JN Life Insurance Company has launched an innovative term life insurance product, with an investment option it says will allow policyholders to choose the duration of their policy, tailoring their needs for insurance, for premiums as low as $800 per month.

The product, JN Life Vest, is available to persons between the ages of 18 and 65 years old, who can purchase a policy for a selected period of time, ranging from 10 to 30 years.

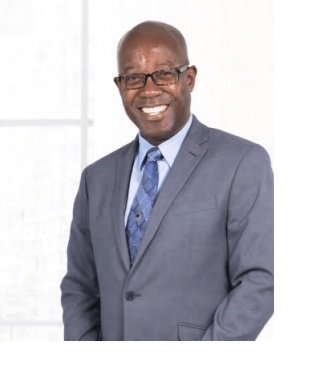

“We designed this product for Jamaicans who want affordable insurance which allows them to plan for life’s eventualities, while having the option to invest in the JN Mutual Funds to meet their medium-to long-term goals,” explained Hugh Reid, general manager, JN Life Insurance Company.

“JN Life Vest allows you to choose between a 10, 15, 20, 25 and 30-year policy terms, to provide for life’s eventualities, whether it is for major illness, a medical procedure, or long-term investment, for the proverbial rainy day. Individuals can also add other benefits, such as accidental death and dismemberment and a disabilities waiver to ensure maximum protection on their policy.”

Reid further explained that a term life policy is a type of life insurance which guarantees payment of a stated death benefit, if the covered person dies during a specified term. Once the term expires, the policyholder can either extend the coverage for another term, convert the policy to permanent coverage, or allow the term life insurance policy to terminate and encash the investments.

Reid explained that the product is affordable and available to all Jamaicans.

“Many Jamaicans are underinsured and want to purchase insurance to provide coverage in the event of eventualities. Many recognise that insurance can provide protection in the event of major illness or death. JN Life Vest will provide them with an affordable insurance product, that starts as low as $800 per month while giving them peace of mind,” he explained.

The JN Life general manager also pointed out that ”JN Life Insurance continues to help Jamaicans to find a way towards physical health and financial wellness”.

He added: “We continue to encourage Jamaicans to practise a healthy lifestyle and plan for life’s eventualities. We are also committed to improving the lives of Jamaicans; and affordable life insurance is one way through which we can do this.”

Comments