Jamaican-based agricultural and agro-processing conglomerate, Jamaica Broilers Group (JBG), has seen a 35 per cent rise in revenues amounting to $35.8 billion for the half-year period ended October 30, 2021, coming from $26.5 billion in 2020.

Gross profit for the period was $7.3 billion, representing a 14 per cent increase over the previous year. However, gross profit as a percentage of sales (gross margin) declined from 24 per cent to 20 per cent when compared with the prior year.

The decline in gross margin is primarily attributable to increased input costs, which was partially mitigated by the significant growth in the American business. The Jamaica operations reported a segment result of $1.5 billion, which was $236 million or 13 per cent below last year’s segment result of $1.8 billion.

This decrease was attributed mainly to increased grain prices and international shipping costs, which increased production costs, all of which were not passed on to its customers. Total revenue for the group’s Jamaica operations showed an increase of 31 per cent.

American operations most profitable segment during review period

The US operations reported a segment result of $1.2 billion, which was a 71 per cent increase over the prior year’s result of $696 million. This increase was primarily driven by the increased production and sales in the Best Dressed Chicken line of products.

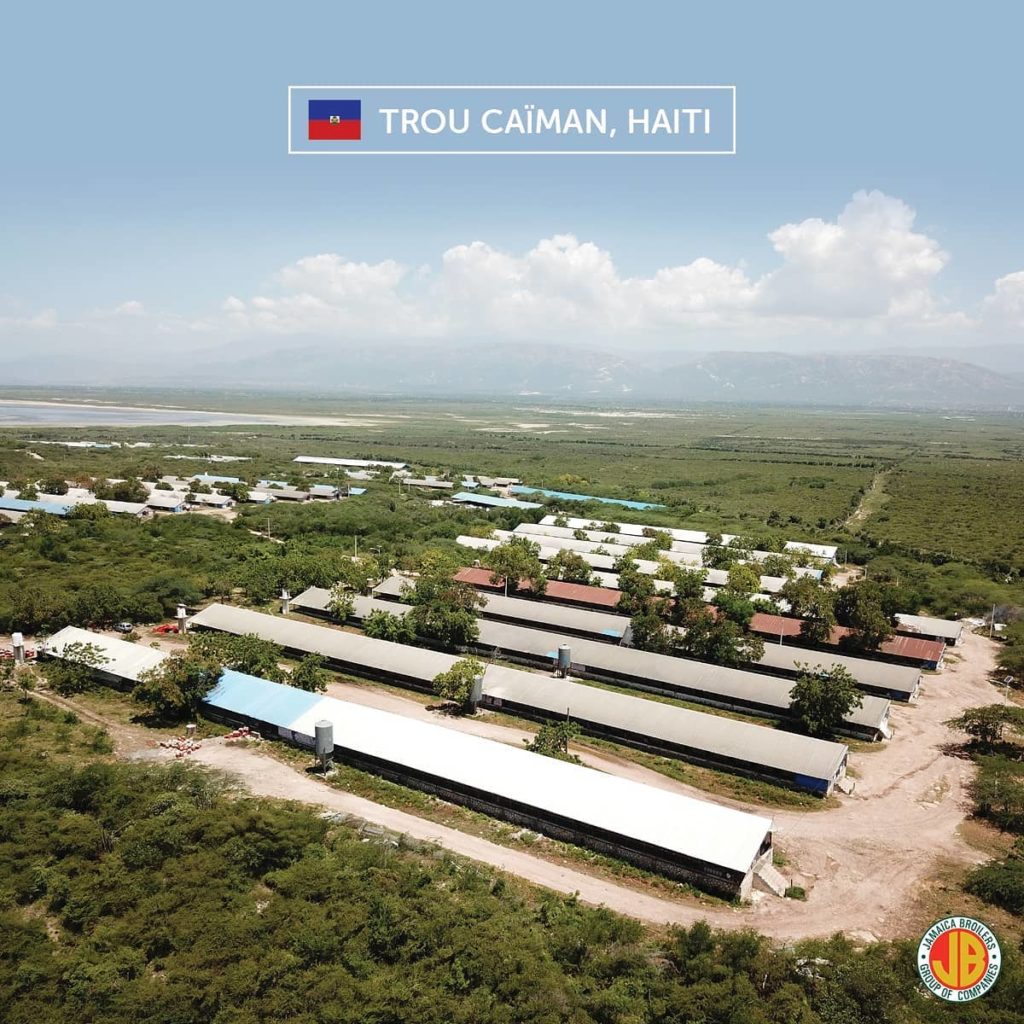

The operations have also seen an increase in the sales of feed and fertile eggs, indicating growth in the US economy. The Haiti operations reported a segment loss of $8.6 million compared to the prior-year loss of $38.7 million, an improvement of $30.1 million.

Total revenue reduced by 29 per cent as Haiti continues to experience economic and political instability which in turn impacts JBG’s operations in that country.

For the six months ended October 30, 2021, net profit after tax was $872 million, a 21 per cent decrease versus the corresponding period in the prior year.

The decrease is primarily due to foreign exchange gains of $290 million in the previous year, included in finance costs, compared to foreign exchange losses of $70 million in the current year. These prior-year gains were mainly in the Haiti operations, where the Haitian gourde experienced significant revaluation against the US dollar.

Operating profit of $1.7 billion was aligned with the prior year.

Comments