Executives at New Fortress Energy have identified growth prospects within the Jamaican operations, highlighting three areas of opportunity in a case study shared during its third-quarter 2024 earnings call.

The case study shed light on US$2 billion in savings realised from Jamaica’s switchover to liquefied natural gas, reduction in crude petrol usage as part of the country’s energy mix, and 33 per cent decrease in carbon emissions. It also pointed to “material growth opportunities”.

One of those opportunities, the case study sites, is in bunkering – supplying to ships – given the Jamaican terminals proximity to the Mexican Gulf and the Panama Canal. NFE plans to “leverage existing infrastructure with no incremental capex [capital expenditure]”.

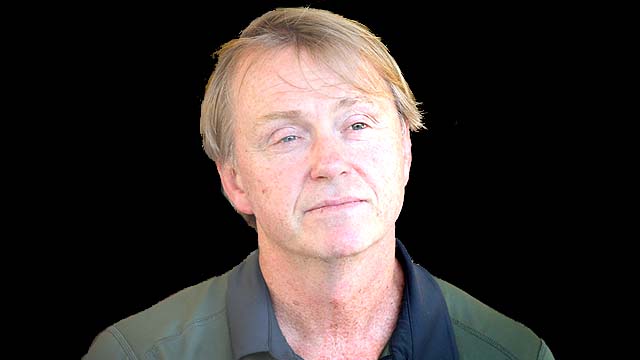

Commenting on the potential for bunkering, President Andrew Dete, who expounded on components of the case study during the earnings call, noted, ” Where the Old Harbour terminal is just top of Kingston is a super busy shipping lane, and we’ve already seen a number of kind of spot transactions in bunkering that we’ve been able to do. And as more cargo ships, both on the container side and the bulk carrier side, continue to get either built with LNG-based engines or able to convert, we think this is going to be a huge opportunity for our terminal to service kind of all of the commercial ship traffic that goes by Jamaica.”

Additionally, the company is eyeing doubling the capacity of the Clarendon combined heat and power plant to meet increased demand from JPS, with which it has “an extremely productive relationship”.

“JPS stated [the] need for additional, reliable baseload power to serve [a] growing market,” the case study outlined.

NFE plans to leverage its “easily converted power assets” to further reduce JPS’ use of crude petrol from 30 per cent to lower.

“The Old Harbour terminal is directly connected by pipeline to the Clarendon CHP (combined heat and power) plant, which we own. Just about 150 megawatts of that supplies electricity to Jamaica Public Service, and then also supplies steam to the Jamalco alumina refinery. And then it’s also connected by pipeline to the Old Harbour power plant, which is owned by Jamaica Public Service,” the president pointed out.

Another opportunity NFE identified was making its Jamaican operation a hub to the Caribbean, noting that it is well positioned as a market hub to receive and distribute LNG throughout the Caribbean.

“Further, we think as the market develops, our hub in Jamaica can really be a hub for the entire Caribbean. We’re obviously, sort of, well — located to access other Caribbean islands. Obviously, our Puerto Rico business actually started and was supplied out of Jamaica originally, which is a great case study for growing other countries out of using this terminal in Jamaica as a hub, and all that incremental growth requires very little capex,” Dete explained.

While commending Jamaica as an excellent case study for economic and macro-fiscal development, Dete said NFE could not avoid “making the very smart decision” to pursue long-term gas and power at very stable, competitive market prices.

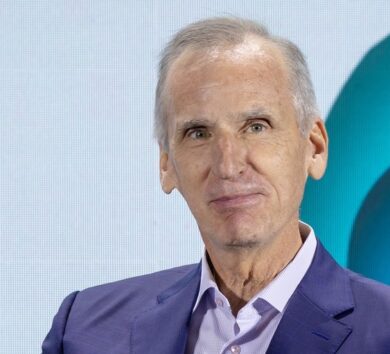

For NFE Chairman and CEO Wes Edens, the Jamaican operation “significantly has a chance to grow materially” despite being a small market with long-term income of over US$100 million over 17 years. He added that NFE’s assets in Jamaica are infrastructure investments, though not recognised as such.

NFE has begun work to identify strategic partners as it explores strategic partner financing, commercial ventures or asset sales in the markets in which it operates. The company recently refinanced a bond debt and raised new capital as it seeks new sources of liquidity.

Comments