Durrant Pate/Contributor

Effective July 1, the National Housing Trust’s (NHT) general loan limit for a single applicant will be increased to J$7.5 million, up from J$6.5 million, which is a 15 per cent increase.

The announcement came as Prime Minister Andrew Holness unveiled a bunch of “housing goodies” during his marathon contribution to the 2023-2024 Budget Debate in the House of Representatives last evening (March 16).

In making the announcement Holness also indicated that, “where a single contributor is buying a housing solution priced at J$12 million or less, the contributor may access up to $8.5 million towards mortgage financing for that unit”.

This, he said, was being done to incentivise housing developments for low income earners.

Holness argued that the move would also create a more effective demand for housing solutions at the targeted price point, as he stated that the NHT would continue to provide 100 per cent financing for NHT schemes, subject to the availability of funding.

Two persons applying jointly will be able to access funding of up to J$15 million, up from J$13 million.

Up to three beneficiaries

Holness reminded the Parliament that, in 2022, the NHT re-introduced its policy to allow up to three contributors to co-apply for a single NHT scheme unit (two bedroom units or larger) to better improve affordability, stating that a key provision of this policy is that proof must be established that the applicants are bona fide family members and have demonstrable kinship ties for example, wives, husbands, children and siblings.

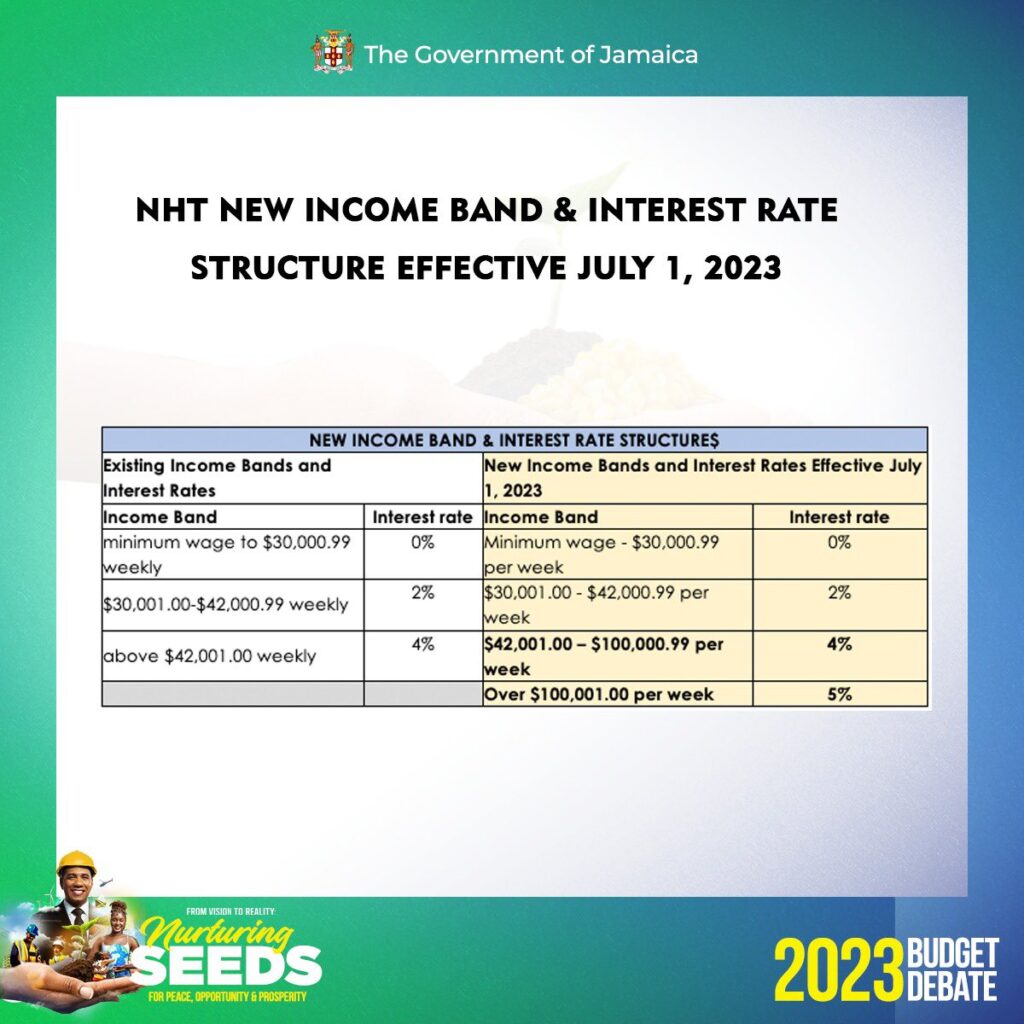

In light of the proposed revised loan limits, Holness disclosed that three co-applicants will be able to access funding of up to $21 million, up from $19.5 million. The prime minister also proposed adjustments to the NHT income band and interest rate structure.

In keeping with the policy position that subsidies should be applied where they are most needed, Holness announced that a new interest rate band will be introduced, effective July 1, for persons earning over $100,001 per week at a five per cent interest rate. Holness told the Parliament that the distribution of NHT contributors by the income bands shows that 66 per cent of them are eligible for mortgage financing at zero per cent interest and less than eight per cent of contributors will fall into the new five per cent rate band.

The prime minister also announced that the limits will be increased for Home Improvement Loans, House Lot Loans, 10+ Loans for Public Sector Workers and 15+ Loans from J$2.5 million to J$3.5 million.

Minimum wage earners contributing to the NHT for a minimum of seven years will be eligible for an increased home grant of J$3.5 million, up from J$2.5 million, toward the construction of a starter home or improvement of an existing housing structure.

Housing Agency of Jamaica benefits

Turning to the Housing Agency of Jamaica (HAJ), the prime minister disclosed that it will be carrying out targeted housing programme in rural areas stating that it will be undertaking 14,000 housings solutions out of the 70,000 to which the government had committed. The HAJ has achieved 4,000 housing starts to date but over the next four years, it is projecting approximately 10,000 housing starts and just over 6,000 deliveries.

“I am happy to announce that approximately 95 per cent of these solutions will be constructed in the parishes of St Catherine, St. Elizabeth, St. James and Trelawny,” Holness declared to thunderous applause from the Government side of the parliamentary chamber.

He outlined a programme of regularising unplanned communities and rebuilding them, noting that the key is to shorten the construction time, so that relocation and household disruption is minimised.

“We are carefully studying this project to see how we can apply the modality to other informal settlements. The intention is to replicate and scale up this project across the island,” Holness said, noting that last year the Government demolished a number of unapproved housing structures on the Bernard Lodge Development.

Many of the structures belonged to individuals who had paid been duped by criminals into paying for land they believed they were legally acquiring.

The lands, however, had been designated by government for agricultural development.

SCJ Holdings, which is carrying out the development, was directed to find alternative sites for those persons who have come forward to claim the unapproved structures which were taken down, with the prime minister also advising Parliament that the first such individual, Shaneil Francis who was sitting in the gallery, has received a housing lot courtesy of the Government to start the rebuilding process.

Holness said he would personally assist Grant in taking her through the legal process of having her new home constructed.

Comments