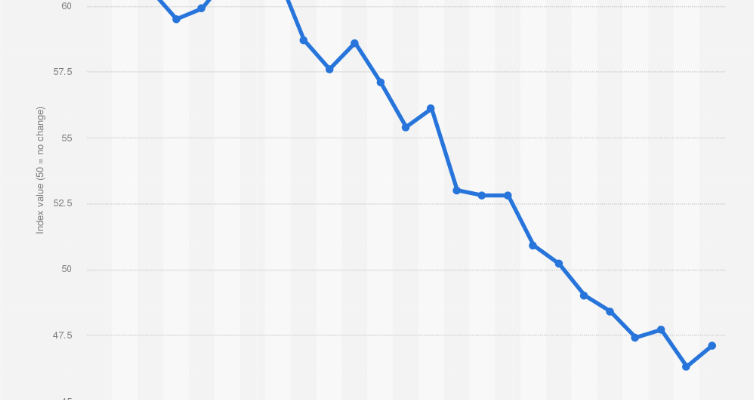

Manufacturing PMI drops to 46.9 in May

Durrant Pate/Contributor

Economic activity in the US manufacturing sector continued to contract at an accelerating pace in May with the ISM Manufacturing Purchasing Managers’ Index (PMI) dropping to 46.9 from 47.1 in April.

This reading came in worse than the market expectation of 47. The ISM manufacturing PMI is a monthly indicator of the economic health of the manufacturing sector with the index based on five major indicators.

These are new orders, inventory levels, production, supplier deliveries and the employment environment. An index value above 50 per cent indicates a positive development in the manufacturing sector, whereas a value below 50 per cent indicates a negative situation.

Further details of the index revealed that the New Orders Index declined to 42.6 from 45.7 while the Employment Index improved to 51.4 from 50.2. Commenting on the latest monthly report, Chair of the Institute for Supply Management, Timothy R. Fiore noted, “the May composite index reading reflects companies continuing to manage outputs to better match demand for the first half of 2023 and prepare for growth in the late summer/early fall period. The Prices Index fell back into ‘decreasing’ territory (and in dramatic fashion) after one month of increasing prices.”

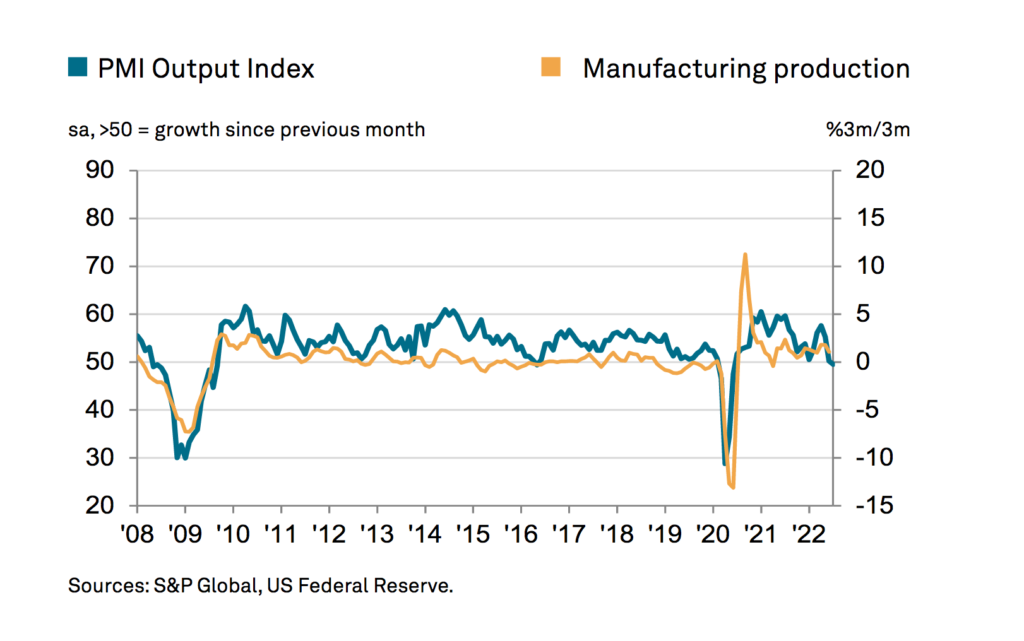

Similar reading from another manufacturing PMI gauge

In the meantime, the S&P Global US Manufacturing PMI was revised slightly lower to 48.4 in May of 2023 from a preliminary of 48.5, pointing to the biggest decline in the health of the manufacturing sector for three months. The drop was driven by a solid contraction in new orders amid muted demand conditions.

Efforts to run down stocks were met by a steeper contraction in purchasing activity, hinting at lower production growth in coming months. Sharply falling demand for inputs contributed to an unprecedented improvement in vendor performance.

On the other hand, output and employment continued to increase, as firms expanded their capacity to fulfil existing backlogs of work amid improved supply conditions. On the price front, input costs fell for the first time since May 2020.

The decrease in costs contributed to the slowest rise in selling prices for almost three years as firms also sought to become more competitive and boost new sales. Also, the degree of confidence was solid overall.

The S&P Global US Manufacturing PMI is compiled by S&P Global from responses to questionnaires sent to purchasing managers in a panel of around 800 manufacturers.

Comments