Digital marketing company, One Great Studio Limited (1GS), has set its sights on entering the junior market of the Jamaica Stock Exchange (JSE) with an initial public offering (IPO) scheduled to open on August 28.

1GS, in a statement, is inviting applications from prospective investors for the subscription of up to 338,627,439 ordinary shares in the Lady Musgrave Road-based firm.

Barita Investments will serve as the lead broker, with the IPO tipped to close at the end of trading on September 18. This is, however, subject to 1GS’s right to change as stated in its prospectus, now available on a dedicated website and the JSE. All applications should be submitted through the Barita BOSS platform.

The IPO comprises 169,313,720 ordinary shares readily available for the general public and 169,313,719 reserved shares designated for key strategic partners and 1GS team members all priced at J$1.00 per share.

According to 1GS, proceeds raised from the issuance of subscription shares will play a crucial role in supporting the company’s growth and enable the pursuit of strategic investment opportunities, bolster growth initiatives, and reduce outstanding debt. 1GS also plans to use the proceeds to expand regionally, and invest in human capital development to meet rising market demand.

Launched in 2012 and having since grown into a 55-member team of dedicated professionals, 1GS caters to a diverse clientele spanning both local and international markets.

The company boasts a comprehensive range of digital marketing services with a primary focus on digital channels. These services include search engine optimisation (SEO), brand strategy and design, digital marketing, mobile app design and development, digital strategy, and website design and development.

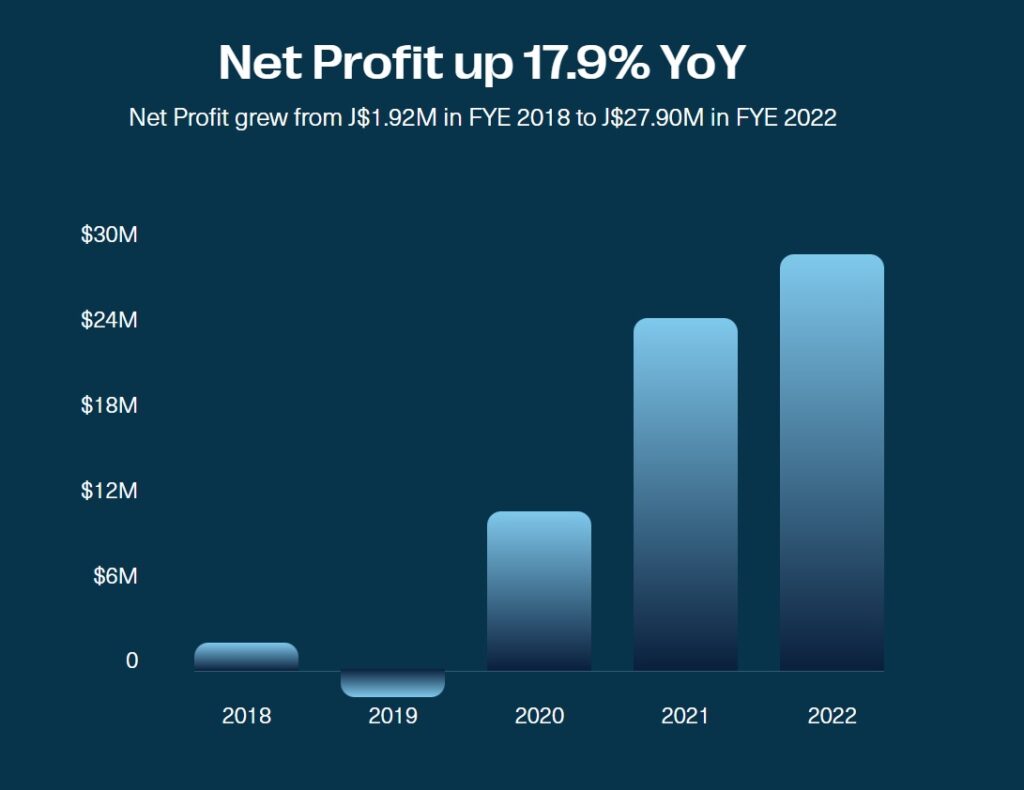

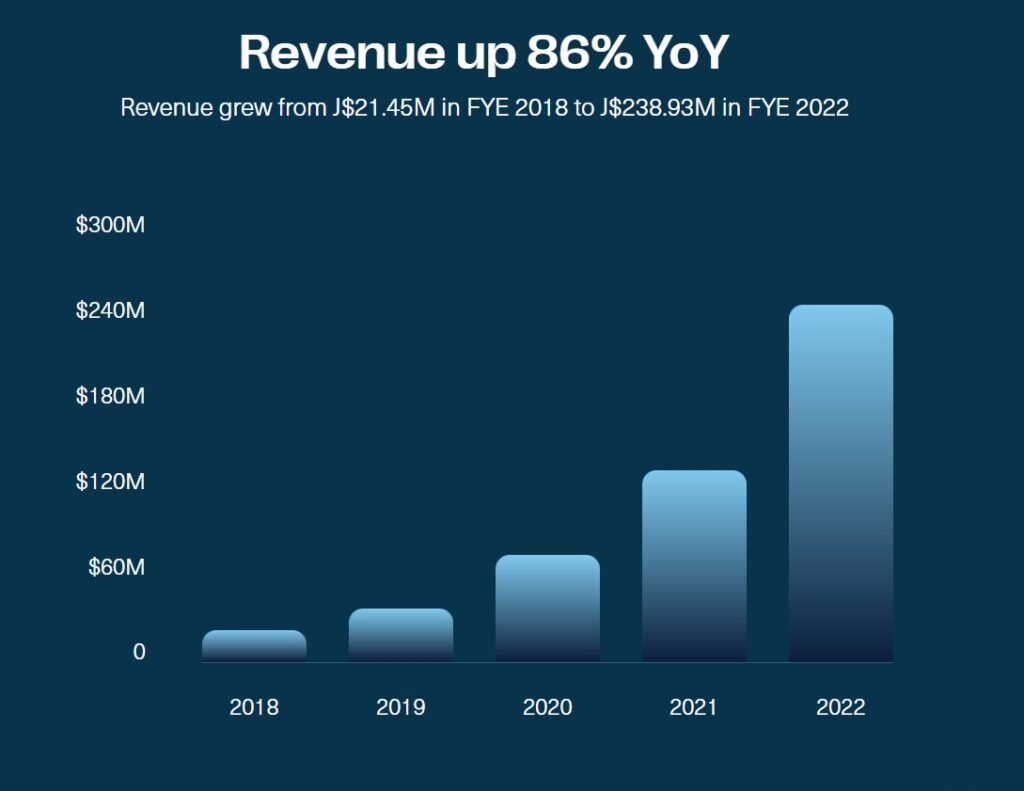

1GS’s financial performance showcases remarkable growth, with revenues increasing from J$21.45 million in 2018, to J$238.93 million in 2022, representing a compounded annual growth rate of 82.70 per cent.

During this time, operating profit of J$3.97 million in 2018 grew at a compounded annual growth rate of 98.86 per cent to J$62.09 million in 2022. The company’s success in cross-selling solutions has led to increased revenue per customer across the 1GS Group, with the average annual customer spend increasing from just under J$630,000.00 in 2018 to over J$2.00 million in 2022.

1GS’s customer base also experienced a significant expansion from 42 clients in 2018 to an impressive count of 117 in 2022. This achievement can be attributed to the skillful execution of 1GS’s well-crafted organic and inorganic growth strategies over the period.

Djuvane Browne, 1GS chief executive, expressed his pride in the company’s journey and its future prospects.

“Today, we stand tall as a home-grown digital-first agency, serving clients worldwide through our global team of design, development, and marketing professionals. This IPO presents an opportunity for you to invest in our business and participate in the future growth and success of 1GS. Over the last five years, our management and executive team have been strategic and intentional in driving the company’s revenues and profits,” he began.

“The strategic acquisition of a global search engine optimisation (SEO) agency in September 2022 has significantly propelled our growth trajectory. We are well-positioned to leverage design and technology to drive profitability and positive impact. We are thrilled to invite the Jamaican public to become potential shareholders of 1GS and, by extension, participate in the growing digital marketing economy. With transparency about our past, present, and future, we leave no questions about who we are, our achievements, what sets us apart, and the immense opportunities that lie ahead,” added Browne.

“Over the last five years, our revenue has grown at a compounded annual growth rate above 80 per cent from J$21.45M in 2018 to J$238.93M in 2022. In September 2022, we completed our first major acquisition. This acquisition has had a profound impact on our business. This impact is evident in our Q1 results, when 1GS earned J$114.93M in revenue which represents a 159.85 per cent year-over-year increase. This represents almost 50 per cent of the revenue for the entire year in 2022. This growth also translated to our bottom line. In Q1, 2023 our profit before tax was J$28.52M, which represents a 116 per cent year-over-year growth,” Browne noted further.

“This is the ethos of what we do at Barita. This transaction represents the capabilities of how Barita’s Investment Banking Unit was able to work closely with One Great Studio Company Limited to unearth their strategic imperatives,” shared Terise Kettle, senior vice president for investment banking at Barita Investments Ltd.

“We always want to ensure that we are playing our role in growing our client’s business, driving innovation and thus helping them to transform their company. More importantly, we consider the leadership of One Great Studio Company Limited to be bold in their approach to growing the business. One Great Studio Company Limited has been a long-standing partner of Barita, and we are happy that we were able to assist them by providing strategic advice and funding for their recent acquisition and now acting in the capacity of arranger and lead broker for this initial public offering,” she continued.

Comments