Jamaican listed property, lifestyle and media company, Pulse Investments recorded very strong gains for its just-ended 2021 financial year

The company’s audited 2021 financial statements for the year ended June 30, 2021, showed profits up by 73.5 per cent, moving from $883.3 million in 2020 to $1.53 billion this year. Income also showed a robust gain, increasing by 52.9 per cent to $1.93 billion this June, up from $1.26 billion in the prior year.

The audited 2021 financial statements for the year filed with the Jamaica Stock Exchange (JSE) this week showed that earnings per share increased to 23 cents from 13 cents last year. Administrative and other expenses fell marginally by 3.1 per cent moving from $395.4 million in 2020 to $383 million as at June 30 this year, as the company tightened expenses in the current challenging pandemic environment.

Biggest gains made on investment property

While rental income and model commissions showed gains of 9.7 per cent and 7.1 per cent respectively, the biggest gains were from investment property, mainly from Villa Ronai in Stony Hill, St. Andrew, which was acquired by Pulse during the just-ended financial year. Both the Ronai and Trafalgar Road properties returned significant appreciation in value, but Ronai also recorded gains, as a result of the conversion from a leasehold property to a fully-owned Pulse asset.

The prior year expansion as a result of the completion of the Pulse Suites project at the Stony Hill location also added to the gains in the value of investment property this year. Rental income was up to $103.6 million (from $94.4 million in 2020). Model commissions moved to $49.3m, up from $46 million last year.

Gains on investment property this year was $1.12 billion, up from $583.7 million in 2020. The company’s TV production business line was also up significantly as more broadcasters in the Caribbean and North America responded to increased demand for Pulse programming such as Caribbean Model Search, Caribbean Fashion Weekly and new titles including Pulse World 360.

Revenues increased by 39.5 per cent, moving from $314.5 million in 2020 to $438.8 million in 2021. No live events were staged in the financial year, so there were no revenues from ticket sales or live event sponsorship.

New financing secured in 2021

During the year, the company obtained new financing of $2.31 billion with $1.21 billion actually received and a $1.1 billion bond floated for short term debt replacement and construction of the first phase of a planned 30 home development at Villa Ronai. The $1.1 billion bond was arranged and underwritten by Barita Investments Ltd.

Funds received earlier in the year were used to repay a $250 million bond previously arranged by NCB Capital Markets and to acquire the Villa Ronai property from a related party. Although down, largely as a result of the impact of COVID 19, the company’s hospitality business has rebounded with Pulse Rooms at Trafalgar showing fair business.

Pulse Suites at Villa Ronai had a very limited operation during the financial year. Pulse remains optimistic regarding its hospitality business as vaccinations are ramped up in Jamaica and the wider world. Pulse’s new real estate initiatives as well as the funding secured marks the final phase of the company’s transition to a company with property at its core, allied to a diverse range of business lines, most within the creative industries, where Pulse started life.

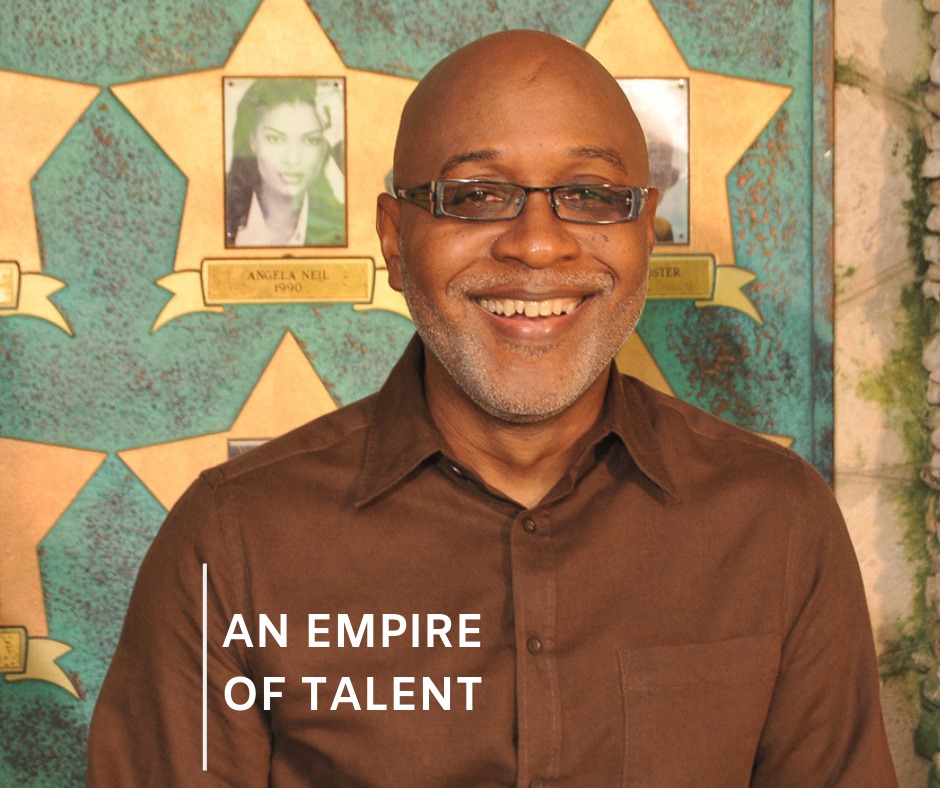

The Kingsley Copper-founded company’s new mantra ‘Leisure, Lifestyle Living!’, reflects this unique synergistic mix which includes property development, property sales, property rentals (residential and commercial), guest accommodations, attractions, wedding centre as well as externally operated spas, restaurants and fitness centre.

These will be supported and complemented by Pulse media, fashion and model management. Pulse has expressed its appreciation to all its stakeholders, especially its shareholders for their support. The company’s 40th-year celebrations were cut short by COVID-19 in 2020, but continued achievement in this extremely challenging environment is certainly reason for continued confidence.

Comments