Durrant Pate/Contributor

The Jamaican stock market remains bearish though lacking pace and stocks meandered along last week coming into this week.

Following the highs induced by PanJam Group’s restructuring exercise the week before, trade volumes last week normalised, totalling 152.84 million units (-63.6 per cent) valued at over $1.967 billion (-94.6 per cent).

In the week before PanJam’s restructuring exercise (March 3rd to 7th), volumes totalling $181.04 million units valued at $785.92 million. With approximately 55 per cent of the traded stocks declining, six of the nine major indices were down week-over-week.

Biggest decliners

The largest decliners were the Manufacturing & Distribution (M&D) Index (-2.1 per cent) and the Cross-Listed Index (-1.8 per cent), while the largest advancer was the USD Equities Index (+6.1 per cent). The decline in the M&D index was driven primarily by Wisynco Group (-3.9 per cent), Lasco Manufacturing ( -10.0 per cent) and Carreras Limited (-4.9 per cent), the first-, eighth- and fifth-largest constituents by market capitalisation.

Meanwhile, the cross-listed index’s decline was primarily driven by Massy Holdings (-2.7 per cent), the largest constituent by market capitalisation. There was no explicit news to explain the declines.

Conversely, the 6.1 per cent US Equities Index rise was driven primarily by Productive Business Solutions (PBS: +23.7 per cent), the 4th largest constituent by market capitalisation. In the absence of news to explain the movement, PBS’ price jump is attributable to its low trade volumes, which are normally associated with wider bid-ask spreads and ultimately greater price volatility.

Over the last 52 weeks, PBS traded with a volume range of 1 to 7000 units and a price range of $1.19 to $1.85 per share. Ultimately with major indices declining year-to-date, the market may be pricing in a mixed December 2024 earnings season when more than half (57 per cent) of the stocks’ earnings grew by less than 5.0 per cent.

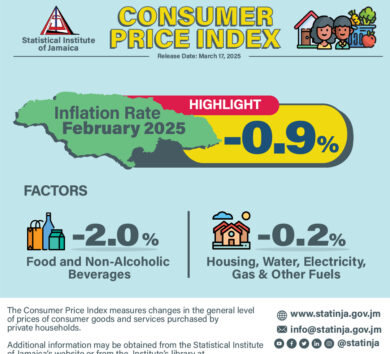

Moreover, the looming threats of US protectionist policies on local inflation and economic growth could also be contributing to the bearish sentiment. Last week‘s market activity saw 124 stocks traded with 44 advancing, 68 declining and 12 trading firm.

Comments