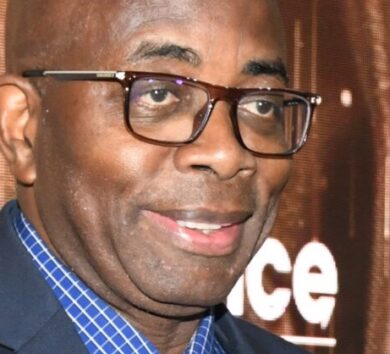

Durrant Pate/Contributor

The Jamaican Teas Group is reporting a slight decline in its financial performance for the second quarter ended March 2022, but experienced strong growth in its manufacturing division.

The highlight for that division for the quarter was the strong gain in local sales, which rose 26.2 per cent over the prior year to bring total manufacturing sales for the six months to J$880 million, an increase of 5.4 per cent over 2021 that delivered sales of J$835 million. Export sales were slightly down for the period in Jamaican dollars following two years of robust growth.

Exports declined by five per cent in the quarter. Some of this decline is directly related to the shortage of raw materials required to fulfil orders of finished products.

Jamaican Teas Group chairman, John Jackson, explains that “This decline occurred, in part, in shipments directly from Asian suppliers to our overseas customers and is an immediate result of the substantial increases in ocean freight costs experienced over the last several months, which was diminished customer demand for some types of products. While other export customer orders have remained strong, some export sales in the quarter, and in the half year, declined as a result of our inability to fill orders due to delays in the arrival of some imported raw materials.”

According to Jackson, “the management actions have ameliorated the effects of these delays and increased factory shifts are being worked to address the order backlog.”

“Subsequent to the end of the quarter, we received adequate supplies that will result in it filling the backlog in orders,” he added.

Slight decline in retail division

For the second quarter revenues from the retail division amounted to J$149 million versus J$132 million a year ago. However, the division saw a 12 per cent sales increase in the quarter.

Jackson reports that the Jamaican Teas retail store has returned to its former hours of operation and has continued to see improved sales, customer count and profits following the quarter end. During the March quarter, there were no units sold by the real estate division.

However, the latest development at Belvedere in St Andrew is proceeding apace with physical completion anticipated later in calendar 2022. Sales activity for Belvedere has already commenced with the displaying of model units that have been well received by potential purchasers.

The commencement of sales is slated for completion this year with several sales contracts already signed. This division booked several studio sales during the year ago quarter, where that project is now completely sold out.

Currently, the focus is to concentrate on one development at a time and, accordingly, there will be periods when there will be little or no sales until each development is completed.

QWI outperforms local stock market

The investment division, represented by QWI‘s investment share portfolio, continued to outperform the local stock market although its total gains for the quarter were 12 per cent below last year. Combined with some expense increases, QWI’s profit contribution to the group’s bottom line was lower than in the 2020/21 quarter and the half year period.

The second quarter and half year profits were lower than the prior year period for Jamaican Teas.

During the quarter, there was a mixed performance of stocks on the Jamaican and US stock exchanges, with the stronger performance mainly in Jamaica’s Junior Market. This resulted in some reduction in investment gains for QWI from J$68 million a year ago to J$58 million the quarter in review.

Comments