Key Insurance Company put in a good performance for the nine-month peroid ended September 30, 2023.

The results showcase a remarkable 51.3 per cent increase in profit before tax compared to the same period in 2022, underscoring the company’s dedication to sustainable financial growth.

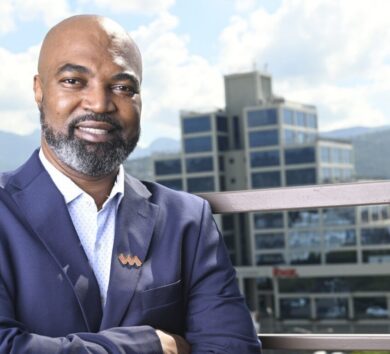

KEY chairman and GraceKennedy Group CEO, Don Wehby, expressed his enthusiasm for a robust third quarter, stating, “These results are a testament to KEY’s resilience and strategic approach in navigating the current economic landscape. We remain committed to delivering value to our stakeholders while fostering sustainable growth.”

The company also reported notable year-over-year growth of over 50 per cent in investment income, totalling $141.3 million. This performance is testament to KEY’s adept handling of market dynamics and commitment to optimising its investment portfolio.

The company’s profit before tax surged from $40 million in 2022 to an impressive $60.5 million, demonstrating KEY’s unwavering commitment to financial excellence. The quarter ended September 30, 2023, witnessed further growth, with an 84.5 per cent increase in profit before tax, soaring from $22.3 million to an impressive $41.1 million.

General manager Tammara Glaves-Hucey remarked, “Our team’s focus on strategic initiatives, especially in expanding premiums in the non-motor portfolio, have proven instrumental in driving our financial performance. This sustained growth underscores our commitment to delivering exceptional results.”

KEY’s insurance revenue experienced a robust 22.4 per cent increase, surging by $361.6 million during the nine months under review, compared to the same period in 2022. The non-motor portfolio played a pivotal role, contributing 61.7 per cent or $223.2 million to this substantial growth.

The company, however, faced increased insurance services expenses, with a $119.9 million rise representing a 9.7 per cent increase. This was primarily driven by a $72.8 million or 10 per cent surge in claims during the nine months that ended September 30, 2023.

Despite the challenging economic climate, KEY’s outlook remains highly optimistic. The company is resolute in its pursuit of expanding market share, with a clear focus on bolstering revenue and enhancing profitability. The commitment to executing a well-defined strategic plan is unwavering, coupled with a proactive approach to addressing market challenges and identifying opportunities to boost operational efficiency.

Comments