Providing growth, opportunity and well-being under the brand

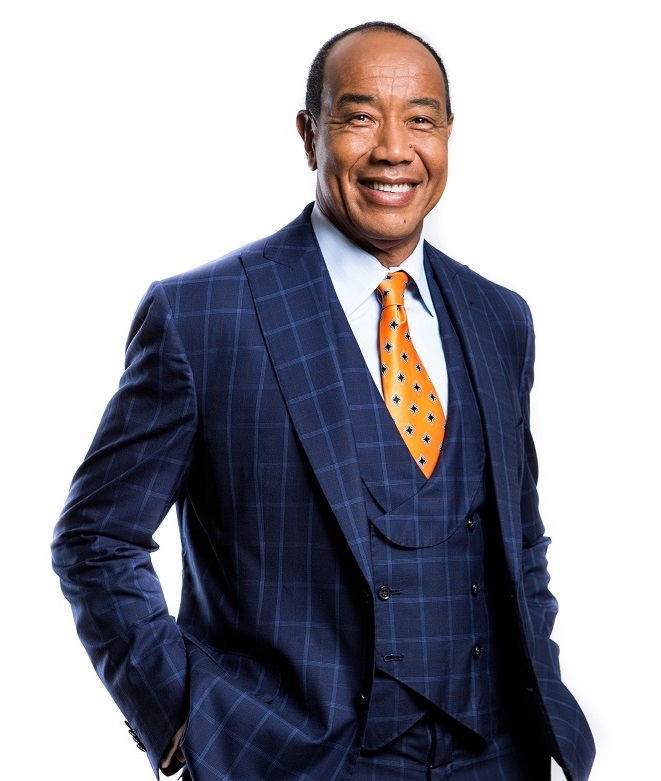

In 2018, Paul Simpson, via his private equity vehicle, Cornerstone, purchased the oldest brokerage house in Jamaica, Barita Investments for J$2.8 billion.

Since then he has transformed it into a leading financial player valued at J$110 billion.

He is now focused on talent retention and making it an institution where employees can grow, prosper and be well rewarded.

Barita is buying back on the open market upwards of 10 million shares worth J$850 million at current market value.

The purchase of the shares is for Barita’s Employee Stock Ownership Plan (ESOP). The plan is to have these shares purchased from the open market between September 6, 2022 and October 14, 2022.

More recently, Cornerstone Group conducted an employee culture survey soliciting candid and frank comments from employees.

What came back was that, with inflation rising, times are tough and their salaries were being eroded by ever increasing living expenses.

They asked for a seven per cent increase. Barita’s management team came back and offered 12 per cent.

Paul Simpson has vowed to make Cornerstone an employer of choice with a culture that fosters growth and rewards effort. Barita has not lost any senior staff since inception, a sign of confidence reposed in its operations and its increasing expansion.

The aim now is how to make the business even better within the next three to five years and, in order to do so, getting feedback from its staff became a prerequisite.

It became essential to create an environment that fosters trust, where everyone is heard, and the company can embrace a work from home culture when needed.

Simpson has now accomplished three significant transformational objectives that augur well for all those who work at Barita.

What are they?

- Increased salaries.

- Enacted share options which allow staff to own a piece of the business

- Ensure there is upward mobility within the company. There is a pathway to advancement for those who have the wherewithal to get on it.

Many Jamaican companies should sit up and take note.

Speaking with Our Today, Simpson quipped that this move may see profits go down but a happy workforce is invaluable and all can share in Barita’s success.

Cornerstone, with a fund of US$500 million has become a leading investment force in a comparatively short time, proving to be a major rival to more entrenched entities that have dominated the landscape for decades.

It now consists of four arms of operation, namely:

Banking and technology

Investment banking

Real Estate and Infrastructure

Alternative investments and Energy

An open letter to staff from Paul Simpson read:

“I am heartened by the fact that most employees understood and liked our purpose and vision as a Group, and also likes our entrepreneurial spirit, openness and integrity. This is an area which we intend to continue to build on, as without this DNA, we would not have been able to grow the business as aggressively over the past four years.

“I agree that at particular points in our evolution we have to pivot depending on focus and be agile with it. I am also heartened by the fact that the survey highlighted the good work and leadership done by most managers.

“Importantly however, you pointed out areas where we need additional attention and focus. Those include:

- Leadership and accountability

- Respect and trust

- Collaboration and responsibility

- Work-health balance

- Reward and recognition

- Communication and work productivity

- Growth and Development“

Speaking with Our Today from Canada, Paul Simpson’s mentor, NCB and Portland Holdings Chairman Michael Lee-Chin said: “I have a lot of time for Paul Simpson. One of his biggest qualities is his ability to listen, parse, then execute. He is disciplined and sticks to his framework. He is not afraid to take risks but his risks are within his circle of competence.

“A lot of us simply don’t listen. We can all learn from Paul’s characteristic – listen, parse, then execute.”

Lee-Chin added that successful investors are guided consciously by the three Ps:

- Predict where the future is

- Plan for that prediction

- Persevere with their plan

He notes that Simpson has demonstrated these attributes

The NCB boss continued: “Paul has decided Jamaica has a bright future and he is bullish on the country. He has acquired trophy properties that have a good state of value and will develop those assets. Take for instance his plans for high quality tourism. Tourism will be a major pillar of the economy for decades to come.

“He is a young man able to anticipate where the ball is going then pursue it with his plan. He doesn’t just talk – his actions are 100 per cent in keeping with what he says he is going to do.

“Jamaica needs more Paul Simpsons. We should applaud him. He is a good role model not just for young people but for any generation.”

At 39, Simpson has become a leading player in Corporate Jamaica and his rise is making headlines.

Should he take his talents outside of Jamaica and, like a young Alexander, look beyond Macedonia to Persia?

A word to the wise from Jamaica’s leading business icon, Lee-Chin.

“Consolidate your home base and, if you have the capacity, then go beyond home. Always secure your home base first, then take on the second concentric circle.”

One of the best British high commissioners Jamaica has had, Asif Ahmad, is also an admirer of Simpson’s accomplishments and character.

Speaking from the UK, on the day Queen Elizabeth II died, Ahmad said: “I first met Paul Simpson through our education initiatives, more specifically with the prospect of Barita coming on board as a sponsor of the Chevening Scholarship. We formed a good and lasting friendship. I was the only diplomat invited to his wedding.

“He is a young ambitious man who is true to his word. He acquired Barita, one of the oldest stock brokerages and took it to another dimension. He is making big investments in Jamaica. He is doing something unreal and is going to make his mark. Paul Simpson is a pacemaker. But saying that, he is also humble and remembers how Earl Jarrett encouraged and believed in him.

“I love his commitment to Jamaica. He will be transformational. He is looking to open an office in Miami and will be taking Barita to Europe.”

Comments