What looks like a refrigerator but feeds the mind?

A special new installation at NCB’s Duke Street branch has flipped the script on financial literacy on Read Across Jamaica Day.

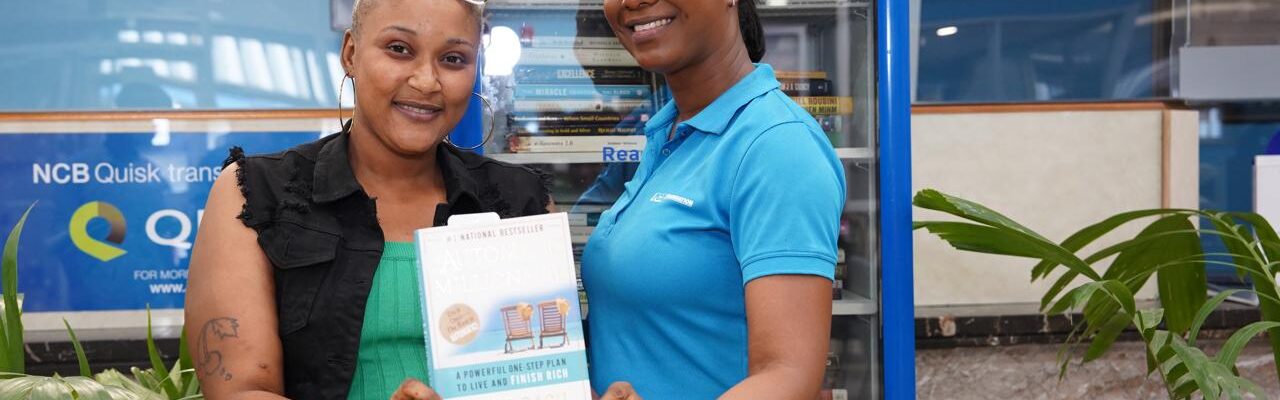

In partnership with Di Cawna Library, the NCB Foundation has curated a one-of-a-kind collection of books focused on financial education, entrepreneurship, self-development, and wealth-building. The collection is creatively housed in a refurbished fridge, now located in the customer service area of the Duke Street branch in downtown Kingston—free for browsing and borrowing. Customers are encouraged to take a book, leave a book, or simply spend a few minutes flipping through ideas that could change their financial future.

The installation will remain at the Duke Street branch for the rest of the week before being moved to other locations across the island as part of a travelling activation.

Curated to inspire smart money habits and shift mindsets, the selection includes titles like Outliers by Malcolm Gladwell, How to Kill a Unicorn by Marc Payne, My Brand Compass by Dr Terri-Karelle Reid, and Crisis Economics by Nouriel Roubini and Stephen Mihm, as well as personal finance staples such as The Automatic Millionaire by David Bach.

“I feel like this is a really good way to help people become more independent,” said Sheshurah Hinds, a customer at the Duke Street branch, who picked up a copy of The Automatic Millionaire. “A lot of us were never taught about savings or investments in school, so having these kinds of books right here makes a big difference. You can pick one up while you wait, and leave with something useful so you can help you plan better, spend smarter, and take more control of your money. Big up NCB.”

“This initiative adds real value to the in-branch experience,” said Roxanne Nugent, Service Quality Manager at NCB. “While our customers wait to be served, they have access to material that is engaging and informative. It’s a simple but meaningful way to support continuous learning and encourage better financial habits.”

This initiative comes at a time when Jamaica continues to face a concerning financial literacy gap. According to the Bank of Jamaica, only 33% of Jamaicans are considered financially literate — well below the global average of 50%. Studies also show that this lack of knowledge can lead to poor money habits, underutilisation of financial products, and long-term financial instability.

Founded by creative changemaker Rachel McDonald, Di Cawna Library is a grassroots initiative that brings books into the heart of communities — placing mini libraries in fridges, crates, and on street corners where people actually live and gather. The initiative has sparked a quiet literacy revolution by making books more visible, approachable, and available to everyone.

“We just want to get Jamaicans reading again—and we want books everywhere to promote the transfer of knowledge,” said Rachel McDonald, Founder of Di Cawna Library. “When children see adults reading, they’re more likely to model that behaviour, and that’s powerful. For this installation, we carefully selected books that offer a deeper understanding of the world of finance and investment. NCB Foundation challenged us to step outside our usual focus and think about how we could support adult financial literacy in a meaningful way. Their goal was clear: to help clients better understand financial concepts and build confidence in managing their money.”

Comments