Dequity Capital Management Limited (DCM) has officially launched its initial public offering (IPO) following a well-attended investor briefing on Thursday (November 27) hosted in partnership with VM Wealth Management, lead broker and arranger of the offer.

The IPO, now open to the public, provides investors with a rare opportunity to participate in the private equity asset class, an investment avenue typically reserved for institutional players and high-net-worth individuals.

The company is offering 657.5 million shares at J$1.00 per share, with 394.5 million shares available to the general public and 263 million shares reserved for strategic investors. All applications must be submitted electronically via the VM Wealth IPO Edge Platform.

During the briefing, Romario Sterling, capital markets manager at VM Wealth Management, underscored the unique opportunity the offer presents for everyday Jamaicans seeking long-term growth exposure.

He said that Dequity is “giving the average Jamaican investor access to private equity as an investment asset class… an opportunity to benefit from an asset class that can give astronomical returns.”

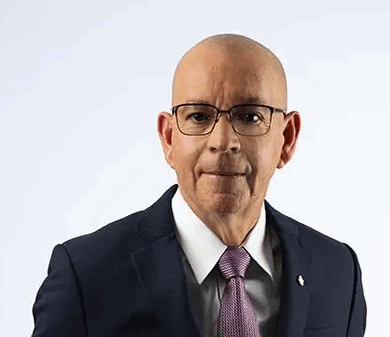

DCM’s chairman Dr Damien King presented Dequity’s investment strategy within the context of Jamaica’s significantly strengthened macroeconomic environment.

“Jamaica now has – for the first time since independence – a stable and predictable macroeconomic environment,” Dr King said. “That means there are tremendous opportunities for entrepreneurs. Our role is to identify high-potential small and medium-sized companies, take positions in them, and contribute to their success by injecting capital and providing management support.”

Dequity’s business model centres on growth equity, targeting companies that are established and generating revenue but require capital and governance to scale. The firm’s portfolio is diversified across financial services, real estate, healthcare/telemedicine, gaming, and media/print, helping to strengthen resilience and reduce concentration risk.

Sterling highlighted that the offer is attractively priced to encourage market participation. The J$1.00 offer price represents a 22 per cent discount to Dequity’s net asset value (NAV), with projections indicating that the discount may widen to 40 to 50 per cent after the successful retirement of the company’s outstanding bond.

“We’re projecting significant upside once the transaction is completed,” Sterling said. “The pricing gives investors a clear value proposition from day one, with further gains as the company delivers and deploys new capital.”

Comparative market analysis shared at the briefing also showed Dequity’s price-to-book ratio of 0.78 times, below the average of comparable listed equity funds on the Jamaica Stock Exchange.

Dequity CEO Kadeen Mairs explained the strategic rationale behind the IPO, noting that the majority of proceeds will be used to retire the company’s existing bond, which currently represents 65 per cent of Dequity’s liabilities.

“Eliminating this debt gives us the flexibility we need to pursue new investments, support our portfolio companies and unlock greater value for our shareholders,” Mairs said. He added that Dequity’s strengthened financial position will provide momentum not only for the firm’s expansion, but also for broader economic recovery efforts following Hurricane Melissa.

“We have to continue pushing productivity. By putting ourselves in a stronger position, we can help our portfolio companies grow and support Jamaica’s rebuilding process.”

The prospectus is now published and available for review. The offer opened on November 27 and will close on December 18, unless extended or closed early based on investor demand.

Comments