GraceKennedy (GK) has announced that the investment and advisory arm of its GraceKennedy Financial Group (GKFG), GK Capital Management Limited (GK Capital), has signed a joint venture agreement with the Trinidad and Tobago Unit Trust Corporation (TTUTC).

The new venture, which remains subject to the requisite regulatory approvals, will allow GK and TTUTC to partner in the distribution of mutual funds in Jamaica.

Speaking at the signing of the agreement which took place last Friday (May 20) at GK’s headquarters in downtown Kingston, GK Group CEO Don Wehby explained: “Our vision for GraceKennedy is to grow as a global consumer group. This will include leveraging relationships with our international partners. If you look at the list of our current international partners, there’s Western Union, Proctor & Gamble, Frito Lay and others; but what is so heartwarming for me about this new partnership is that TTUTC is a Caribbean company.”

“This is yet another example of how we are expanding GKFG’s service offerings and broadening our reach to new market segments.”

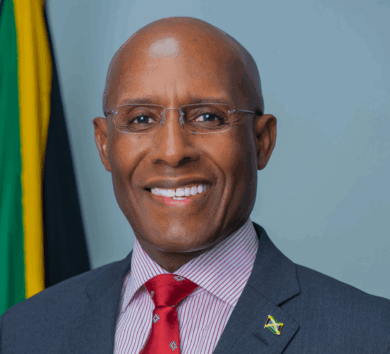

Don Wehby, GraceKennedy Group CEO

Wehby added: “We look forward to reaping the rewards of this new venture with them, while fulfilling our financial inclusion strategy for Jamaicans. For over 100 years, Jamaicans have remained confident in GK’s ability to generate innovative solutions, and it’s critical that we create wealth building options for all socioeconomic groups across our country. This is yet another example of how we are expanding GKFG’s service offerings and broadening our reach to new market segments.”

In January this year, GK Capital announced its intention to enter the mutual funds market.

TTUTC is the largest operator and manager of mutual funds in the Caribbean, and currently manages US$3.7 billion for more than 625,000 investors.

TTUTC’s Executive Director Nigel Edwards, who attended the signing at GK headquarters on May 20, commented: “GraceKennedy touches the life of every single Jamaican, and that’s really important to us because our business is built on creating wealth for every single investor.”

He added: “We are elated about this partnership and believe the timing is perfect. Even as uncertainty keeps sweeping global economies, financial markets, and industries, we remain focused on delivering value. UTC’s business trajectory is prudently mapped, and our investment management philosophy is borne out of a customer-centric approach.”

Also present at the signing of the agreement were Steven Whittingham, deputy CEO of GKFG and head of GK’s investment and insurance divisions; Managing Director of GK Capital Patsy Latchman-Atterbury; and Gregory Hines, vice president of business development and principal investments at GK Capital.

Discussing the new venture, Whittingham explained: “The initial funds will diversify the sphere of investment opportunities for GK Capital’s clients and expand our product reach. While we acknowledge that we are entering a competitive CIS market, the design of the funds and the planned novel approaches to distribution will deliver a unique customer experience, and drive client acquisition and the accumulation of assets under management.”

Comments