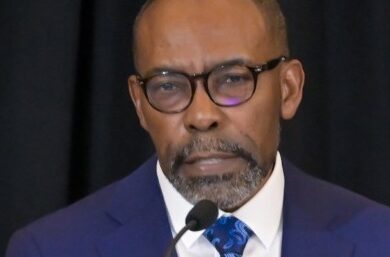

Durrant Pate/Contributor

Economic growth in Euro Area is weakening based on the latest projections from the European Central Bank (ECB) September 2022 staff macroeconomic outlook.

While the ECB is projecting that outside the Euro Area, the global real gross domestic product (GDP) is expected to rise by 2.9 per cent in 2022, 3.0 per cent in 2023 and 3.4 per cent in 2024, the outlook for the Euro Area is less optimistic. In keeping with global development, the outlook for international trade and foreign demand in the Euro Area has gotten worse in comparison to June projections.

Amid rising commodity prices, persistent supply constraints, still relatively robust demand, and tight labour markets, global inflationary pressures are still widespread and elevated. However, it is anticipated that these pressures will lessen as GDP slows and commodity markets stabilise.

The balance of risks around the baseline estimates is biased to the downside for global GDP and to the upside for global inflation in an environment of high uncertainty. With the removal of the pandemic-related restrictions, the Euro Area economy expanded by 0.8 per cent in the second quarter of 2022.

This growth was primarily driven by high consumer spending on contact-intensive services. As more individuals travelled over the summer, businesses have experienced high energy costs and persistent supply shortages but the latter have been progressively improving.

Key growth factors

The ECB Governing Council anticipates that the economy will significantly slow down over the course of this year, despite the fact that robust tourism has supported economic development during the third quarter. This is due to four key factors.

- The economy as a whole is facing headwinds from high inflation, which are being exacerbated by disruptions in the gas supply.

- The robust increase in service demand that accompanied the economy’s reopening will wane over the ensuing months.

- The Euro Area economy will receive less assistance as a result of the declining global demand, which will also be accompanied by tighter monetary policy in many major nations, and deteriorating terms of trade.

- Uncertainty is still high and confidence levels are plummeting.

The labour market continues to thrive with employment increasing by more than 600,000 people in the second quarter of 2022 and hours worked surpassing their pre-pandemic levels. The ECB staff’s baseline macroeconomic projections for September 2022 are on the assumption that high gas prices and preventive energy conservation measures will restrain gas demand.

Growth is anticipated to pick up in the medium term despite less favourable financing conditions as the energy market rebalances, uncertainty diminishes, and supply bottlenecks are overcome.

Steady budget balance improvement

In the years leading up to 2024, a steady improvement in the Euro Area budget balance is predicted. However, there is still a lot of uncertainty around the budgetary estimates mainly related to the Russia-Ukraine war and developments in the energy markets.

The overall Stability and Growth Pact general escape clause should be extended to the end of 2023, according to the European Commission, which will allow fiscal policies to adjust to changing circumstances where necessary. The Bank of England has stated that fiscal support measures to lessen the effects of rising energy prices should be short-term and aimed at the most vulnerable people and businesses.

The goal of structural policy should be to increase the growth potential and resilience of the Euro region. The ECB notes that global economic activity is still being impacted by high inflation, tighter financial conditions, and persistent supply-related challenges.

Although there are still strains on supply chains, a lower demand outlook has helped to ease tensions in the Euro Area.

Comments