The following is a preliminary analysis of the 2023-2024 opening Budget Debate presentation, delivered by Dr Nigel Clarke, minister of finance and the public service on March 7. The analysis was conducted by PwC’s tax team, led by Brian J Denning.

Dr Nigel Clarke, minister of finance and the public service, delivered his opening Budget Presentation for the 2023-24 financial year on Tuesday (March 7).

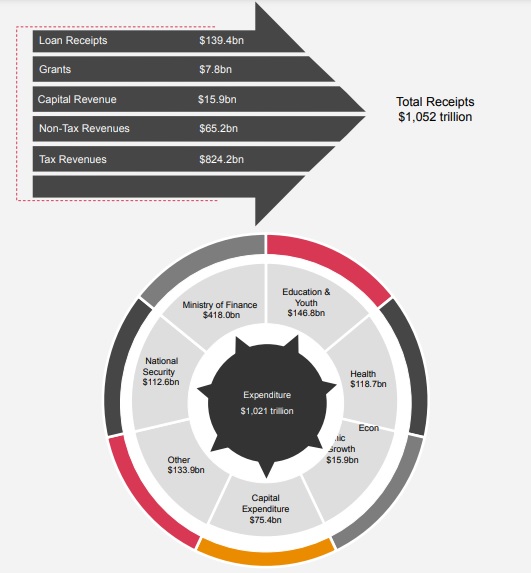

Minister Clarke outlined how the Government of Jamaica (GOJ) plans to fund the 2023-24 National Expenditure Budget of JMD 1.021 trillion which was previously tabled in Parliament.

Overall receipts for 2023/24 (including JMD 139.4 billion in loan receipts) are projected at JMD 1.052 trillion. This gave Minister Clarke sufficient fiscal space not to impose any new or higher taxes. The Revenue Measures announced today are instead projected to cost a modest JMD 153.33 million.

This is the sixth consecutive year that no new taxes have been imposed and the eighth consecutive year when viewed on a net basis. For those of us who have been monitoring Jamaica’s budgetary performance over many years, we still have vivid memories of new or higher taxes being levied year after year to plug perennial fiscal deficits. Jamaica has however, through strong fiscal discipline, developed commendable

resilience to the many international storms we have been buffeted by including a global pandemic and an ongoing war between Ukraine and Russia.

Both the current GOJ administration as well as previous administrations are to be credited for the critical course corrections that Jamaica implemented in order to get its finances under better control over the last 10 years.

Minister Clarke spent much of his presentation outlining what steps have been taken under the ongoing public sector transformation programme including addressing pay restructuring and scale harmonisation.

This exercise is critical to the ongoing management of Jamaica’s finances. It also needed to pursue greater equity and harmonisation across the public sector pay structure and reduce the anomalies and inefficiencies that have accumulated over many years. Minister Clarke noted that pay offers currently on the table are the absolute best that the Government can do given all circumstances. Segments of the public sector are however restive and have been taking informal industrial action in the form of ‘sick-outs’.

Additional fiscal space would undoubtedly give the Government greater wiggle room to address these and other pressing recurrent and capital expenditure demands.

SEEK WAYS TO IMPROVE PERFORMANCE

There is therefore no time like the present for actively pursuing further tax policy and administrative reforms to fine-tune the Jamaican tax system and realise further gains.

The path to national development is paved with tax receipts. This does not mean imposing new or higher taxes.

But it does mean that we should seek ways to improve performance, eliminate inequities and enhance compliance.

For compliant taxpayers, there still remains a feeling that there are too many delinquent taxpayers (including those in the informal/cash economy) who are not bearing their fair share.

In his 2022/23 Budget presentation last year, Minister Clarke announced a series of proposals to enhance our regulatory, fiscal and business framework.

A number of these have been implemented including the Common Reporting Standard (CRS), the JAMDEX (Jamaica Digital Exchange) – a digital currency backed by the Bank of Jamaica, public sector compensation reform (ongoing), a redesign of Jamaica’s paper currency and a reduction in the rate of import customs duty (ICD) on the importation of electric vehicles.

In contrast other proposals announced have yet to be fully implemented including:

• Promulgation of a new Customs Act & Regulations (it was indicated that this is in its final stages)

• A wholesale review of the Income Tax Act

• Amendment of the Large Scale & Pioneer Industries Act and implementation of supporting regulations

• A consolidation of Jamaica’s various payroll taxes into a single payroll tax deduction

• An implementation of a uniform sanctions code across Jamaica’s tax framework

What this highlights is that with many competing demands and limited resources, it is challenging to implement all the reforms already decided upon let alone additional reforms which are also needed.

NO UPDATE ON TIMELINE FOR REDUCING ASSET TAX

One way to fast track these is to target reforms that will quickly enhance revenue collection and invest same into providing additional resources where needed (e.g. in the Tax Policy Division of the Ministry of Finance) to help drive the implementation of other much-needed reforms.

In his 2021/22 Budget, Minister Clarke had announced a reduction of Asset Tax on financial institutions but this was subsequently deferred due to fiscal uncertainty brought on by the COVID-19 pandemic. He noted in last year’s Budget that this reduction remained outstanding and still needed to be implemented (fiscal space permitting). Minister Clarke did not however give any update in his speech concerning any timeline for promulgating this reduction.

This Asset Tax remains however somewhat of a nuisance tax in that it dis-incentivises regulated financial entities from holding chargeable assets within their Jamaican entities.

This is sub-optimal as assets generate income which generates income tax and asset management generates employment etc.

This illustrates the importance of choosing our taxes carefully – once implemented it can become difficult to wean ourselves off them.

In contrast, well-designed taxes encourage desirable behaviours and can stimulate increased economic activity.

The Revenue Measures announced by Minister Clarke align with this approach. While they may have a limited revenue impact (in terms of implementation cost), their intent is to stimulate desired behaviours, associated economic activity and in turn incremental taxes.

The reform of the GCT treatment of second-hand car sales will bring Jamaica’s GCT regime more into line with established international VAT treatment of such sales. The current regime dis-incentivises second-hand car sales by GCT registered taxpayers such as dealers which in turn impacts the ability of such dealers to purchase and resell second hand vehicles, offer trade-in arrangements etc.

In contrast the current regime favours second-hand car sales by taxpayers who are not GCT registered and this can also facilitate tax leakage.

Minister Clarke announced a 30% tax credit on the installation of solar power generation systems (costing up to JMD 4 million) for residential use. While these systems already enjoy relief from GCT, the grant of an income tax credit is aligned with international practice and is designed to enhance the economic payback of such an investment. It is hoped that this will encourage more accelerated adoption and installation of these systems which can in turn lessen Jamaica’s energy bill and demand for fossil fuels.

To boost the bloodstock/racing and agricultural sectors, GCT is being removed on the importation of live horses, small ruminants and pigs. By making these key inputs less expensive, it is hoped that this will assist in stimulating activity in these sectors.

HIGHLIGHTS

In his budget presentation, Minister Clarke announced the introduction of an income tax credit for the purchase and installation of residential solar photovoltaic systems. The tax credit would be available to employed and self-employed taxpayers and would be calculated at 30% of the cost of of the system, up to a maximum system cost of $4 million. The credit is programmed to take effect from the year of assessment 2023.

Whilst the loss in potential revenues from the implementation of this measure was estimated at $100 million, the Minister posited that the potential losses would be offset by positive socio-economic gains; including environmental gains from reducing carbon dioxide emissions, diversifying local energy supply and reducing the demand for crude oil.

The move to introduce environmental tax credits to individual taxpayers to offset the high costs associated with the purchase of solar systems is a positive one. This initiative should increase the availability and use of renewable energy and hopefully reduce the environmental footprint in residential homes.

Given the increasing importance of Environmental, Social and Governance (ESG) concerns locally and internationally, environmental initiatives benefiting the productive sector would also be welcomed.

Credits made available to the productive sector for environmental and social initiatives have the potential to be a game-changer in the way that Jamaican companies prioritise environmental and social issues, in keeping with international best practices.

In his budget presentation, Minister Clarke noted the disparity in the current GCT treatment of the second sale of motor vehicles by private individuals versus registered GCT taxpayers (such as car dealers).

While individuals account for GCT at a flat rate of JMD 12,000/JMD 18,000, dealers are required to account for GCT of 15% on the full sale price of the vehicle.

The current GCT regime for motor vehicles inadvertently:

a) distorts price competition in the local second-hand vehicle motor market by placing a greater GCT burden on legitimate GCT-registered automobile dealers, compared to sellers who are either not GCT-registered or who effect such sales in a manner to avoid this burden;

b) encourages second-hand vehicle sales to be structured ‘off-books’ to avoid reporting and taxation (thereby facilitating non-compliance and under-reporting and remittance of tax obligations);

c) levies an excessive amount of net GCT on second and subsequent sales of motor vehicles in Jamaica which is disproportionately over and above 15% of the original market value (OMV) of the vehicle when it was new and originally imported into Jamaica. This excessive GCT must either be passed on to the consumer or absorbed by the dealer. This creates a competitive disadvantage for registered automobile dealers and mitigates against their full participation in the second-hand car market;

d) discourages legitimate automobile dealers from offering trade-in deals to its customers in respect of their existing second-hand vehicles when purchasing new vehicles;

e) pushes the second-hand vehicle market into the hands of businesses which do not resell the second-hand vehicles on their books, take no responsibility for their condition at the time of sale or offer any warranty or support for such second-hand vehicles. This has a deleterious effect on the pool of second-hand cars available to consumers;

f) limits the scope for Tax Administration Jamaica (TAJ) to secure GCT and other taxes on commissions generated by some of these businesses as their involvement in the vehicle sale is less visible compared to a business that buys and resells second-hand vehicles;

g) discriminates against motor vehicles in terms of GCT treatment when compared with other goods. While the GCT Act restricts input tax claims in respect of GCT borne on the purchase of motor cars, it does not limit the GCT chargeable on a subsequent sale by a GCT-registered taxpayer;

h) causes consumers to maintain a second hand vehicle in their name until its resale notwithstanding that they purchase a new vehicle – this creates insurance and public liability issues;

i) incentivises motorists to sell their vehicles privately rather than through a vibrant, transparent established second-hand car market. The sale of vehicles privately can also give rise to additional personal security risks.

MARGIN SCHEME MECHANISM FOR SECOND SALE OF MOTOR VEHICLES

In light of the above, it is proposed to establish (in the first quarter of 2023/24) a margin scheme mechanism whereby GCT registered taxpayers (such as car dealers) may account for GCT on the second sale of a motor vehicle based on the difference between the purchase and selling price of the vehicle.

Second sales by private individuals will continue to be liable to a flat rate GCT of JMD12,000/JMD18,000).

This measure will provide more options for the sale of second hand vehicles, build out the market for the second sale vehicles and providing greater visibility of the transactions to Tax Administration Jamaica (TAJ).

The proposed amendments are in line with established practice in multiple jurisdictions, including the United Kingdom, Ireland and Barbados.

Initiatives are to be introduced to provide support for the local agricultural and bloodstock/racing industries.

It is proposed to eliminate General Consumption Tax (GCT) on the importation of live horses to improve Jamaica’s breeding stock of race horses and rejuvenate the local racing industry. It is anticipated that this

measure will be implemented in the second quarter of 2023-2024.

It is further proposed that GCT will be removed from the importation of pigs and small ruminants. It is envisaged that this measure will improve local food security and provide a source of income and employment for persons in rural areas. This measure will have a sunset provision of five years (subject to

review). It is anticipated that this measure will be implemented in the first quarter of 2023-2024.

The implementation of these initiatives are estimated to result in a loss of tax revenue of J$53.33

million.

Comments