It is now confirmed that Trinidad and Tobago-based AS Brydens & Sons Holdings’ (ASBH) purchase of a 44.8 per cent strategic equity in Caribbean Producers (Jamaica) was aided by its acquisition of Mayberry Jamaican Equities’ 20 per cent ownership stake in the Montego Bay-based distributorship.

Mayberry announced the sale of its equity holding in CPJ to ASBH, which it described as a strategic partner.

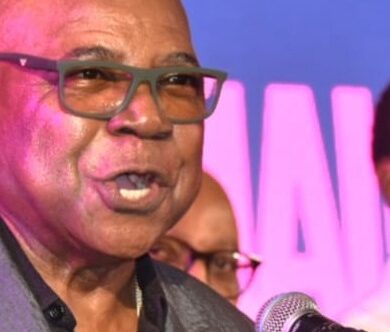

For Christopher Berry, executive chairman of Mayberry Jamaican Equities, “this strategic move reflects MJE’s ongoing commitment to optimizing its investment portfolio and delivering value to its stakeholders. The company continues to seek new opportunities that align with its strategic objectives and growth plans.

“We made the investment in CPJ over eight years ago because we believed in the company, the economic development of Jamaica and the importance of the tourism sector to our economy. [On July 9], we have realised the gains from that investment, which has provided handsome returns to the shareholders of MJE,” Berry continued.

ASBH, which is cross-listed on the Jamaica and Trinidad and Tobago stock exchanges, announced its acquisition of the 44.8 per cent equity stake in CPJ for an undisclosed amount Tuesday, without detailing the specific terms of the transaction.

ASBH is now the largest shareholder of CPJ, but the Trinidadian distributor will be pursuing an outright controlling stake in the Jamaican entity, which supplies Jamaica’s tourism sector.

While acknowledging that its acquisition exceeds 20 per cent of the issued share capital of CPJ, ASBH pointed out that such a purchase will trigger the Jamaica Stock Exchange’s (JSE) general principles relating to takeovers and mergers and the applicable domestic securities regulations.

Comments