Scotiabank Jamaica says it is moving to adjust some of its fees “in line with the current operating environment”, which will affect business clients and individual customers.

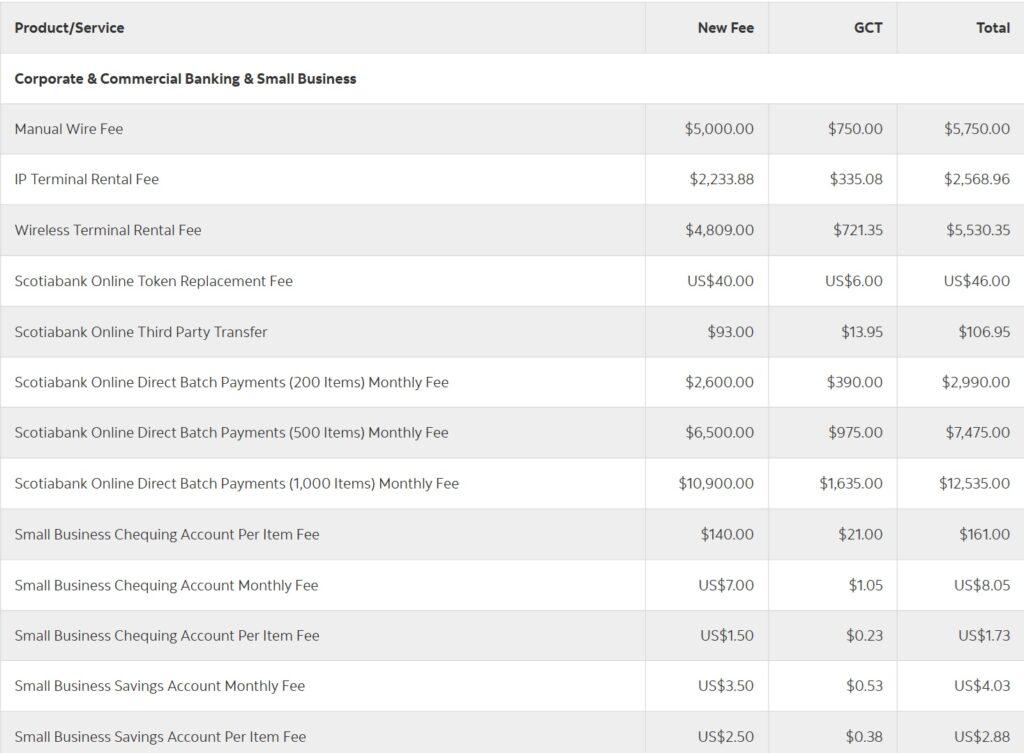

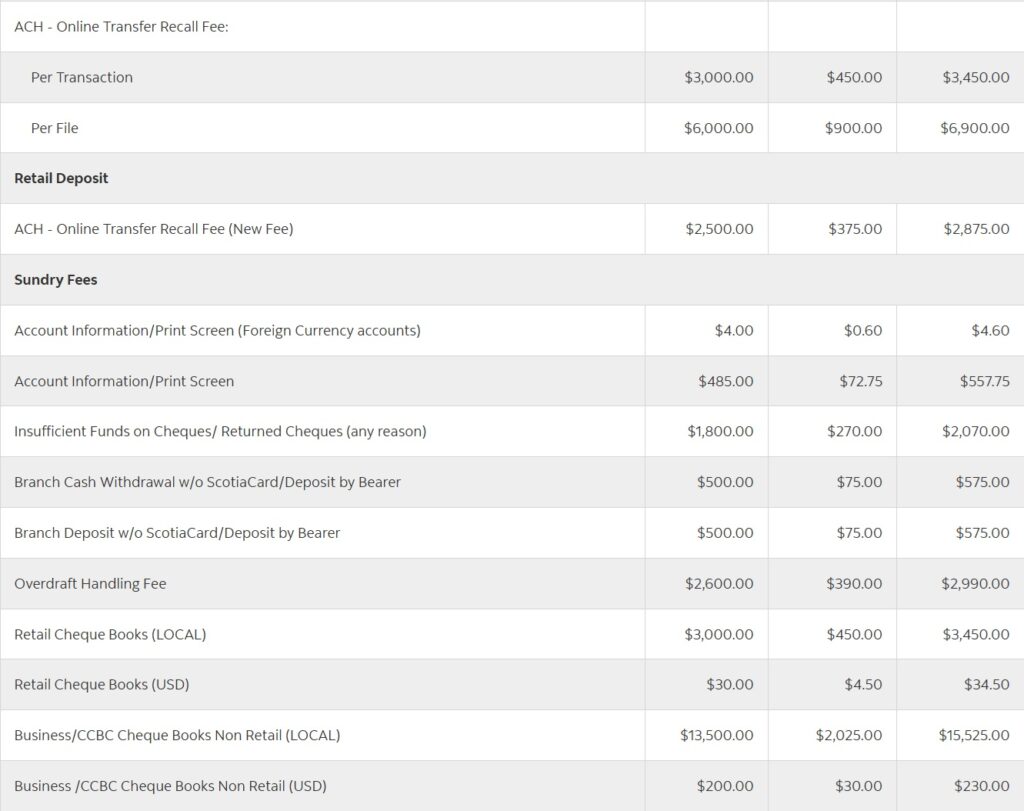

In a news release on Tuesday (March 18), Scotiabank advised that the adjusted fee regimen takes effect on May 1 and will cover “credit cards, lending services and some sundry fees”.

Off the bat, the bank is unveiling associated fees for supplementary credit cards as well as revamped charges for annual membership.

In one example, supplementary cards for Scotiabank’s AAdvantage Business Executive product now attract a J$5,307.03 fee plus J$796.05 in general consumption tax (GCT). The same supplementary card was once J$498.50, according to the bank’s website.

Additionally, while the annual fee associated with Scotiabank’s AAdvantage Business Executive credit card remains unchanged (previously costing J$10,858.37), GCT charges bring the new total to J$12,487.13 per annum.

Our Today could not immediately contrast fees whose previous rates could not be weighed against the suite of changes.

See full breakdown:

Comments