Indicating in Parliament on Tuesday (November 30) that a recap was necessary to contextualise the Board appointments to Clarendon Alumina Production Ltd (CAP) and, more importantly, inform the public of the macro criticality of CAP and the strategy going forward, Finance and the Public Service Minister Dr Nigel Clarke had the following to say.

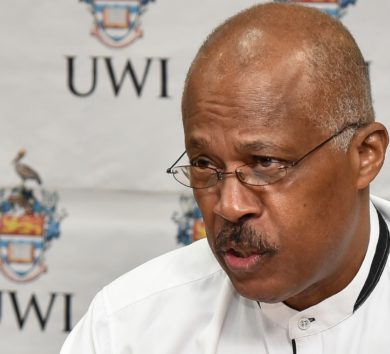

READ: Gordon Shirley to lead new CAP Board

CLarendon Alumina Production Ltd (CAP), which is 100 per cent owned by the Government of Jamaica, has a 45 per cent interest in the unincorporated Jamalco joint venture with General Alumina Jamaica, which is owned by the Noble Group.

Under the unincorporated joint venture arrangements, there is no limited liability company called Jamalco. Instead, CAP and Noble are required to contribute working capital on a monthly basis to acquire the inputs of production and in return receive their proportional share of alumina as output which they then each sell on the world market.

This arrangement has existed for over 30 years with Glencore and Alcoa preceding Noble as the Government’s partner.

Notwithstanding this history, the unincorporated nature of the Jamalco Joint Venture has outlived its usefulness.

In its current form, the arrangements represent an untenable fiscal risk to the Government. Due to the fact that there is no balance sheet for Jamalco, the financing of its operations fall squarely on the shoulders of the shareholders – Noble and the Goverment of Jamaica. Jamalco does not have the ability to borrow, as a legal entity called Jamalco does not exist. As such, in the past, where capital is required to finance Jamalco, the Government has borrowed its proportional share.

Complicating matters, an indebted and cash-strapped Government has, in the past, borrowed against future alumina sales and repatriated the proceeds to the central treasury upfront while fixing the price that CAP receives for its alumina over several years. This has been a practice for over 30 years borne of necessity. Invariably, however, and I can speak to the last 15 years, these arrangements have been very costly, over the long term, as market prices of inputs have often moved adversely as compared with the alumina price fixed years prior.

To be more specific, one of CAP’s central problems has been having a fixed price for alumina, set years prior, and having the cost of HFO, caustic soda and lime, but particularly, HFO move adversely upwards creating huge mismatches between costs and revenues and leading to large negative cash flows and losses.

As such, CAP has had significant cash flow difficulties over a long period of time and been a fiscal risk to the Government of Jamaica with substantial cash calls from time to time. Over the past 15 years, the Government has

financed CAP – in the form of an assumption of CAP debt in 2013-14, or in the form of loans from the central government to CAP or in the form of other financial resources provided to CAP. All told, the Government has provided financing to CAP of over US$800 million over the past 16 years.

Over these 16 years, CAP has made a profit only once – in 2016-17 – with losses in 15 of the last 16 years. The total loss over the last 16 years exceeds US$700 million.

For long stretches of time, CAP depended on its partner Noble to finance working capital obligations on its behalf and therefore built up large working capital liabilities to Noble.

The structural and legal arrangements that give rise to these predicaments can no longer be justified. CAP has competed with health, education and security for scarce taxpayer dollars and has been a fiscal risk to the Government of Jamaica. In the 2010 IMF Agreement, divestment of CAP was a strategic priority which occupied the attention of the then administration.

This could not be achieved at any sensible price, however, due to, among other things, the unincorporated structure through which the Government holds its Jamalco investment. As such, the Government has been working over the past four years towards incorporating Jamalco and having all the vast array of assets – factory, land, machines, equipment etc. and liabilities required for operations fully vested in a new limited liability version of Jamalco. It has been a major

priority of the Ministry of Finance to eliminate the fiscal risk posed by and the historical financial hemorrhaging caused by CAP.

As has been disclosed in this House [of Representatives] before, the Ministry of Finance and the Public Service has

therefore provided strategic and financial leadership to the incorporation process which is now far advanced. As an intermediate step, the Ministry of Finance and the Public Service has provided financial resources that have allowed for a restructuring and re-engineering of CAP’s balance sheet.

Last year August, 2020, I announced in this House a major breakthrough on the path to incorporation when the Ministry of Finance and the Public Service loaned CAP US$137 million to repay its interest bearing obligations to Noble. This allowed CAP to terminate the alumina sales agreement, which still had five years remaining, and under which CAP was committed to sell alumina at fixed prices, agreed years prior, which were now below the market price and in some months below the cost of production. The alumina sales agreement was replaced by a marketing agreement where CAP received the same market price for its alumina as Noble less a fixed two per cent commission.

This put CAP in a vastly improved position with respect to its revenues. This was a major breakthrough which has, since that time allowed CAP to enjoy higher prices for alumina, and a lower cost of interest in its debt. Instead of paying Noble eight per cent it pays the Ministry of Finance four per cent, a savings of approximately US$6 million a year.

Combined, these Re engineering steps – refinancing of its debt and termination of alumina sales and replacement with marketing agreement have allowed CAP to enjoy profitability thus far this year – ie since April 1, 2021 for the first time in six years and only the second time in 16 years.

This House should recognise that.

As importantly, CAP has been able to make its working capital calls from its internally generated resources rather than borrowing from Noble. This too is a major positive change.

Additionally, this year, in 2021, the Ministry of Finance and the Public Service lent CAP a further US$60 million to repay Noble the non-interest bearing working capital loan accumulated from CAP’s inability to finance its share of working capital requirements over long periods of time.

Today, CAP does not owe Noble one red cent.

This is a major achievement of the Government of Jamaica. More importantly it is an achievement of the Ministry of Finance and the Public Service and the Ministry of Mining working together.

As you can understand these developments also provide positive momentum to the incorporation process.

So, due to the restructuring engineered as described above:

• After losing US$700 million over the last 16 years, CAP was profitable for the first half of this year (April – September) before the fire which would be the 2nd year of profits in 16 years

• After draining cash for several years CAP has had positive cash flows for this financial year

• After owing Noble or Glencore substantial sums for at least the past 15 years, today CAP owes Noble not one red cent.

So, we were doing so well. And then a fire in September brought production at Jamalco to a halt and interrupted this record transformation of CAP. This was a tremendous blow.

Minister Montague recently provided an update on the fire and I don’t intend to repeat. Let me clear on the following though:

The fire is a major threat to Jamaica’s economic recovery. Jamalco has the capacity to produce 1.2 million tonnes of alumina. Prices vary on the world market, but using a price of US$330 per tonne, at full production, and with Jamalco now producing zero due to being down because of fire, represents an annualized loss of approximately US$400 million to the economy. That is as if most of the BPO industry was wiped out. It’s significant.

The immediate priority for the new Board therefore is to work with our joint venture partners – Noble to chart the course for the restart of production in the quickest possible time and to reevaluate the strategic options for the reconstruction of the power house. This requires detailed consideration as the issues involved are complex and technical. We have to recognise that Noble has the capacity to be nimbler than the Government and now more than ever when we are racing against the clock we have to know how to use that to the advantage of the Jamalco joint venture, and ultimately to CAP and the Government with appropriate measures that provide necessary assurance. Let me be clear we are racing against the clock.

The insurance claim related to the fire at Jamalco was submitted.

There is an overall claim of up to US$250 million to cover business interruption, reconstruction and exceptional costs. The business interruption tranche allows for administrative expenses to be addressed while the power plant reconstruction takes place. (However Jamalco’s mining operations have been suspended).

There is the risk that if reconstruction takes longer than required the cap for business interruption could be exhausted. We are therefore in a race against time. The shareholders of Jamalco, CAP and the Government will have to be smart, practical, business like, strategic and technically proficient.

The parallel priority for the new board will be to continue the work towards the incorporation of Jamalco.

As I said earlier, this work has been under way for the past four years. Substantial progress has been made over that time and the legal agreements to give effect to incorporation have been substantially agreed with the exception of a handful of major items to be resolved.

The board will be required to familiarise themselves with where we have reached with incorporation as we work towards finalising incorporation. The vision of the Government is that it eventually owns its 45 per cen stake in an incorporated Jamalco that we proceed to take public on the Jamaica Stock Exchange.

Since the emergence of the bauxite industry in the 1960s, no Jamaican has ever had a direct economic interest in a bauxite/alumina plant in Jamaica. This Government will change that.

Jamaicans will have the opportunity to directly own a piece of a major industrial asset operating in our bauxite/alumina industry.

This vision is within reach.

Comments