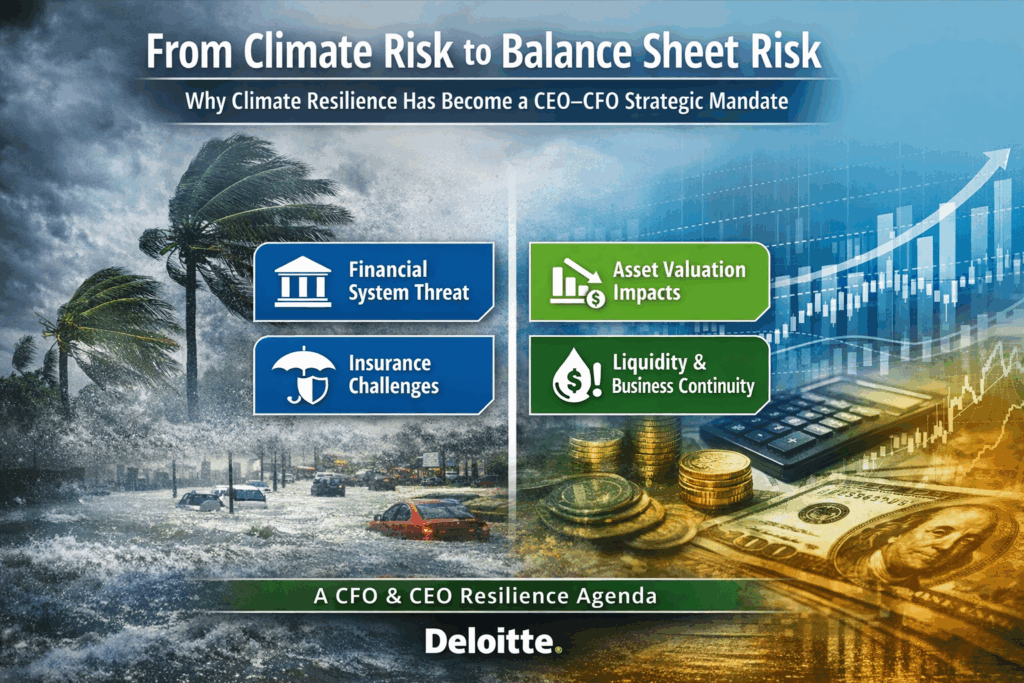

Across global markets, climate risk has shifted from an environmental concern to a material financial determinant, influencing asset valuation, sovereign creditworthiness, regulatory requirements, and capital flows.

For Jamaica – one of the world’s most climate‑exposed economies – this shift is even more acute. Today, climate resilience is not merely operational risk management; it is a strategic, enterprise‑level financial priority that demands joint leadership from CEOs and CFOs.

1. Climate Risk as a Financial System Exposure

The Bank of Jamaica’s comprehensive assessment of climate‑related financial risks demonstrates how physical hazards translate into systemic risk across the financial sector through credit, market, and operational channels. Hurricanes, flooding, and sea‑level rise create financial spillovers that affect loan performance, liquidity positions, risk‑weighting assumptions, and overall financial stability. [boj.org.jm]

The IMF’s macro‑financial modelling reinforces this: Jamaica ranks in the highest 25% globally for hurricane‑induced asset losses, with future annual asset damage expected to average 1% of asset value. Without planned adaptation, sea‑level‑related losses could reach US$222 billion by 2100 – far exceeding the size of Jamaica’s current economy. [blog-pfm.imf.org]

For leadership teams, the implication is clear: climate risk is not external to the balance sheet – it is embedded within it.

2. Why CEOs Must Elevate Climate Resilience as a Strategic Pillar

Global best practice shows that resilience is now a corporate strategy issue, not a sustainability sub‑function. Deloitte’s Climate Risk Solution provides a clear framework: integrate hazard mapping, asset criticality assessment, probabilistic financial modelling, and risk-prioritisation indices into strategic planning. This allows executives to quantify exposure, compare adaptation scenarios, and prioritise resilience investments that align with enterprise risk appetite.

In the Jamaican context, this is reinforced by national tools like the Climate Risk Assessment Methodology and the emerging Jamaica Systematic Risk Assessment Tool (J‑SRAT), which align corporate planning with national resilience priorities.

3. Why CFOs Must Integrate Climate Risk into Core Financial Architecture

CFOs are increasingly accountable for ensuring financial portfolios, capital plans, and investment strategies are climate‑robust. Four core financial implications now define climate resilience at the enterprise level:

- Asset valuation & impairment: Climate exposure accelerates depreciation and increases impairment risks for infrastructure, machinery, and coastal assets.

- Cost of capital: International financial institutions – including the IMF and the World Bank – now integrate climate vulnerability into credit assessments, influencing borrowing costs for both sovereigns and firms. Jamaica’s catastrophe bond illustrates how markets are beginning to price resilience.

- Insurance constraints: With global insurance markets tightening, firms are encountering higher deductibles, reduced coverage, and in some cases, uninsurable assets.

- Liquidity and business continuity: Climate events trigger cascading cash‑flow disruptions, necessitating contingency planning and stress‑testing aligned with regulators’ evolving climate‑risk guidelines.

4. Financial Architecture Is Shifting – and Jamaican Firms Must Adapt

Jamaica’s Resilience and Sustainability Facility (RSF), developed with IMF support, signals a national shift toward greening the financial system. Reforms include integrating climate requirements into PPP frameworks, revising fiscal rules, and incentivising renewable investments – changes that will increasingly shape the operating environment for the private sector.

For corporate leaders, this means climate resilience is now directly linked to:

- Regulatory compliance

- Creditworthiness and investor confidence

- Capital allocation efficiency

- Long‑term competitiveness

5. A CEO–CFO Resilience Agenda for Jamaica

To genuinely shift climate resilience into financial resilience, Jamaican leadership teams should implement a three‑part agenda:

A. Diagnose exposure using data-driven tools

Leverage Deloitte’s climate analytics, BOJ climate risk assessments, and national methodologies to quantify hazard exposure and financial implications.

B. Integrate climate risk into enterprise governance

Embed climate considerations into ERM frameworks, board‑level committees, and scenario‑based financial planning.

C. Invest in resilience as a financial strategy

Prioritise resilient infrastructure, supply‑chain redundancy, energy diversification, and digital continuity – supported by emerging climate finance instruments.

Conclusion: Climate Resilience as a Driver of Economic Transformation

The evolution from climate risk to balance‑sheet risk represents one of the most important shifts in corporate strategy for small island economies. For Jamaica, this shift is both a challenge and an unprecedented opportunity. Firms that invest early in resilience will strengthen their financial stability, enhance investor trust, and position themselves as leaders in a climate‑adaptive Caribbean economy.

For CEOs and CFOs, climate resilience is no longer optional. It is the next frontier of strategic enterprise value.

Comments