(Reuters)

Eli Lilly said on Thursday that its newer diabetes drug Mounjaro outperformed Trulicity, its previously top-selling medication for the disease, in reducing the risk of heart attack and stroke in a large, head-to-head study.

In the Lilly-funded trial of more than 13,000 patients with type 2 diabetes and high cardiovascular risk, Mounjaro reduced the risk of major adverse heart events by 8% more than Trulicity, the Indianapolis-based drugmaker said.

The risk of death from any cause was 16% lower for Mounjaro patients than for those taking Trulicity, though researchers are still studying the data to understand what is behind the difference.

Mounjaro achieved the main goal of the trial, which was non-inferiority versus Trulicity for heart protection, the company said, adding that it also led to greater blood sugar control and weight loss.

Lilly shares dipped 0.5% in early trading. BMO analyst Evan Seigerman said in a note that although the trial results showcased Mounjaro’s strengths, a significant contingent of investors had been betting it would show clear superiority.

Stanford cardiologist Dr. Chad Weldy said the new data may prompt him to recommend switching from Trulicity to Mounjaro, at least for patients with type 2 diabetes and obesity or heart issues. Still, he emphasised that insurance, patient preferences, and tolerability will guide final decisions.

Mounjaro is the company’s diabetes drug that targets the GLP-1 protein and is also used for weight loss. In the U.S., the obesity version is sold under the brand name Zepbound.

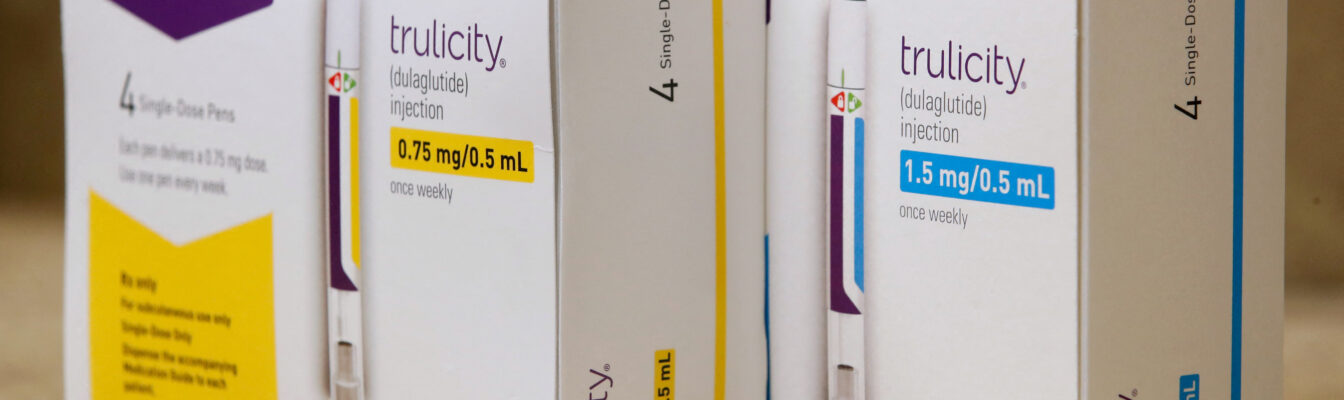

Trulicity, which first won U.S. approval in 2014, has been a go-to treatment for preventing heart disease in people with diabetes since the Food and Drug Administration approved it for that use in 2020 following data showing a 12% reduction in heart-related risk.

Once Lilly’s top seller, Trulicity hit peak sales of $7.4 billion in 2022, aided by the added heart-related approval, according to the company. Mounjaro stole that mantle last year with $11.5 billion in sales, more than double Trulicity’s $5.2 billion.

Kenneth Custer, president of Lilly’s cardiometabolic health division, told Reuters that the new results make Mounjaro an even stronger choice for patients.

The new late-stage study, which spanned nearly five years, was the largest and longest trial yet for tirzepatide – the chemical name for Mounjaro – Lilly said. Custer said the company planned to submit its findings to the FDA later this year for an anticipated 2026 expanded approval.

The company and Danish rival Novo Nordisk have been racing for more than two years to prove their competing GLP-1 drugs, already shown to be powerful weight loss agents and diabetes treatments, can also be used to tackle other major diseases and potentially expand insurance coverage.

Lilly has a similar study underway testing Zepbound as a treatment for heart disease in obese patients. The FDA approved Novo’s rival drug Wegovy to treat heart disease in obese patients in March 2024.

Zepbound has already been shown to reduce the risk of hospitalisation, death and other adverse outcomes in a smaller study of obese adults with a common type of heart failure, although the FDA has yet to approve the drug for that indication.

In diabetes care versus Novo’s Ozempic, Mounjaro has captured more than half of the U.S. market share, according to IQVIA data shared with Reuters by an analyst.

Mounjaro and Trulicity had similar safety profiles in the trial, with most side effects being mild-to-moderate stomach issues that usually resolved after increasing the dose, Lilly said.

The GLP-1 drugs are known to cause gastrointestinal issues and more participants stopped taking Mounjaro due to side effects (13.3%) than Trulicity (10.2%).

Comments