If you want to have a better handle on the money you make, the money you spend, and the money you save, you should get into the habit of budgeting.

Budgeting is the documentation of your plan outlining how much you earn in a given period and how much you plan to spend within that period. It represents a start to more financial freedom and may be considered one of the best ways to save.

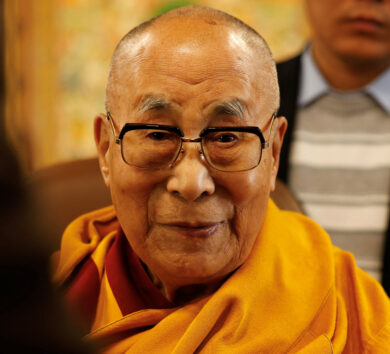

In speaking with Our Today, personal finance enthusiast Garvin Grandison shared that, “When you don’t budget, you run the risk of spending all of your income.”

He cautioned that, in practicing budgeting, you should always save and “set something aside” as you keep an eye on how your money is moving.

“For people, once money is leaving their pockets, it’s an expense. So, you should always try to save. Leave between five and 20 per cent of your net income aside for savings and plan your expenses,” he said.

“For your budget to work, you should have structure for your budgeted categories, leave room for flexibility, and practice self-discipline,” he added.

Many people approach their budgets differently, but Grandison suggested that people should start their budgeting process by looking at their expenses.

You shouldn’t start with your income. If you start with your income, you automatically assume that you can spend more than you really need to. So look at your expenses first, plan out your expenses according to the fixed expenditures and flexible ones and then look at your income.

Garvin Grandison

“You shouldn’t start with your income. If you start with your income, you automatically assume that you can spend more than you really need to. So look at your expenses first, plan out your expenses according to the fixed expenditures and flexible ones, and then look at your income. From there, you should determine how much you can really save out of this process,” he encouraged.

Grandison shared that in creating one’s budget, you should take the time to consider your expenses, then categorise them according to fixed (expenses that are standard and not expected to change) and flexible expenses (those that change depending on particular variables). He then added that once the general categorisation is done, you should total all your expenses and compare the total with your income and what you hope to save.

He stressed that “you can go as granular as you want with your categorisations. You just need to make sure that your budget works for you and your life. You want to capture all that you spend and what you make to ensure that it properly represents you and your spending habits. Budgeting and your relationship with money is psychological, so make sure that it’s a good representation.”

Grandison highlighted that making your budget structured and flexible indicates that the world is dynamic and the ‘script of life’ can change. As such, he believes ‘incidentals’ or ‘miscellaneous’ is a key part of every budget.

“The script is for an ideal world, but we don’t live in an ideal world. You won’t expect your tyre to go flat, or you don’t know what the gas prices will be, and you may even get sick and need to expend on doctor bills and medication. It prevents you from dipping into your other categories and playing on your conscience when you end up overspending,” he shared.

“When you approach [budgeting] like that, you can then determine if your income is enough to support your expenses. If it isn’t, make adjustments, and you can start by adjusting the flexible expenses that you can negotiate,’ he included.

“So you’d say to yourself, ‘maybe I don’t need to spend so much money on entertainment (parties and eating out, for example), or perhaps I don’t need to go to a specific supermarket for groceries. Maybe I can go to a wholesale for my groceries. Have that serious conversation with yourself and make the adjustments. If you find that your income is too little for your expenses, you should explore ways that you can increase your incoming cashflow to be able to meet your outgoing cashflow,” Grandison added.

He pointed out that it only benefits people to take such a strategic approach to manage their personal finances.

Benefits to budgeting your money

Here are three benefits to budgeting your finances:

Gives control over spending and saving: You can decide which budget categories to include and how much to spend in each category. A bonus is that if you commit to saving for a specific named savings account (such as “Vacation”), you may develop a regular savings habit.

Helps track expenses: If you struggle with overspending, a budget keeps tabs on where your money goes so you can identify potential harmful spending habits and cut unnecessary expenses.

Can reduce financial stress: A budget can reduce stress by offering a tool for planning and building your savings. This can give you added peace of mind when an unexpected expense comes along.

Garvin Grandison has worked in the finance and economics sector for over ten years. He holds a BSc in Banking and Finance and an MSc in Corporate Finance from the University of the West Indies. He currently works in the banking sector where he has gained valuable insights into the financial industry and its regulatory landscape. He also serves as the district treasurer for the volunteer and community-focused organisation, Optimist International Caribbean District (OICD), a role that allows him to contribute to the OICD’s positive impact on communities.

Money Management Tips is a weekly feature highlighting general tips for managing your finances. Each week will see a feature on the ways you can strengthen your relationship with money and may feature other personalities in the Jamaican financial world.

This weekly feature does not serve as a standard money management tool. Consult with your financial advisor for specified money management guidance as it pertains to your finances.

RELATED Business budgeting methods and strategies

Send feedback to [email protected]

Comments