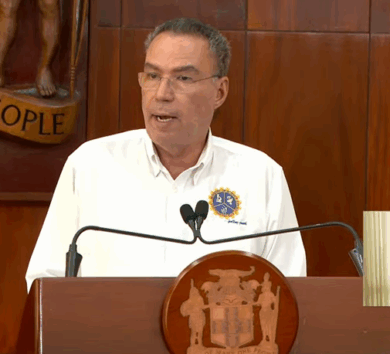

It would have been grief for US Federal Reserve chairman Jerome Powell if he hadn’t dropped the overnight lending rate today (December 10).

President Donald Trump has castigated Powell for not lowering rates quickly enough, thus stymying the US economy.

Powell’s cautious approach is due to prevailing “sticky” inflation and elevated unemployment levels. The President has made it clear he is not a fan of Powell and can’t wait to see the back of him.

Today’s decision to drop a quarter percentage point to between 3.5 per cent and 3.75 per cent is the third interest rate cut this year.

There are those who felt it prudent to have no decrease, while some felt Powell should have made a 50 basis point cut.

“I can make a case for either side. We have to see how the economy evolves,” said Powell.

Addressing his impending departure from the job, Powell declared, “I really want to turn this job over to whoever replaces me with the economy in really good shape. I want inflation to be under control, coming back down to two per cent, and I want the labour market to be strong. That’s what I want. And all my efforts are to get to that place.”

Powell insisted that decisions on interest rates must be predicated on data and not emotion.

“We’ll carefully evaluate that incoming data, and also, I would note that having reduced our policy rate by 75 basis points since September and 175 basis points since last September, the Fed funds rate is now within a broad range of estimates of its neutral value, and we are well positioned to wait and see how the economy evolves.

“The Federal Reserve is well-positioned to determine the extent and timing of additional adjustments based on the incoming data, the evolving outlook of the balance of risks,” said the chairman of the Federal Reserve.

The way Powell sees it, elevated inflation is due in the main to the tariffs, and he does hope this is short-lived.

“These readings are higher than earlier in the year as inflation for goods has picked up, reflecting the effects of tariffs.

“A reasonable base case is that the effects of tariffs on inflation will be relatively short-lived, effectively a one-time shift in the price level. Our obligation is to make sure that a one-time increase in the price level does not become an ongoing inflation problem, but with downside risks to employment having risen in recent months, the balance of risk has shifted. Our framework calls for us to take a balanced approach in promoting both sides of our dual mandate.”

Of this latest rate cut, President Trump commented, “Could have been doubled, at least doubled.”

Comments