Regional insurance giant Guardian Holdings, headquartered in Trinidad, continues to grow profits, revenue arms and its footprint in new markets.

Buoyed by Michael Lee Chin’s NCB Group acquiring a majority stake, Guardian has set its sights on becoming the leading indigenous financial services player in the region. NCB first acquired 29.99 per cent of Guardian in 2016 for J$27 billion.

In May 2019, NCB bought an addition 74.23 million shares in Guardian Holdings for US$207 million, thus raising its ownership stake to 62 per cent.

“As we stated at the beginning of this journey, we believe this transaction is a game changer in the history of the region,” Lee Chin said in explaining the rationale behind this move.

“Amid the context of de-risking impacting the region, we are proud and excited about the implications and prospects of two leading Caribbean institutions coming together to drive economic growth, customer and shareholder value.”

Since NCB’s declaration of intent to become a leading regional financial services powerhouse, Guardian’s profits have increased significantly.

In 2017, with NCB holding about a third of the shareholding, Guardian posted profits of TT$300 million. The following year, profits jumped to TT$485 million. With a head of steam, 2019 brought a profit figure of TT$600 million and last year, even with the COVID-19 pandemic raging, Guardian registered an impressive TT$800 million in profits.

So what accounted for this upsurge in financial performance?

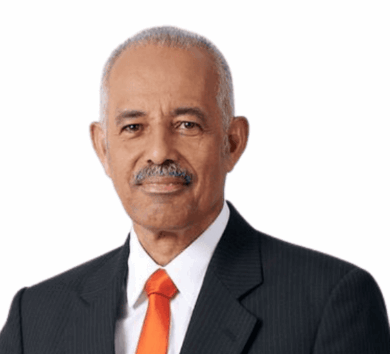

Our Today sat down with Guardian Holdings Group CEO Ravi Tewari for an interview where he attributed the injection of NCB’s culture as one of the reasons for its stellar financial showings in recent times.

“Over the last five years, what has proven to be amazing is the injection of the NCB culture into Guardian. Guardian was already a progressive and successful financial group but NCB sees no reason why you can’t create a financial group of global standards that happens to be domiciled in the Caribbean,” Tewari said.

“I think Caribbean people always have this view that we can aspire to be the best in the Caribbean but we can’t aspire to be the best in the world. It’s a defeatist mentality but, when you bring NCB to the table with Michael Lee Chin’s global vision, why can’t we create a pan-Caribbean financial services group that can compete anywhere in the world? We are on a mission to do that now.”

The Guardian boss said that Guardian was fortunate to have a parent that is steeped in professional financial services. This allows Guardian to be transformed for the future.

“The only company bigger than us is Republic Bank. We intend to take them down in about two years’ time.”

Ravi Tewari, Guardian Holdings Group CEO

The first thing the leading insurer did was to undertake a complete overhaul of its technological applications which had become antiquated. Between 2015 and 2018 Guardian turned to Cloud-based systems and fundamentally changed its method of operations, reaping rewards from this move.

“When you look at the Trinidadian stock market, in 2018, Guardian was ranked the seventh biggest company in terms of profitability. Scotia, Citizens, Massy, First Caribbean, Ansa McAl, Republic were all bigger than we were.

“ As of September 19, 2020 we are now the second biggest company operating in Trinidad & Tobago on the TT stock exchange. The only company bigger than us is Republic Bank. We intend to take them down in about two years’ time,” Tewari made clear.

GUARDIAN REAPING BENEFITS OF ACQUISITION BY NCB

Last year the only companies that grew their profits on the Trinidadian stock exchange were Guardian and Massy, a testament to how far the regional insurer has come. Massy grew because of a one-off gain from selling its IT and communications business to the Mussons Group.

“We are only beginning to reap the benefits of what we began some five years ago and there is still a lot of work to be done. We are not being arrogant, but we are of the belief that, together with NCB, we can become a Caribbean powerhouse and keep growing. Yes, the region is our base, but it cannot always be the centre of our operations,” said Tewari.

This is in keeping with the vision of former chairman of Guardian Holdings, Arthur Lok Jack, who presided over the Group having a presence in both the English and Dutch Caribbean, Central America, the United Kingdom and Gibraltar.

The CEO of Guardian Holdings is anticipating that 2021 will be a good year. Looking across the Caribbean, he places 2020 as being a brutal one for the Caribbean but foresees a brighter day ahead with the return of tourism. He notes that the Jamaica Stock Exchange has been able to attract new listings and has a lot of trading activity.

Sagicor is now trading at 1.8 times book while Guardian is now at 1.2 times book and gaining ground fast.

GUARDIAN HOLDINGS’ STRATEGY

So will Guardian, with the backing of NCB, begin to look for more revenue streams and what kind of timeline will it be looking at to do so?

“We see our businesses as having two sides: the liabilities side where we sell insurance and, in the course of operating that business, you accumulate tens of billions of dollars of assets. Our core business is on the liabilities side where we have to invest all this money, but the reality of the Caribbean market is there is limited supply of existing paper (bonds, equities etc.) therefore we have to create our own assets,” said Tewari.

“This explains our presence in the hotel space with Beaches Boscobel and we will be involved in another Marriott property. If the opportunity is right, Guardian will selectively become involved in other types of business but on the asset side of our balance sheet.

“It’s not so much a case of revenue generation as making sound investments with the cash we accumulate. While some of these businesses have a long gestation, we have to assure ourselves about the certainty of the cashflows.”

Guardian will be getting more into the digital space, deepening its reinsurance footprint and migrating its vertical chain into brokerage. It is also increasing its exposure to the health sector, with Lee Chin championing new forms of oncology. The insurance giant is also looking to become active in merchant banking.

Guardian Holdings will become more diversified with arms across financial services, tourism and healthcare – a Caribbean corporate giant playing on the world stage.

Comments