Durrant Pate/Contributor

In an Our Today news follow-up, Playa Hotels & Resorts NV’s stock rallied 24 per cent on Tuesday (December 24) after the company said it agreed to enter into exclusive strategic talks with Hyatt Hotels Corp.

A successful merger would boost the larger hotel chain’s presence in Jamaica, Mexico and the Dominican Republic, which could likely top the US$1.2 billion market capitalisation of Playa Hotels as of last Friday’s close. Playa’s stock has risen 40% in 2024.

Hyatt’s stock has risen by 21% this year but its share price fell by 1.3% today. Playa and Hyatt have already worked together on a number of properties that Playa Hotels manages including the Hyatt All-Inclusive, Hyatt Zilara, and the Hyatt Ziva.

Talks represent compelling strategic merit

Playa Hotels owns or manages 24 resorts with 8,627 rooms. Hilton reports that the talks with Playa “could have compelling strategic merit to add new incremental durable fee streams for Hyatt.”

Those options include the purchase of Playa Hotels, which Hyatt described as “one of the world’s strongest operators of all-inclusive resorts” and the owner of a “premier portfolio of high-quality, high-end all-inclusive resorts in iconic locations and key markets across the Caribbean and Mexico.”

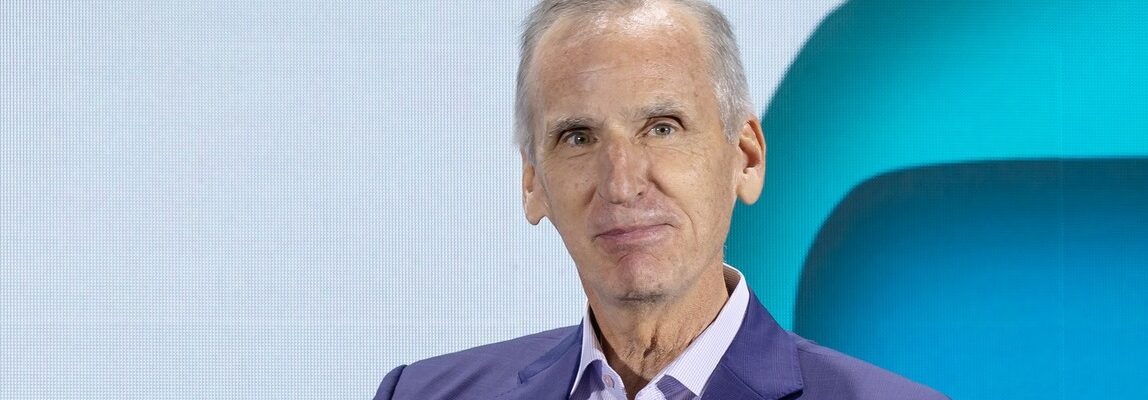

The potential deal comes as Playa Hotels faces a slowdown due to the impact of Hurricane Beryl in Mexico in July, but the hotel chain has since been in recovery mode. During Playa’s most recent quarterly call with analysts, chief executive Bruce D. Wardinski reported that while Hyatt has been making inroads into some of Playa’s areas, it is aiming for a different client base.

According to him, “They’re very large properties with lots and lots of rooms…They go after, quite honestly, a different kind of customer.”

Comments