WASHINGTON (Reuters)

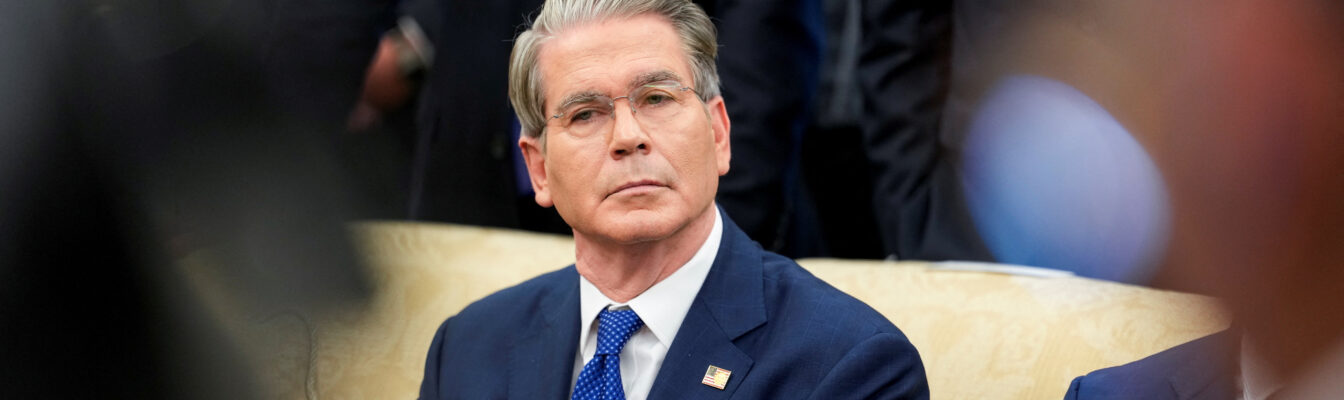

The likelihood of a Federal Reserve rate cut in September is now seen near 100% after new data showed U.S. inflation increased at a moderate pace in July and Treasury Secretary Scott Bessent said he thought an aggressive half-point cut was possible given recent weak employment numbers.

Traders in contracts tied to the benchmark federal funds rate on Wednesday put the odds of a quarter-percentage point cut at the Fed’s September 16-17 meeting at 99.9%, according to estimates calculated by the CME Group’s FedWatch tool that followed the release of July Consumer Price Index data on Tuesday and later comments by Bessent noting that the Fed had used fears of a weakening job market as justification for a larger cut last September.

Trump has slammed last year’s cut as politically motivated given the proximity to the November presidential vote. The Fed cut rates at three meetings at the end of 2024, in September and at two meetings after the election in November and December. It has been on hold since.

Fed Chair Jerome Powell is expected to speak at a central bank research conference in Wyoming next week, a forum he used last year to point to coming rate cuts with a promise “to do everything we can to support a strong labour market as we make further progress toward price stability.”

At the time, the unemployment rate had risen about three-quarters of a percentage point over the prior year. It has not changed much since.

But job growth now seems to have slowed, and Bessent rooted his argument for cuts in recent Bureau of Labour Statistics data showing torpid employment gains in May, June and July, in contrast to initial estimates for May and June indicating stronger employment growth. Fed officials relied on those stronger numbers to argue that the labour market remained in good shape and to hold rates steady at its meetings in June and July.

“If we’d seen those numbers in May, in June, I suspect we could have had rate cuts in June and July. So that tells me that there’s a very good chance of a 50 basis-point rate cut,” in September, Bessent said in an interview on Bloomberg television.

“Rates are too constrictive…We should probably be 150 to 175 basis points lower,” Bessent said, adding to the Trump administration’s penchant for public criticism and detailed policy advice for the independent central bank.

The long list

Bessent urged the rate cuts as the administration moves forward in its search for a replacement for Fed Chair Jerome Powell, with the list of potential candidates now grown to 11, far larger than the short list of three Trump said he was considering just a few days ago.

Trump later on Wednesday said himself that only three or four names were under consideration, “all good, all great.”

The expanded list, confirmed by a White House official, included both of the Fed’s vice chairs, Philip Jefferson, an appointee of former President Joe Biden, and Vice Chair for Supervision Michelle Bowman, current Governor Christopher Waller, Dallas Fed President Lorie Logan, and top Trump economic adviser Kevin Hassett, along with several private sector figures.

Absent was current Council of Economic Advisers chair Stephen Miran, nominated to fill an open Fed board seat with a term that ends in January. Bessent said in his comments to Bloomberg that even if confirmed by the Senate he did not expect Miran to stay at the Fed beyond that point.

The opening Miran is filling could be needed to make room for Trump’s pick to replace Powell, whose term as chair ends in May.

The rate cuts Bessent suggested stop far short of Trump’s call for the benchmark rate to be cut to 1%, but would drop it from the current 4.25% to 4.5% range to around 3% – roughly what Fed policymakers consider to be a “neutral” stance that is neither boosting nor holding back the economy.

It suggests both a comfort level with the expected path of inflation toward the Fed’s 2% target and the ability of the economy to maintain roughly full employment.

Fed officials have been reluctant to declare their inflation battle won, with prices rising faster than the central bank’s target and expected to gather pace at least temporarily in coming months due to the impact of Trump administration tariffs.

Still, arguments to look past any tariff-related bump in prices are gathering steam, with more Fed policymakers saying the jobs revisions had made them more attuned to the possibility of rising unemployment, and some rate cut advocates arguing that the central bank needed to get ahead of the curve.

“A proactive approach in moving policy closer to neutral, from its current moderately restrictive stance, would help avoid a further unnecessary erosion in labour market conditions and reduce the chance that the Committee will need to implement a larger policy correction should the labour market deteriorate further,” Bowman said in remarks on Saturday.

As the tariffs have taken effect, analysts have noted that costs are being divided and not fully passed on to consumers in the form of higher prices.

“The evidence so far is that almost all of the costs of tariffs are being borne by domestic firms,” Citi analysts wrote after the latest consumer price index data was released. “The lack of pass-through should reduce lingering Fed official inflation concerns and allow for a series of rate cuts beginning in September. If anything markets are underpricing the potential for faster and/or deeper cuts.”

Comments