People’s National Party (PNP) Member of Parliament for South St Catherine, Fitz Jackson, is dismissing claims by Government Senator Matthew Samuda that the Banking Services Act proposed was “deeply flawed”.

Samuda, responding to Twitter criticisms of a Jamaica Labour Party (JLP) statement, alleged that the bill “would do more harm than help”. The minister without portfolio in the Office of the Prime Minister (OPM) was at the centre of mounting backlash as Jamaicans bemoaned the rising cost of doing business with the two largest banks in the country—National Commercial Bank and Scotiabank.

(Photo: Twitter @matthewsamuda)

(Photo: Twitter @matthewsamuda)

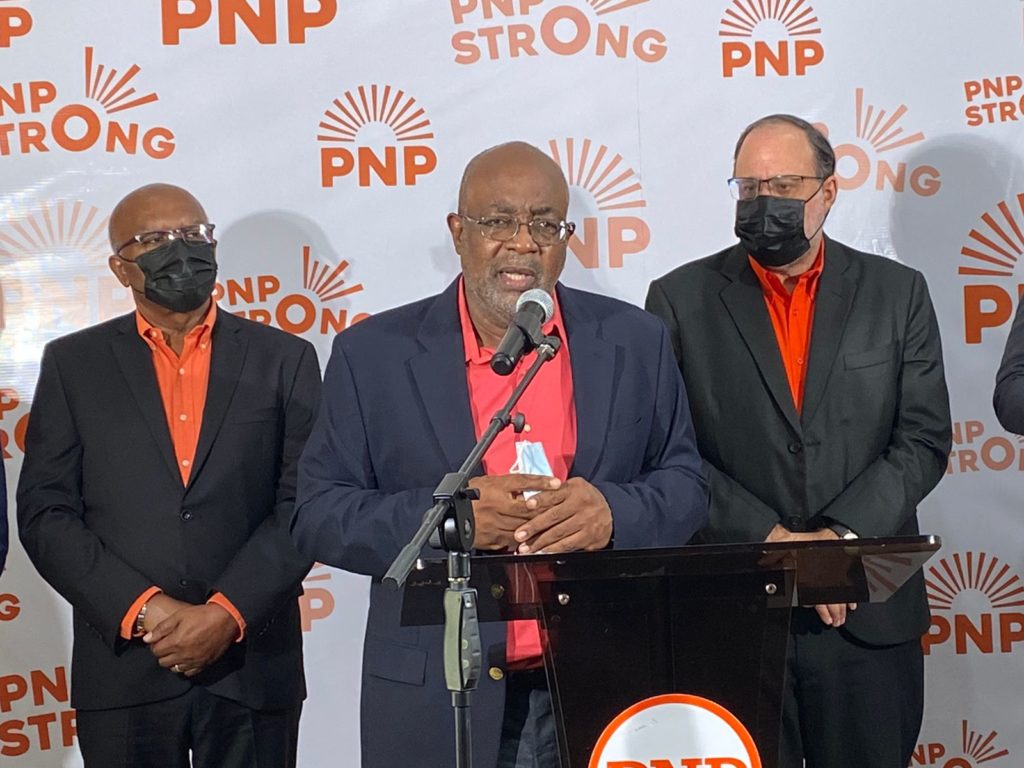

Jackson, during a PNP press conference convened on Tuesday (January 25), slammed Samuda’s remarks as a political distraction, contending that no such “flaws” were ever highlighted at any point.

In fact, all relevant stakeholders, including the deposit-taking institutions (DTIs) themselves, consumer groups and the wider public participated in the consultation process.

“I think that is just a distraction. The records are there to speak for itself. Neither Mr Samuda nor any of his colleagues pointed out any flaws, and, bear in mind that the bill was subject to review by the Solicitor General’s department [and] the Chief Parliamentary Council so, from a legal standpoint, all the prerequisites were addressed in it,” Jackson told Our Today.

“From a policy standpoint, all of their members signed off on it. As I said, the bill is merely a compilation of the recommendations that were arrived at in a bipartisan way,” he added.

Jackson, while welcoming the signal of Government action, called it disgraceful that the bill still sits unpassed nearly a decade after it was first introduced for new amendments in 2013.

“As Jamaica and perhaps the world is aware, this matter is not a new one. It has been affecting Jamaican bank account holders for many years—brought to the fore in Parliament through a private member’s motion I tabled back in 2013…while the People’s National Party formed the government,” the former state minister for finance indicated.

According to Jackson, the 2013 dateline was mentioned to emphasise that the bill was not brought to lawmakers’ attention in a “contentious or partisan way”, but to highlight an issue that impacted a wide cross-section of Jamaican society, including small businesses, pensioners, unemployed and the working class.

“Banking is much like a utility service; telecommunications, water, [electricity], the roadways—everybody depends on the banking system and banking services for everyday life in modern societies,” Jackson said.

“And, therefore, it was and is imperative that we ensure there is equity in the utilisation of that service,” he posited.

The Opposition MP further noted that, unlike other services, banks rely on the income of others to generate their profits; without the customers, these institutions cannot survive in a vacuum.

What was initially a means to an end has now turned into a lucid nightmare for Jamaicans as banks move with alacrity to find a fee for virtually every banking process.

“A manufacturer will borrow money, use their own savings etc, invest it, reap a profit and that’s it. Service provider [does] the same. In banking, and particularly the deposit-taking institutions, they have a special privilege in society where the banks allow them to take the deposits and invest [them] for making profit,” Jackson argued.

“What we have seen over recent times, the banks, not being satisfied with their normal stream of income—interest on loans and other instruments that they give—found a convenient way of exploiting the deposits that are placed in their charge for safekeeping,” he added.

Jackson cited Section 1 of the 1964 Banking Services Act, which ‘gives banks the responsibility to keep deposits safely and preserve the value of said deposits’, a clause he contended banks have collectively reneged on of their own accords.

“What the banks have done, unilaterally, is to impose a myriad of fees to extract from their depositors on the surface of it, small amounts, but cumulatively significant [sums]. You will find that over the last year, for example, over J$50 billion is earned by the banks in fees,” Jackson told journalists.

“Fee income now becomes roughly 40 per cent of banks’ revenues. The normal practice of banking has been transformed to the disadvantage of depositors. Each year, monies have been extracted…but when the Government became aware of the extent to which it was impacting depositors, nothing has been done,” he explained.

Five years later, when votes were tabled in the House of Representatives in 2018, Jackson lamented that Parliament failed the people it was elected to speak on behalf of, as the bill was defeated 30-29 in opposition to further amendments.

“We as Parliamentarians, all of us, have a collective responsibility to protect the ordinary Jamaicans. And what was set out is the promulgation of an amendment to the Banking Services Act that establishes a minimum service package. And I want to underscore that: all deposit holders must enjoy a minimum level of service from the banks licensed by the Government of this country.”

— People’s National Party (PNP) Member of Parliament for South St Catherine, Fitz Jackson

The minimum service package, according to Jackson, was that since the banks get the benefit of the deposits, these institutions should: allow a minimum number of transactions per month/per year without any fees; account holders must be able to make deposits without fees or penalties; holders must also be able to withdraw from their accounts without being penalised by way of a fee; as well as holders being facilitated to make inquiries into their accounts without fees attached.

This was a pressing concern, especially as most banks had abandoned ‘passbooks’, thereby ending a physical record for Jamaicans to track their account activities.

Insisting there wasn’t an agenda towards banks, Jackson asserted that the bill promoted fairness for hard-working Jamaicans and provided a buffer to keep banks from achieving profit margins at the expense of the customer pool.

“Banks are a way of mobilising capital for national development, so there’s no ill-will against banking,” he added.

Now, as NCB, Scotiabank and other banks charge customers to access their own money, and tempers correspondingly flare, Jackson explained that the Banking Services Act, personally re-tabled in Parliament, has been languishing since October 2020.

According to the PNP MP and former State Minister for Finance, the Government has no one to blame but itself since it sided with the banking sector and denied support for the bill.

“When it came to voting, to make what they say ought to happen, happen, they abandoned the people and they surrendered to interests of the banks. That bill was defeated 30-29 and it was straight on party lines. All members of the Government, including the prime minister, voted against it. All members of the then Opposition voted for it,” Jackson said.

Comments