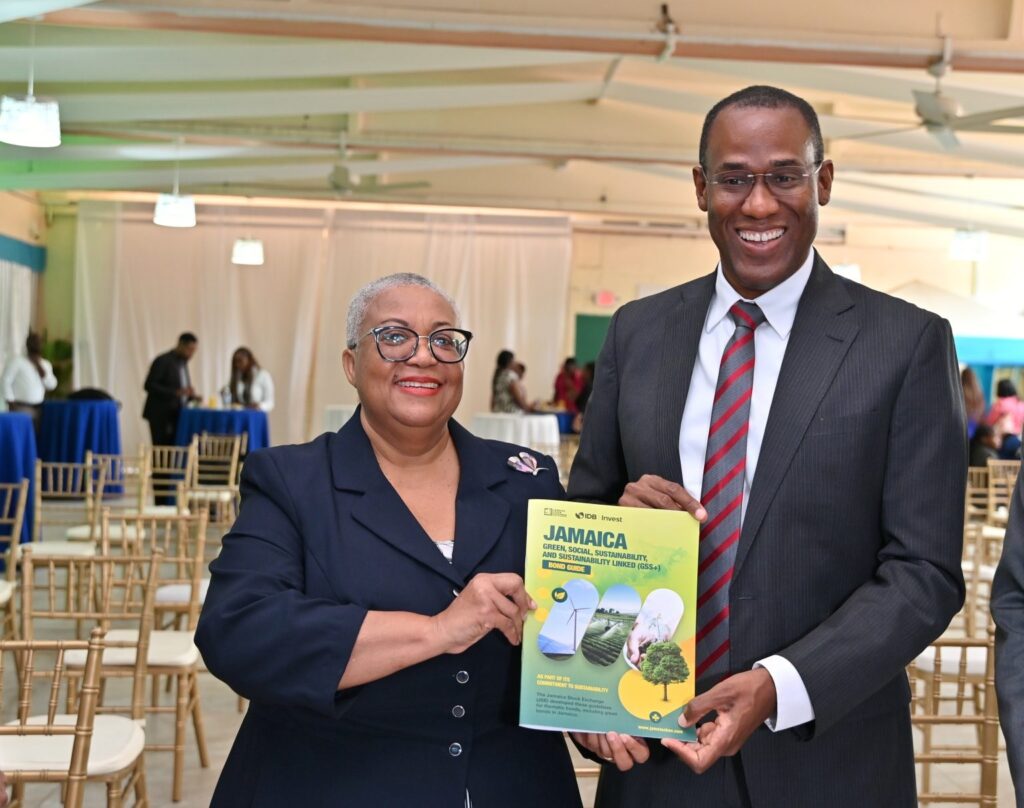

Durrant Pate/Contributor

Finance Miniter Dr Nigel Clarke has declared that Jamaica is now creating the infrastructure to enable green financing to take off, whilst endorsing the Jamaica Stock Exchange’s (JSE) comprehensive guidelines aiming to attract J$6 billion in investments in green, blue and sustainability bonds,

Speaking at Tuesday’s (July 30) launch of the comprehensive guidelines, Dr Clarke emphasised the infrastructure, which is being built will enable Jamaican projects and institutions to tap into this growing and significant pool of funds. He, however, cautioned that Jamaica would need credible, dynamic, financial entrepreneurs to fully exploit investment in green financing.

The guidelines, titled ‘Jamaica Green Social Sustainability and Sustainability Linked Bond Guide‘, seek to enhance Jamaica’s capacity to attract investments with positive environmental and social impacts. They were released last month to provide brokers with additional procedures for these thematic investments.

Arguing that it will take a different type of thinking to exploit all the opportunities, the finance minister remarked, “I am saying to the world that Jamaica is ready and there is a house for your green dollars here. Even the government of Jamaica will need to access green financing for its projects. This is a brand-new area that entrepreneurial financial intermediaries are expected to take full advantage of so that we can engage in the kind of adaptation and mitigation measures so that we can be more resilient against the natural disasters to which we are vulnerable.”

IEG wants to capitalise on investments in the green bond sector

Among the specially invited guests at the launch were members of the green energy sector, the financial sector and the regulatory sector. Director of Innovative Energy Group (IEG), Wayne Wray outlined his company’s vision to capitalise on investments in the green bond sector.

According to him, successful green bond listings will require large, diverse and reputable partners and we at IEG have begun that engagement with those stakeholders. As IEG organises for the next round of acquisition we believe that Jamaican-listed companies with the requisite corporate governance guidelines and the transparent reporting requirements of the JSE are better equipped for success.”

Remarks were also brought by Monique French, chief credit officer of CIBC Caribbean, and Angus Young, CEO of NCB Capital Markets, who both endorsed the initiative and pledged to continue to work with the green energy sector to build a robust pipeline to develop local and regional programmes.

Working together to maximise benefits in the green bond sector

Malini Samtani, climate change officer in IDB Invest’s Advisory Services Division, gave a presentation on GSS+ bonds demonstrating how governments and the private sector can work together to maximise benefits in the green bond sector.

Yvonne Vogt, consultant of legal partners HPL, LLC whose firm worked with key stakeholders in developing the Guidelines and explained key aspects of the guidelines while Dereck Rajak, CEO of Caribbean Information and Credit Rating Services (CARICRIS), who will be working with the JSE to rate Green Bond prior to and post-issuance, were the other presenters.

The JSE began developing the green guidelines with the support of IDB Invest and sustainable finance consulting firm HPL back in 2023. The blueprint highlights the potential for companies listed on the JSE to tap into thematic bonds, which could mobilize investments toward achieving the nationally determined contributions (NDC) targets, such as emission reduction and poverty alleviation.

Experts anticipate that Jamaica could see up to J$6 billion in green investments over the next 25 years. The green bond market is a strategic step toward facilitating these investment flows. The new green trading bond platform, which will be rolled out by the JSE, will list debt instruments that meet green, blue, or sustainable metrics. These bonds, like traditional ones, must adhere to JSE’s listing rules and regulations.

The Development Bank of Jamaica (DBJ) estimates that the country needs to invest J$5 billion in climate mitigation and J$1 billion in climate adaptation measures by 2050. The JSE’s new guidelines aim to mobilise financial resources to support these critical investments.

Comments