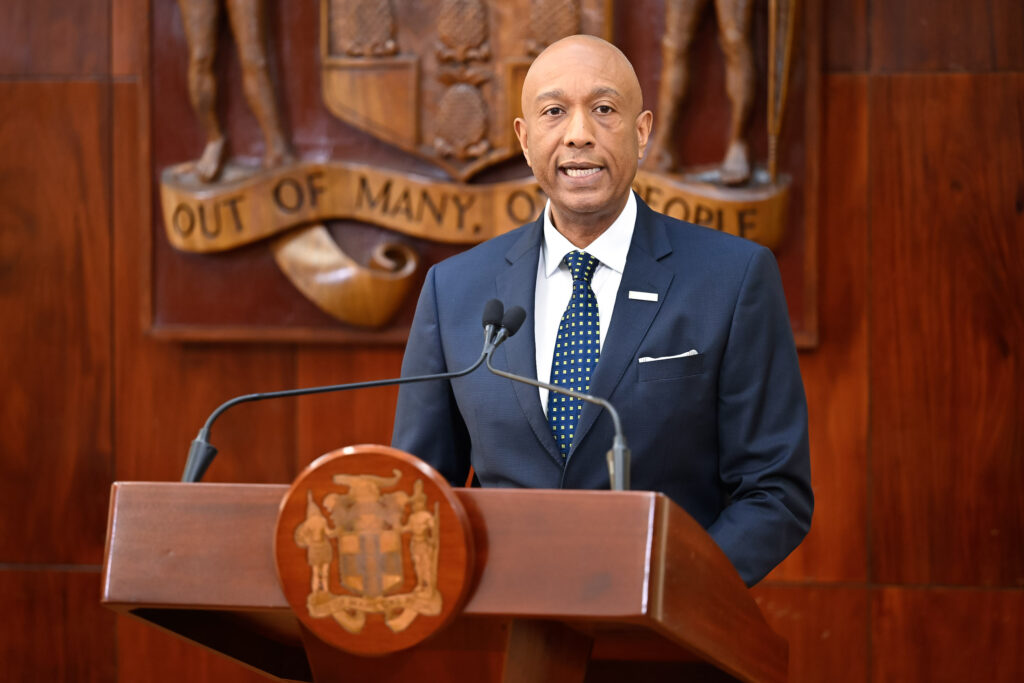

Speaking in a recent video posted on Prime Minister Andrew Holness’s Facebook page, DBJ Managing Director Dr David Lowe highlighted that while businesses face difficulties in accessing capital, the government-run financial institution stands ready to provide better channels to funding.

“DBJ will basically be there for you to create access to capital. We are not only looking at businesses that are established in bright lights, but the people who are going to generate economic activity, create a job for their neighbour, create an opportunity to send their kids to school,” he shared.

“We know that capital is difficult to access, and I think DBJ has developed a programme that will create better access to getting money to expand their businesses so they can move from one shop with one room to a large ability to employ other people and then to make an impact,” Dr Lowe continued.

The managing director said further that DBJ understands the needs of businesses, particularly those of micro, small and medium-sized enterprises, “by being on the ground” and listening to business owners share their pain points. One such challenge, Dr Lowe highlighted, was maintaining cash flow while filling orders from large suppliers.

“…There are issues as simple as inventory [where] people who have a little farming business and they sell to a hotel, and they have to wait 30 days or 35 days when they still have to make payments at the end of the week at the delivery,” he noted.

“We’re looking at a programme that can help them to get access to that receivable. So, we’re in dialogue with tourism interests, we’re looking at supply chain integration, and we’re trying to make sure that they can be relevant in the economy,” Dr Lowe added, without giving more details on the programme

Already, DBJ has a reverse factoring programme geared towards providing small producers with guarantees to pay their suppliers, as they focus on fulfilling deliveries to their customers and getting paid. The bank launched the programme in 2021.

Improving loan transmission through AFIs

Beyond cash flow and working capital needs, DBJ offers loans to businesses seeking to expand their operations and invest in new equipment. This is done in partnership with local commercial banks, otherwise referred to as approved financial institutions (AFIs).

Dr Lowe is, however, aware that securing loans through AFIs can be a rigorous process and has frustrated some small business owners.

In an interview with Our Today, he conceded that some small businesses and organisations representing the MSMSE subsector have expressed frustration with the loan application process through DBJ’s AFIs.

“It has not been a smooth process for a long time. The nature of how you engage as partners to lend money can somehow add to process elongations, I call it,” he shared.

“Sometimes, what happens in terms of the time for approval is that the feedback that I’ve got is that you have success with many MSMEs, and then you have a lot of MSMEs that are not as lucky. And what we tend to do is to focus on the ones that are not as lucky, because they get frustrated based on the length of time,” the DBJ managing director further outlined.

“So, one person may get through in six weeks, the other person might get through in six months. Some people don’t get through at all, and what we tend to get is more information from the ones that are not successful.”

In most cases, Dr Lowe said, businesses that are unsuccessful in securing loans don’t provide adequate financial information for banks to assess if they can repay. At other times, loan applicants submit documents piecemeal, expecting immediate or automatic approval, but, instead, the process takes longer.

Self-assessment for business loans

To this end, he recommends that business owners need to “do self-filtering, which is something that we’re now initiating”.

The self-filtering process involves business owners gathering financial documentation to present to AFIs and then assessing if they can afford a loan based on a set of requirements outlined by DBJ.

“So, if you are legitimately a potential beneficiary after going through that, then we expect the process to be smoother. We don’t expect a continuation of what has been there. It’s not a perfect system,” Dr Lowe told Our Today

While noting that DBJ is not a “retail institution” and does not approve loans, Dr Lowe explained that by engaging with MSMEs, the development bank can help businesses to self-evaluate and manage expectations regarding accessing loans.

Previously, businesses seeking loan financing through DBJ were recommended to the Voucher for Technical Assistance, an initiative that would prepare them for the rigours of a loan application. When Our Today asked if the DBJ would reintroduce the capacity-building initiative, Dr Lowe pointed out that the institution is building on it.

“We want a frictionless approach between the banks and ourselves, and if we do that, it becomes a little bit less pain[ful] in the process. Because all of these things require information, time to assess and the speed at which all of those things come together,” the DBJ managing director related.

“That’s really the process we’re managing. It’s not that our money is not available. Our money is always available. And I’m assuming that the criteria are always the same across banks,” he added.

Collateralisation

In addition to self-assessment, the DBJ also provides collateral security for businesses.

“There’s the capacity for us to de-risk a particular type of loan where we offer collateral support, and sometimes those two are not sold together. So, for the people who know that exists, it becomes a no-brainer,” the managing director said.

However, when an applicant is unaware of the collateralisation option, this is another reason the loan application process is difficult. Dr Lowe noted, though, that he could only speak anecdotally since the DBJ had not completed its assessment of how AFIs disbursed loans.

He also admitted that the development bank will need to improve its communication and public education about its products. At the same time, he encouraged business owners to be “reasonable” about their loan expectations.

“I don’t want to ever be critical of any bank. They have their own risk appetite. They have shareholders to worry about. They have to be guided by their own policies,” Lowe cautioned about assessing the success rate of loan applications.

“My purview is to make sure [the process is] seamless from us to applicants,” he added.

Since Dr Lowe’s interview with Our Today, the DBJ has announced a re-engagement with its AFIs to accelerate funding to Hurricane Melissa-impacted businesses.

Comments