Losses will be recouped over time

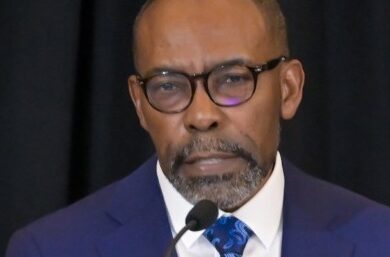

Durrant Pate/Contributor

It is now emerging that TransJamaican Highway Limited (TJH), which holds a 35-year concession for the construction, operation and maintenance of Highway 2000 East-West, incurred a one-time settlement loss of US$13.9 million for its acquisition of Jamaican Infrastructure Operator (JIO).

The acquisition of JIO, which is the operator of the toll roadway, was executed last December. The losses incurred are considered as settlement on pre-existing relationships between TJH and its JIO subsidiary.

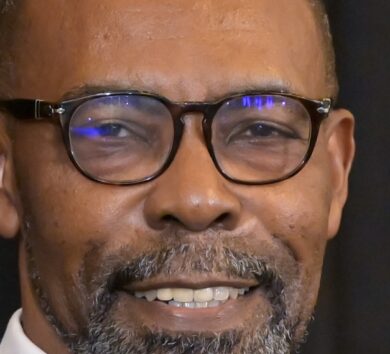

TJH Managing Director Ivan Anderson explains that the company, “stands to gain from future cost savings as this transaction is expected to significantly reduce our operating expenses by more than 50 per cent (approximately US$12 million per annum) and increase our profitability in subsequent years”.

For the quarter ended December 31, 2022, TJH incurred loss before tax of US$10.1 million, reflecting a decline of US$13.7 million compared to pre-tax profit of US$3.6 million for 2021.

Big decline in profitability

This decrease in profitability mainly resulted from the settlement loss on the acquisition of JIO in addition to increased operating and administrative expenses. This was also offset by increased revenue and slightly lower finance cost.

Loss before tax for the 12-month period ended December 31, 2022, was US$4.3 million and reflects a decrease of US$9.6 million, compared to pre-tax profit of US$5.3 million for 2021. For the 12-month period ended December 31, 2022, TJH reported a net loss of US$7.2 million, reflecting a decline of US$11.2 million compared to profit of US$4 million for the same period in 2021.

This came after recognising corporate tax of US$1.4 million and deferred tax charge of US$1.5 million. Deferred tax charge of US$1.35 million was recognised for financial year 2021.

For the quarter ended December 31, 2022, TJH reported other losses of US$0.9 million, reflecting a drop of US$0.7 million when compared to other gains of US$1.6 million for the same period in 2021.

Anderson, in his forward to shareholders, reports that this decline “was primarily due to lower foreign exchange gains emanating from the revaluation of the 8.0 per cent (JMD) Cumulative Redeemable Preference Shares and a decrease in year-end amounts written off from the Toll reconciliation process. This was also offset by slight increases in income from secondary income and interest earned on invested funds during the quarter”.

Other gains for the year ended December 31, 2022 were US$1 million, which is a decline of US$2.1 million, compared to US$3.1 million for 2021.

Robust revenue growth

While TJH incurred losses during the year as a result of its acquisition of JIO, the toll road concessionaire exhibited much resilience regarding its revenue, which continues to recover from the pandemic lows. For the December quarter, TJH had revenues of US$18 million, reflecting an 18 per cent increase of US$2.7 million, compared to US$15.3 million recorded for the same period in 2021.

This was attributable to the continued improvement in traffic following the lifting of the measures implemented to combat the spread of the COVID-19, in addition to the annual increase in toll tariff, which took effect in July 2022. Revenue for the year ended December 31, 2022 was US$65 million, compared to US$52.8 million for the same period in 2021, representing an increase of 23 per cent.

For the December quarter operating expenses climbed to US$10.8 million, reflecting an increase of US$1.7 million, compared to US$9.1 million for 2021. This increase was primarily due to legal and professional fees related to the acquisition of JIO in addition to small increases in insurance and marketing for the quarter.

This was cushioned by slightly lower maintenance and operator’s fees charged by JIO for the quarter. For the year operating expenses totalled US$39.9 million compared to US$34.1 million for the same period in 2021.

This was impacted by among other things higher amortization charges for the year and increases in the operator’s cost.

Comments