New research from Mastercard has identified a positive shift in the payment behaviours of Jamaican consumers — revealing a growing adoption of digital payment methods in the country.

According to the study, where 600 Jamaican adults were part of the survey conducted, 93 per cent of Jamaicans surveyed feel comfortable or very comfortable when trying new technology. Debit and credit cards are the preferred digital payment method for online purchases (84 per cent).

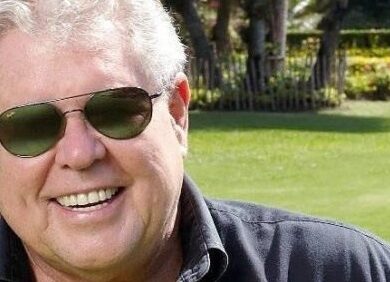

Dalton Fowles, Mastercard country manager for Jamaica, Trinidad and Tobago, Barbados & Eastern Caribbean said, “At Mastercard, we are committed to facilitating a seamless digital transition in the country, ensuring convenience, security, and privacy for consumers. By leveraging innovative solutions and prioritising consumer trust, we aim to drive financial inclusion and enhance the overall payment experience of all Jamaicans.”

Furthermore, debit cards are the most widespread digital payment method used in Jamaica: 51 per cent of Jamaicans surveyed use debit cards for daily purchases.

Mastercard understands these changing preferences and is working with its partners, including financial institutions, Fintechs, merchants, and governments, to develop innovative financial solutions that connect Jamaicans to the digital economy and allow them to enjoy its benefits. Its debit cards, for instance, offer reliable, safe, and transparent transactions for purchases made in person, online, via apps, or through digital wallets.

Convenience, security and privacy among determining factors in Jamaica

Convenience, security, and privacy have proven to be top priorities for the acceptance of digital payment methods among Jamaicans:

- 50 per cent of Jamaicans surveyed consider that using digital payment methods reduces the need to carry physical currency, while over 52 per cent are enticed by the swift processing of transactions.

- Additionally, 29 per cent find appeal in the global acceptance of digital payments for online purchases.

- Furthermore, 93 per cent of respondents consider security important or very important when choosing how to pay, with 71 per cent consistently opt for the most secure payment method available.

- 27 per cent of surveyed Jamaicans have already enabled two-factor authentication to protect their transactions.

To respond to this preference of Jamaicans for secure payments, Mastercard has a holistic cybersecurity strategy. The company uses data analytics and artificial intelligence to identify vulnerabilities early and deploy automatic protection shields to all consumers.

Comments