Durrant Pate/Contributor

Regional distribution company, Massy Group delivered a commendable half year performance in March in which profit and revenues went up in line with expectation.

In addition, Massy, which is based in Trinidad and Tobago and boasts operations in Jamaica as well as having its shares cross listed on the Jamaica and T&T stock exchanges, is already reaping dividend from its acquisition of the Rowe’s IGA supermarkets in Jacksonville last December. Massy accumulated TT$6.8 billion (US$1 billion) from third party revenue from continuing operations, which grew by 11 per cent.

This was propelled by 16 per cent revenue growth in the integrated retail portfolio, which is benefiting from its acquisition of the Rowe’s IGA supermarkets.

Group profit before tax (PBT) from continuing operations grew by 17 per cent to TT$520 million (US$77.2 million) while group profit after tax from continuing operations rose 19 per cent to $354 million (US$52.5 million or J$7.9 billion) with a slightly lower effective tax rate of 32 per cent compared to 33 per cent in the prior half year.

Gas portfolios suffer decline

Strong PBT growth in the ‘Integrated Retail Portfolio’ of 20 per cent and in the ‘Motors and Machines Portfolio’ of 11 per cent, which compensated for the PBT decline in the ‘Gas Products Portfolio’ of 11 per cent during the review period. The rebalancing of the divestment funds portfolio (DFP) and higher interest rates in the US facilitated significant improvements to the DFP and the TIRCL reinsurance business performance.

During the review period, the DFP produced a gain of US$2.6 million versus a loss of US$1.4 million in the prior half-year, a US$4 million swing. TIRCL PBT for the half year was US$1.6 million versus a US$429,000 loss in the half-yeah 2022, a US$2 million swing.

Given that even greater contribution from discontinued operations came in the second half of 2022 which will not recur in the second half of 2023, the board of directors has approved a half year dividend of TT 3.15 cents, which represents a five per cent increase over half-year dividend in 2022 of TT 3 cents.

As expected, less profit was earned from discontinued operations in half-year in review than earned in the same period in 2022, as the group is near the completion of its divestment agenda. Consequently, Earnings Per Share (EPS) increased by nine per cent over prior year from TT15.40 cents to TT16.83 cents.

Massy at 100

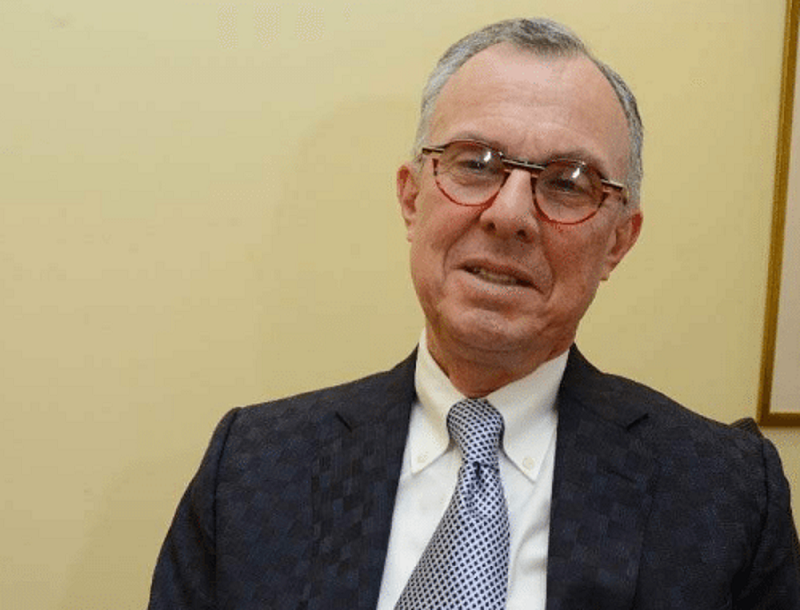

On February 1, the group celebrated its 100th anniversary, the outgoing chairman Robert Bermudez noting, “throughout our 100-year journey, the lessons we’ve learned along the way, our successes, and the mistakes we’ve made, have all helped us grow and shape who we are today.” He commented, “purposefully, the group is taking the opportunity to live out its Purpose through its celebrations and engagement initiatives around its 100-year anniversary.”

Bermudez has served as a director on the Massy Holdings board for the past 26 years, retiring from the position of chairman with great pride in what the organisation has achieved over the years and in its ability to stay resilient. He took the opportunity to welcome the group’s incoming chairman, Robert Riley, who is an accomplished executive and is a Chaconia Gold awardee from the Government of Trinidad and Tobago for his contributions to national development while serving as bpTT president.

Riley is also an international executive who served as the Global Head of Safety & Operational Risk for BP PLC.

Comments