Excelerate Energy is targeting after-tax earnings between US$80 million and $110 million by 2030 after finalising the acquisition of Jamaican assets from New Fortress Energy.

The Texas-based liquefied natural gas (LNG) provider highlighted the earning potential of its newly acquired asset in its recent earnings call for the second quarter of 2025. It also indicated plans for the expansion of its operation into bunkering and its footprint into other Caribbean jurisdictions.

“The acquisition of Jamaican LNG terminals and infrastructure, along with expanding operations in the region, positions Excelerate favorably within the industry,” the company noted.

As part of its expansion plans, the company will significantly increase its capital expenditures in the region.

For CEO Stephen Kobos, the recent acquisition of Jamaican assets marks a critical step in Excelerate’s “evolution”, as its growth strategy has included owning and operating downstream infrastructure assets.

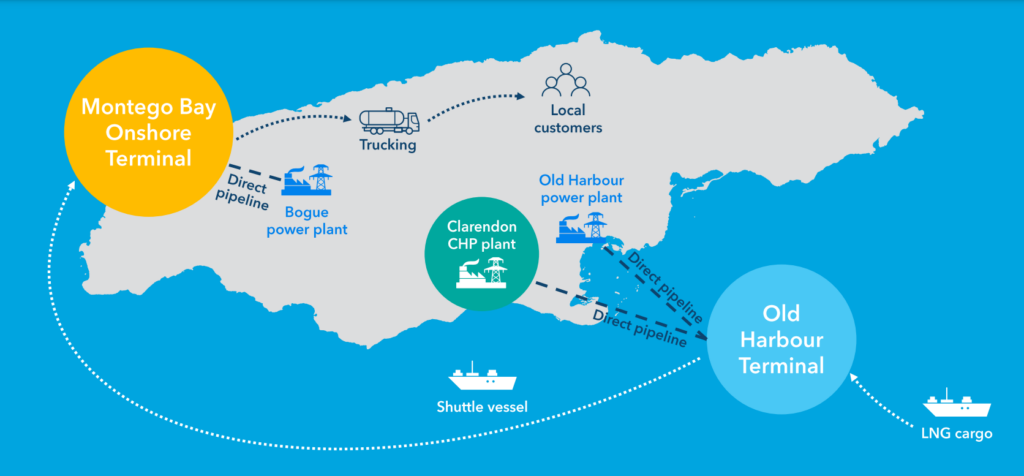

The transaction with New Fortress Energy closed in May, adding to Excelerate’s portfolio the Montego Bay and Old Harbour LNG terminals, a combined heat and power plant in Clarendon, and several small-scale regasification facilities throughout the island.

Integration of Jamaican assets

Since closing the acquisition, Excelerate has been engaged in the integration of Jamaican human resources, systems, and processes, as Kobos shared in the earnings call.

“We’re also working to optimise the existing business, enhance customer service, and strengthen our continuity plans. I’m pleased to report that integration is proceeding as planned and the Jamaica assets are exceeding our operational expectations,” the CEO told shareholders.

“Thanks to the excellent condition of the assets and the deep expertise of our new Excelerate colleagues, we are well-positioned to deliver sustained reliability and high operational performance. The Jamaica transaction is a compelling strategic win for Accelerate and for our shareholders,” he continued.

The company’s Jamaican assets already had established multi-year contracts and were generating revenues for their previous owner. They will continue to do so under Excelerate’s ownership.

Kobos pointed out that apart from the immediate earnings contribution of the Jamaican portfolio, “the transaction also strengthens the foundation of our US LNG supply portfolio.

“Jamaica’s 21-year contract profile dovetails nicely with our 20-year offtake of US LNG from Venture Global’s Plaquemines Phase Two. With this alignment, we have secured a long-term downstream destination for our volumes. As we optimise the Jamaica platform, we expect to unlock near-term EBITDA growth by improving asset performance and expanding commercial activity,” Kobos explained.

Expansion plans

The CEO also outlined plans to “scale this model across the Caribbean”. This, he said, will need investment as the company pursues new infrastructure development in a move to grow its customer reach.

“By 2030, we expect to generate US$80 million to US$110 million in incremental EBITDA from optimising the Jamaica platform and investing US$200 million to US$400 million in growth capex to expand our operational presence in Jamaica and across the Caribbean,” Kobos disclosed.

He justified the earnings projections and investment target, noting that Excelerate anticipates demand for LNG in Jamaica will continue to grow. He pointed out that, in addition to energy-generation switching from fossil fuel inputs to LNG, demand will also rise on account of additional power generation needs as the Jamaican economy continues to grow.

Already, the Excelerate team has begun identifying ways to increase LNG supply through its Jamaican assets while maximising current contractual arrangements with local customers

“We have already begun to sell incremental volumes of LNG and natural gas to customers on the island, and we expect this early momentum to continue. In the medium to longer term, we will make investments in larger-scale infrastructure projects that support our growth. These opportunities span a diverse range of initiatives, including new power generation, terminal expansions, LNG bunkering and additional pipelines. The second part of our approach is to position Jamaica as a regional hub for LNG distribution across the Caribbean,” Kobos explained.

The CEO highlighted that Jamaica’s location allows the company to benefit from “a structural cost advantage” given its proximity to the US and other key regional markets. As such, the company can “respond quickly to regional demand, making [Jamaica] an ideal launch point for LNG distribution and power development”.

“We are advancing a hub and spoke model that leverages our floating LNG terminal in Old Harbour as a central storage and distribution point,” Kobos shared.

“From there, we can efficiently deliver LNG throughout the Caribbean using smaller vessels to reduce transportation times and lower fuel costs. We see this as a natural expansion of our downstream operations and an important part of our long-term Caribbean growth strategy. And while we are still early in our ownership, we have hit the ground running, and we see clear opportunities to scale the platform efficiently. Now let’s turn to terminal services,” he added.

Comments